Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business Berbagi. Latest news related EPF withdrawal.

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

In case of lump sum withdrawal the lesser the number of years of service the lower the amount a person will receive.

How to calculate epf withdrawal amount. No you cant withdraw all your EPF funds only 50 of the total amount is allowed to withdraw. Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. Rest will be settled only at the age of 56.

If an employee wishes to resign from his work for any reason whatsoever he may withdraw the remaining EPF balances. Online PF Calculator will help you estimate how much balance you will have in your employers provident fund account when you retire. Instead of taking a loan you can withdraw funds from your PF in whole or in part.

EPF withdrawals have always been a topic of discussion. For withdrawals after 5 yrs of employment there is no TDS. The total EPF balance includes the employees contribution and that of the employer along with the accrued interest.

You can withdraw EPF amount for a similar reason for maximum 3 times. You just need to enter the current balance of your EPF account or Pension fund account and your Employers contribution towards your EPF account. What is the calculator about.

Based on the latest government rule inoperative or old PF accounts are now made to generate interests. If the contribution period must be more than 5. This is the new rule now.

The major concern for them is whether the EPF withdrawal amount is taxable or not. Lets take a look at the tax rules on EPF withdrawal. Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020.

The move is expected to benefit around 48 crore employees. Your basic monthly salary your expected average annual. EPF Calculator How to Calculate PF Amount for Salaried Employers EPF Calculator.

The amount withdrawn from EPF account is liable to tax but it can be exempted from tax in certain conditions. Aadhar number must be linked and verified with UAN. Check out your tax liability.

She added that the government will be paying the Employees Provident Fund. Posting Komentar untuk How To Calculate Pf Withdrawal Amount In India. In the EPF fund the employee can to withdraw the accumulated amount 2 months after hisher resignation.

Our EPF calculator will help you to estimate your Employee Provident Fund EPF corpus at the time of retirement. How to use it To arrive at the retirement corpus you need to enter few details such as. An EPF account offers an annual return of 85.

Frequent changes in EPF withdrawal rules keep employees on the edge. Some of the valid reasons are unemployment retirement purchase of land purchaseconstruction of a house renovating a house wedding education repaying a home. The EPF calculator is a simulation which shows you the amount of money that will accumulate in your EPF account at retirement.

EPF Contributions To Be Deducted at 24 from August 1 2020. Employees can withdraw the whole money accumulated in their EPF account after they retire and the sum placed in. An employee can withdraw the PF amount during his service period for medical expenses marriage or for purchase of house and other such cases.

Types of PPF Calculators. As per the EPF act 1952 any person who retires after completing service of 58 years minimum is eligible to withdraw the full PF amount and claim the EPS amount. Learn how to withdraw PF amount in online.

So lets take a look at the EPF withdrawal rules to understand this better. The employer also contributes towards the employees pension fund along with EPF. EPF subscribers will now be able to withdraw either 75 percent of the provident fund balance or 3 month wages as a non-refundable advance whichever is lower.

Know all about PF and EPF benefits. How Much Can a Person Withdraw from EPS Account. PF contribution rate of employee and employer was defined as per EPF Act.

EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. To withdraw your PF amount using the EPFO portal you will need to ensure the following. There is however a window to partially withdraw the amount for those nearing retirement.

The employee can use this post-retirement. Calculating Procedure on Provident Fund PF Amount for Salaried Government Private Employers. You can make partial withdrawals in case of financial needs such as house construction or purchase higher education or a medical emergency.

EPF or PF Calculator - Calculater the amount of money you will get on retirement by Growwin. Employees Provident Fund EPF is a government run initiative that is under the Employees Provident Fund and Miscellaneous Provisions Act 1952. You need to be over 55 years of age to withdraw the fund in case of early retirement as per rules stated by the EPFO.

The Employees Provident Fund EPF calculator will help you to calculate the amount of money you will accumulate on retirement. An employee will be allowed to withdraw the pf amount of 90 if he decides to withdraw the advance amount from PF account before. You can withdraw the entire EPF amount only after retirement.

If you decide to quit your job and withdraw the balance from your EPF account once and for all you will only be able to remove a portion of the amount based on the purpose of withdrawal. Check your eligibility. How to Withdraw PF Amount in Online.

How to get advance PF Amount Withdrawal PF money from your EPF Account. Your present age and the age when you wish to retire. According to the EPF Act for claiming final PF settlement one has to retire from service after attaining 55 years of age.

Try out our calculators for all your needs. The Employees Provident Fund calculator will help you to estimate the EPF amount you will accumulate at the time of retirement. Tax on EPF withdrawal.

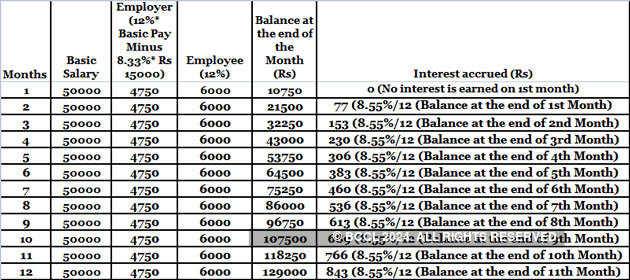

How Epf Employees Provident Fund Interest Is Calculated

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Epf A C Interest Calculation Components Example

Epf A C Interest Calculation Components Example

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Tidak ada komentar:

Posting Komentar