If you want to know how to withdraw money from EPF this article can help you understand the process. News Update 1 st June 2021.

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

EPF Withdrawal before 5 years of Service.

How to epf withdrawal. Aadhar number must be linked and verified with UAN. After the age of 58 you can withdraw the full EPF amount as well as the pension. In case you want to withdraw your funds before 5 years of service you should keep the following EPF withdrawal rules in mind-.

Employees should however ensure that their contact number used to. Httpscleartaxinsepf-withdrawal-onlineEPF is a mandatory retirement savings scheme available for all employ. However to make these withdrawals there are certain conditions that must be met by the EPF member.

The EPF scheme allows employees to save funds and accumulate interest monthly and is payable in full. An employee can withdraw up to 50 of his PF amount from his EPF account. Now it tells you how to withdraw EPF without UAN.

One can withdraw the advance amount from their PF. Here are the steps are given in the blog. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. While it is better to not. While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so.

Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. Before you can withdraw money from EPF online there are two things you must ensure. It is managed by the Central Board of Trustees CBT which is consists of representatives from three parties such as the.

EPF withdrawal using Form 19. Want an advance from my Provident Fund Account. The i-Citra withdrawal facility is open to all EPF members aged 55 years old and below.

This is because early withdrawals from the EPF are not a part of the tax-deductible income of the employees. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. The labour ministry has announced that EPF members can now withdraw twice from their EPF account to meet the emergency expenses arising due to the Coronavirus pandemic.

Withdraw EPF balance and full pension after 58 years of age. EPF withdrawal is also possible if an employee leaves the job and stays unemployed for at least two months. The government has notified the amendment in EPF scheme rules regarding withdrawal of funds from the EPF account to deal with coronavirus.

Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. The Employee Provident Fund EPF overseen by the Employees Provident Fund Organization EPFO is a retirement benefits scheme. EPF scheme member can withdraw the money from the EPF scheme for various reasons like marriage buying a house etc.

When you count on EPF Withdrawal online you unlock numerous benefits including. Benefits of EPF Withdrawal Online. EPF Withdrawal Rules.

Transfer the PF Amount through EPF Withdrawal or EPFO Withdrawal with Interest rates. Please Apply for an Advance Withdrawal through COMPOSITE CLAIM FORM Aadhar 1MB Instructions 6927KB COMPOSITE CLAIM FORM Non-Aadhar 955KB Instructions 7695KB Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF Scheme 1952. Instead of taking a loan you can withdraw funds from your PF in whole or in part.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. Link your Aadhaar to UAN b. Over time this accumulates to a lot of money which ensures peaceful retirement.

An employee can made up of a Provident Fund PF account during his period. Those candidates can deposited 12 of the money from their basic salary to the Provident Fund PF account. EPFO allows members to withdraw money from EPF Account twice to meet COVID-19 Emergency.

Form-19 can be downloaded from the EPFI website. The maximum withdrawal amount permitted is RM5000 and it will be disbursed up to 5 months. Funds Instructor have already discussed EPF that the Employees Provident Fund EPF is a savings scheme introduced under the Employees Provident Fund and Miscellaneous Act 1952.

This article will tell you in detail about when and how you can withdraw funds from your EPF account. Here is a step-by-step guide to withdraw the amount. It is available for citizens non-citizens and permanent residents.

Click on the link for detailed information. EPF Withdrawal Online - Individuals can benefit from the convenience of the withdrawal process of PF online. How to withdraw PF online with a UAN number.

Hassle-free and seamless EPF Withdrawal- When you rely on the online process for the EPF withdrawal claim you save time and efforts that would have been misspent in making multiple PF office visits and in standing prolonged queues. The government announced back in March 2020 that an individual can withdraw a certain sum from their Employees Provident Fund account if heshe is facing financial problems due to the coronavirus-related lockdown. EPFO has allowed its members to avail the second COVID-19 advance from their PF account.

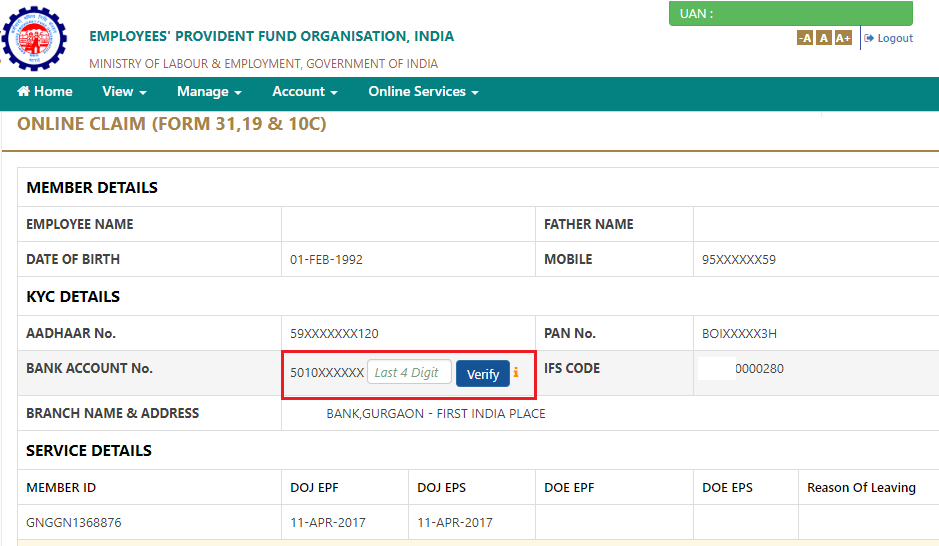

Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. To withdraw your PF amount using the EPFO portal you will need to ensure the following. To be eligible you must have a minimum of RM150 in your EPF account on the day of application.

You can make up to 3 withdrawals from these criteria. Procedure for EPF withdrawal online. If youre looking to withdraw your EPF here are certain rules you need to remember.

However if the withdrawal amount is less than 50000 no TDS is deducted. Submit an application to withdraw EPF online. EPFO allows for withdrawal of funds in your PF account only after your retirement except for in certain special circumstances.

12 of an employees salary is deducted as contributed to PF every month and the employer matches that contribution. EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. You need to fill and submit Form 10D to claim your full pension.

Step 2 Then input your UAN your password and the Captcha to sign in. EPF withdrawal via UAN Online claim submission If you know your Universal Account Number UAN then you can directly apply for pf withdrawal without the need for employer attestation.

Pf Withdrawal Form Know Epf Withdrawal Procedure

How To Withdraw Epf And Eps Online Basunivesh

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Tidak ada komentar:

Posting Komentar