Answer 1 of 23. In this post we will discuss the steps for PF online registration in detail.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

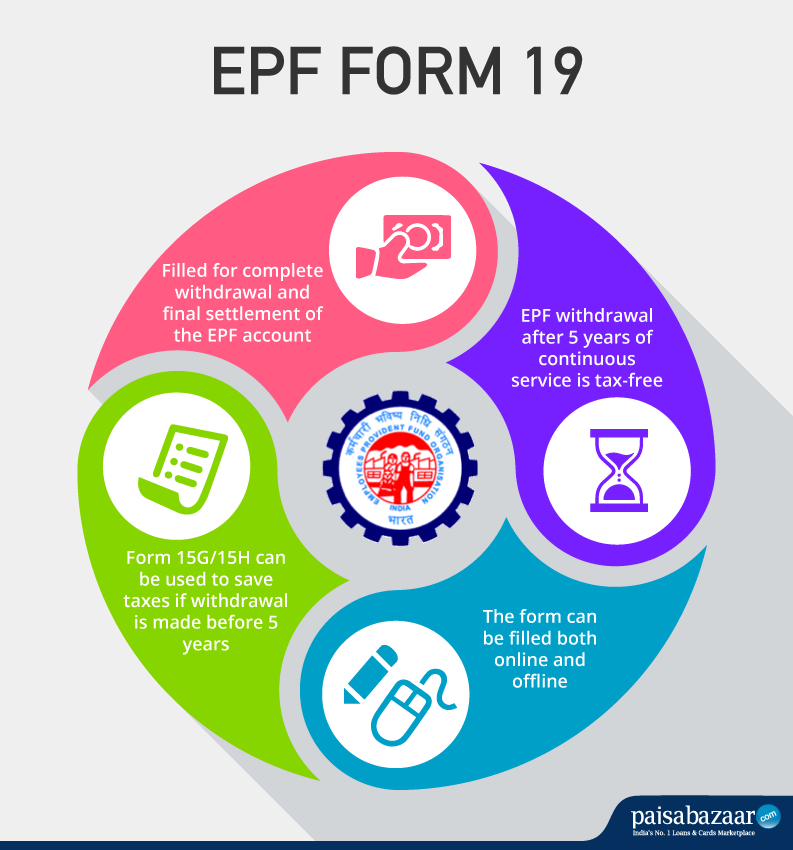

Full EPF Settlement EPF Part withdrawal loanadvance or pension withdrawal under the tab I Want to Apply For.

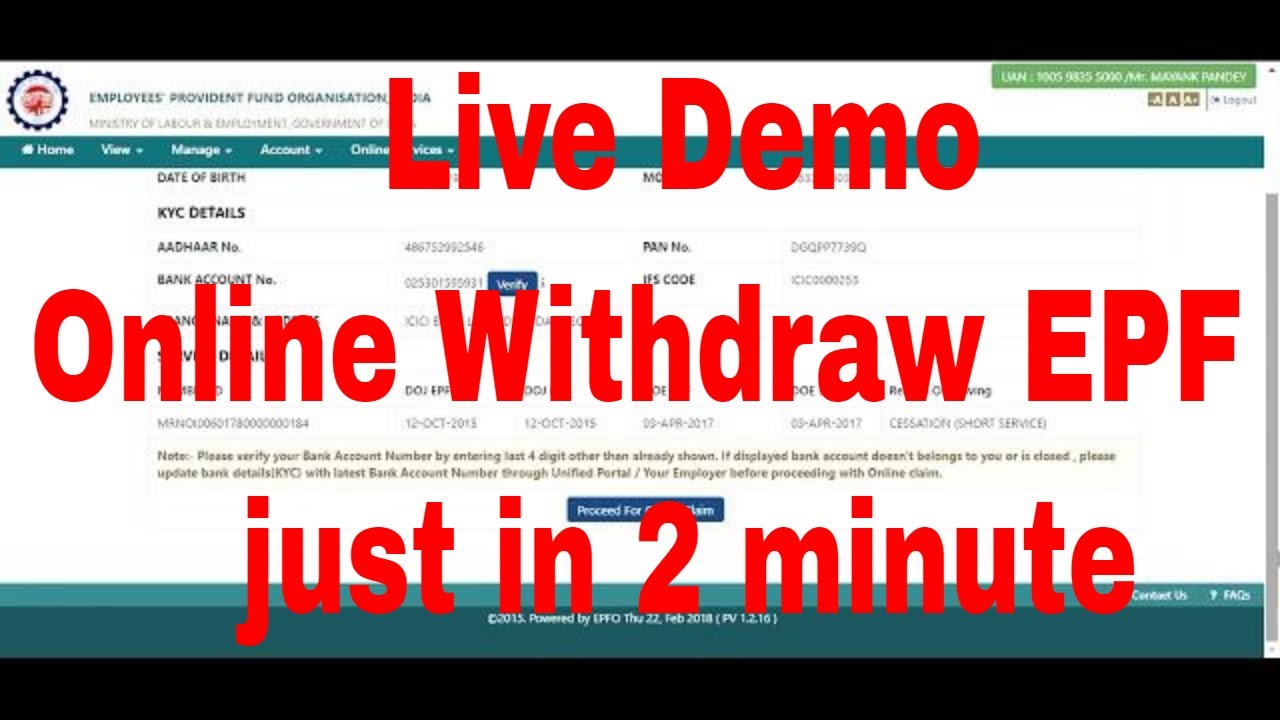

How to apply full pf online. Greetings Its a very good question and its very useful to know how to apply PF through online. For example if you want to know your EPF balance or if you want to check contributions made by your employer you can do so through the EPFO e-SEWA portal mobile app and SMS by logging in with your UAN. You dont need to go to PF office now.

