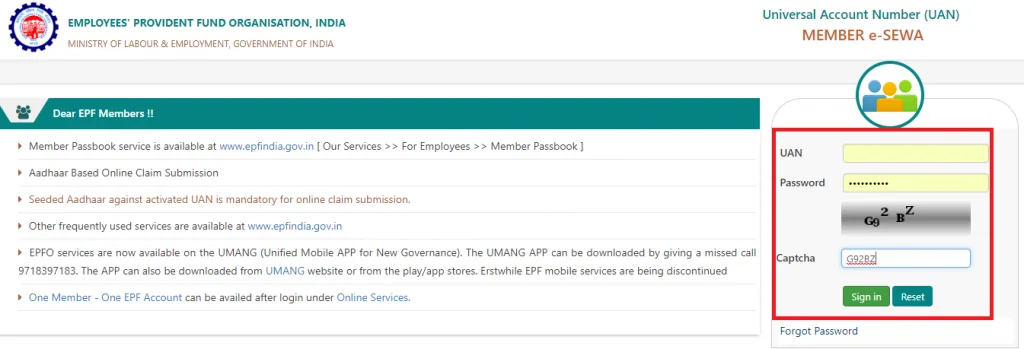

Here are the steps. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal.

How To Withdraw Pf Online Without Employer Signature Youtube

Click on the Manage tab and select KYC to check whether your KYC details such as Aadhaar PAN and the bank details are verified or not.

How to online epf withdrawal. Sign in to your account with a password UAN and Captcha code. In case youve forgotten your password you can reset it via an OTP sent to. Further the processing time involved in the EPFO online claim is quick as funds are transferred to the employees bank account within 5.

Select Claim Form-19 31 10C. Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code. Here is how to withdraw PF online via UMANG App.

Click on Proceed for Online Claim. Input the last four digits of the registered bank account and click on Verify. You need to open the UMANG App on your mobile phone and log in.

How to withdraw EPF Online. Steps to Fill EPF Withdrawal Online. Next to this you will be redirected to a new page.

Link your Aadhar to UAN. Initially visit the official EPFO member portal through the EPF withdrawal link. Want an advance from my Provident Fund Account.

The simplest way to withdraw PF is via smartphone Umang App. It must also be linked with your KYC including bank details IFSC and Aadhar. Prior to Applying to get EPF withdrawal you need to Update your own Aadhar amount in UAN portal.

Procedure for EPF withdrawal online. Following is mentioned the online process for EPF withdrawal. For making an online application for partial withdrawal online an individual must meet the following two conditions.

Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active. Enter Bank Account Number as seeded against UAN and verify. A Person can withdraw 90 percent of his available PF equilibrium after the age of 54 years.

You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal. Visit the UAN Member Portal and login using the UAN and password. Select Yes for your online certificate of undertaking stating that the EPF claim amount will be credited to the bank account mentioned.

Select the Purpose for which advance is required the amount required and the employees address. Before you move on to the process to withdraw EPF you must ensure that your UAN is activated and is linked with your KYC Aadhaar and PAN Card details. Please Apply for an Advance Withdrawal through COMPOSITE CLAIM FORM Aadhar 1MB Instructions 6927KB COMPOSITE CLAIM FORM Non-Aadhar 955KB Instructions 7695KB Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF Scheme 1952.

Go to the EPF Portal and sign in using your UAN and password. Upon successfully logging in first verify if your KYC details are under the Manage tab. How to Withdraw EPF Online.

You will then have to select All Services from the drop-down menu and look for EPFO. Here is how to withdraw PF online via UMANG App. Click on Proceed For Online Claim 5.

Step-by-step EPF Online Withdrawal Process. After this is ensured you you must follow the below steps to withdraw your EPF online-Log in to the UAN member portal using your credentials. How to Apply EPF Withdrawal Online.

You will then have to select All Services from the drop-down menu and look for EPFO. First is via Umang App and second is via EPFO website. Here you will be presented with a form.

How to file online advance claim for the purpose Outbreak of pandemic COVID-19 1. Then select the Raise Claim option from the drop-down menu. Login to Member Interface of Unified Portal.

Get your Aadhar authenticated by your company. PAN and Aadhar details seeded into EPF database. Tick on the certification and submit your application.

Next select the Claim Form 31 19 and 10C option under the Online Services tab. Select the Member UANOnline Service OCSOTCP course of action available in the Services label. EPF withdrawal through program.

On the following screen. Online EPF Withdrawal Process. Enter the last 4 digits of your bank account and then click Verify.

The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. Provide the last four digits of your bank account when you see the Member Details. Visit the UAN portal.

Click the Online Services tab and select Claim Form-31 19 10C Verify your member details. You can withdraw EPF Online via two methods. Making an online application for EPF withdrawal.

Click on the Claim Form-31 19 10C on the drop-down menu. UAN Universal Account Number is activated and the mobile number linked to. Go to Online ServicesClaimForm-311910C 10D 3.

You need to open the UMANG App on your mobile phone and log in. Select PF Advance Form 31 from the drop down. Visit the Member e-Sewa portal on the EPFO portal.

Online Withdrawal of PF with UAN. Here are the steps you need to follow. Then select the Raise Claim option from the drop-down menu.

Log in with your UAN and password. Step 2 Then input your UAN your password and the Captcha to sign in. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab.

Select PF Advance Form 31 to withdraw PF amount online. Select the For Employees recourse available under the Our Services label. Click the Online Services tab on the menu bar.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. How to withdraw EPF Online Offline. Fill the EPF withdrawal form online.

How to withdraw your PF savings with UAN. Withdrawing funds through PF withdrawal process online is easy and timesaving as the EPF withdrawal online process is simple and hassle-free. Click on the Proceed for Online Claim option.