Write the deduction amount in your tax return in the Other work-related expenses section. Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day.

Simplified Way To Claim Work From Home Expenses Cahill Cpa

It is up to your employer to determine who is authorized to sign these forms.

How to claim working from home on taxes canada. But keep in mind that you cant include vacation days weekends sick days or any leaves. This amount will be your claim for 2020 up to a maximum of 400 per individual. Keep a record of how many hours you worked from home.

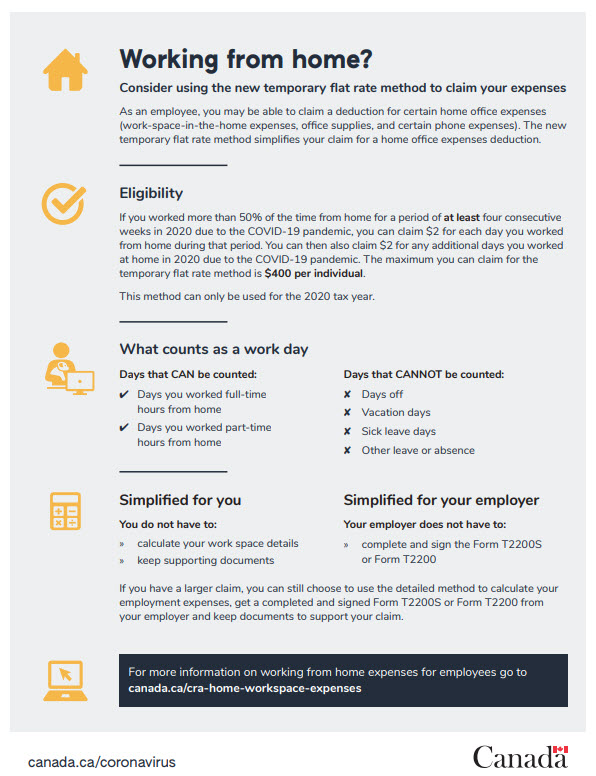

Unfortunately there are certain expenses that a salaried employee cant claim on their return. Claim a tax deduction up to 400 for working from home. In response the Canada Revenue Agency CRA has introduced a new temporary flat rate method to simplify claiming the deduction for home office expenses for the 2020 tax year.

As an employee you may be able to claim a deduction for home office expenses work-space-in-the-home expenses office supplies and certain phone expenses. This deduction is claimed. The Canada Revenue Agency has restrictions and guidelines on what is allowed to be deducted starting with determining whether you are an employee or if you are self-employed.

To earn the same 400 invest in the Canada Imperial Bank of Commerce stock. Heres how you can best use the saved tax. Work out your deduction amount.

Enter the lower amount of line 24 or 25 of Form T777 at line 9945. You can claim 2 for each day you worked from home in 2020 due to the COVID-19 pandemic up to a maximum of 400. Your employer is not required to complete and sign Form T2200.

Eligible employees working from home in 2020 due to the COVID-19 pandemic. The temporary flat rate method. You will need a Form T2200S Declaration of Conditions of Employment for Working at Home During COVID-19 to be completed and signed by your employer if you worked from home in 2020 due to the COVID-19 pandemic.

This includes if you have to work from home. Form T2200 and Form T2200S must be signed by your employer. Canadians doing a thankless job of working from home can claim the new work-from-home tax deduction in 2020.

For those using the detailed method to calculate their home office expenses the CRA has expanded the list of eligible expenses that can be claimed to include home internet access fees. You dont need any supporting documents for this method nor do you need a signed T2200. This includes the four-week period and any other work days beyond that.

Claim the amount on line 22900 of your tax return. Deductions reduce the amount of income they pay tax on. These include expenses like.

Canada has a work-space-in-the-home deduction that you can use if you work out of your house. You can claim 2 for each day you worked from home up to a maximum of 400. There are 2 other ways you can work out deductions for working from home.

With more people working from home the question of deducting home expenses often arises. Canada Revenue Agency. The workspace has to be where you mainly do your work more than 50 of the time.

Home office expenses can be claimed as a deduction on an employees personal income tax return. Enter on line 229 the allowable amount of your employment expenses from the total expenses line of Form T777. Claim the 400 Tax Benefit for Working From Home Canada Revenue Agency.

Deductions for Employees The CRA allows you to deduct certain home expenses for. You need to meet all of the above conditions to be eligible to claim your home office expenses. This rate allows eligible employees to claim a 2 deduction for each day they worked from home due to COVID-19.

To be able to use this method. Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400. Write COVID-19 hourly tax rate in your tax return.

Fill in the form. The CRA has issued a temporary flat rate method for the 2020 tax year. You had to work.

Complete the Calculation of work-space-in-the-home expenses portion of Form T777 Statement of Employment Expenses. By using the temporary flat rate method you can make a claim without a signed form from your employer or receipts for your expenses. If your home is 1000 square feet and your home office measures 200 square feet youll be able to claim an amount equal to 20 2001000 20 of your related expenses on your return.

In other words you can claim up to 200 days. If you are not sure. You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

Find out more at wwwatogovauhome. Expenses paid for the workspace at your place during the year youre filing your taxes for can be deducted if they meet one of two conditions. While employees who primarily worked from home have always been able to claim work expenses for the 2020 taxation year the Canada Revenue Agency has.

Did You Work From Home In 2020 If So You Are Likely Eligible For Some Tax Relief Cbc News

How Canadians Can Claim The 400 Work From Home Tax Credit Venture

Working From Home 2020 Tax Information University Of Victoria

Canadian Psa If You Re An Employee Who Worked From Home You Can Claim A Home Office Credit Save Spend Splurge

Deducting Work From Home Expenses From Canada Taxes 2020 2021

Tidak ada komentar:

Posting Komentar