I just did it recently and withdraw my full amount from the PF Account online. In several cases salaried persons may not remember their EPF account numbers in which case they can make an. What is required for online withdrawal of savings from PF.

So here we go Request you to activate your UAN number and update the mandatory KYC information in UAN portal to claim your PF withdrawal. EPFO has lately introduced the online facility of withdrawal which in turn has made the entire process hassle-free. How to apply pf online pf withdrawal pf ka paisa online kaise nikale full pf withdrawal processHi i m Devilal kashyap welcome to my YouTube channe.

Also if someone is applying online for EPF partial withdrawal ie. Please share this video it will be helpful to othe. Online application for PF withdrawal.

Plz watch this video till the end to understand the full process. Plz like share and. The Procedure to withdraw money from a PF account it very simple.

Select the claim you require ie. This 12-digit UAN is extremely useful and is all you need to check your PF details. Apply Online for PF EPFO COVID-19 Help Employees Provident Fund Organisation of India members can apply for the Advance claim for the outbreak of pandemic COVID-19.

EPFO subscribers can now withdraw 75 of their savings or up to a maximum of 3 months basic pay and dearness allowance from their PF account whichever is lower. Loanadvance heshe doesnt need to submit any documents along with. EPFO will obtain your KYC ie.

Keep all the documents ready required for the registration. In order to apply for PF withdrawal online you need to make sure the following conditions are met. PF online withdrawal procedure is as follows.

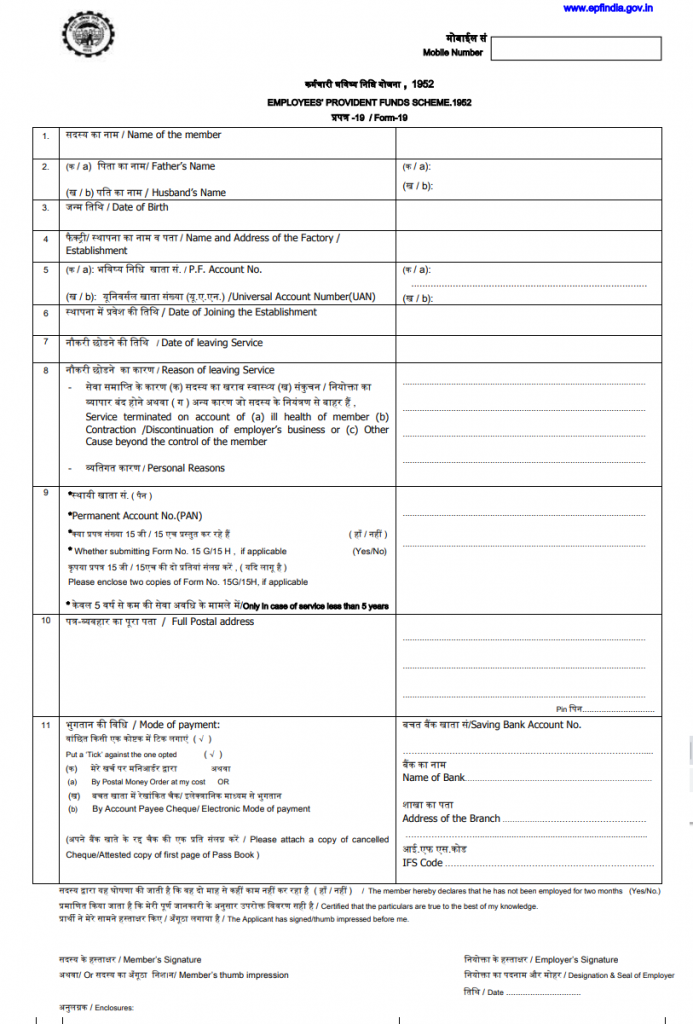

This video will help you understand the process to apply for PF ONLINE. A member has to fill in the required details before submitting the form to his or her previous employer. UAN is linked with your KYC ie Aadhaar PAN and bank details.

UAN should be activated and the mobile number used for activating the UAN is in working condition. However there are few prerequisites that should be met before applying for the withdrawal of EPF online through the EPF portal. It is mandatory for the establishments having 20 or more employees to register for PF.

All work and claim can be done via their official portal of EPF India. PF withdrawal process online only 4 steps easy way how to apply PF onlineFollow us on Facebook page Link. So take a look at the procedure.

If the member is not eligible for any of the services like PF withdrawal or pension withdrawal then that particular option will not appear in the drop-down menu. Aadhaar details from UIDAI and your online PF claim will be processed and your bank account will be credited with the amount of the claim. PFWithdrawalOnlinePFClaimSubmissionFullPFWithdrawalOnlinePFClaimsubmission100MViewsTo stay away from loss - work on this httpsyoutubef0pPc33RJdchtt.

Kindly follow the below step to. Step by Step procedure for PF online registration.