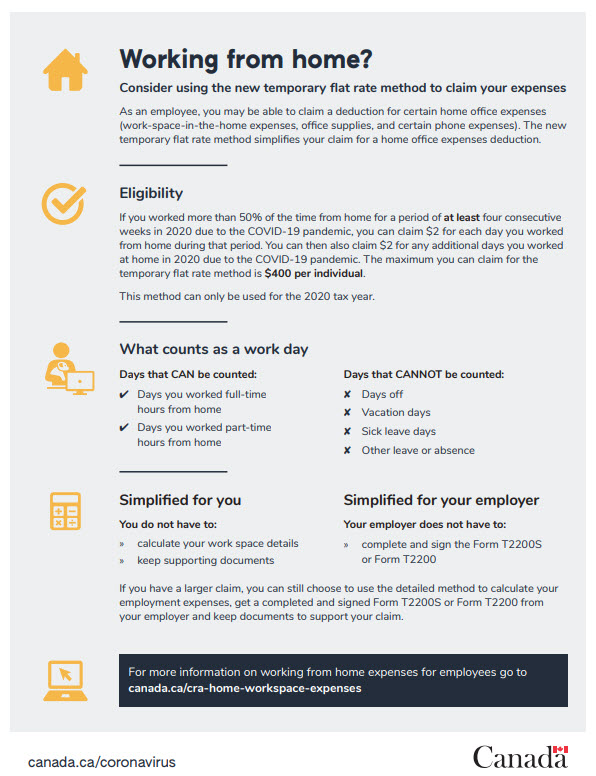

Canadians doing a thankless job of working from home can claim the new work-from-home tax deduction in 2020. You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses.

Working From Home 2020 Tax Information University Of Victoria

But with the temporary flat rate method you can claim only up to 400 regardless of how many days you worked from home.

How to claim working from home on taxes 2020 canada. Fill in the form. For the 2020 tax year the CRA introduced a new 400 temporary tax deduction for all Canadians who worked from home. What you can actually deduct after working from home for most of 2020.

6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs. Working From Home Can Get You a 400 Tax Deduction. This is to cover all your extra costs of working from home.

For illustrative purposes if an employee works from home for 300 hours during the period from 1 March 2020 until 30 June 2020 and elects to use the Shortcut Method then it can claim deductions of 240 in respect of WFH Expenses ie. Your employer completes and signs this form to certify that you worked from. CRA 2020 Tax Breaks.

The home office deduction Form 8829 is available to both homeowners and renters. Remember to attach the form to your 2020 income tax return after youve filled it out. In response and to provide Canadians some tax relief the Canadian Revenue Agency CRA tweaked their rules on how employees can claim home office expenses on their 2020 personal tax returns.

In this form youll have to enter the number of days you worked from home last year and multiply it by 2 day. To be able to use this method. The all-inclusive temporary shortcut method was introduced from 1 March 2020 due to the COVID-19 pandemic and the increased number of employees working from home.

You can claim 080 for every hour you worked from home. Taxpayers must meet specific requirements to claim home expenses as. 1 July 2020 to 30 June 2021 the 202021 financial year 1 July 2021 to 30 June 2022 the 202122 financial year.

While employees who primarily worked from home have always been able to claim work expenses for the 2020 taxation year the Canada Revenue Agency has. To earn the same 400 invest in the Canada Imperial Bank of Commerce stock. You can either claim tax relief on.

Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400. Claim the amount on line 22900 of your tax return. Form T2200S Declaration of Conditions of Employment for Working at Home During COVID-19 is a shorter version of Form T2200 that you get your employer to complete and sign if you worked from home in 2020 due to the COVID-19 pandemic and are not using the temporary flat rate method.

Things you bought like a desk your higher bills like electricity or phone. The shortcut method 80 cents per work hour covers all your work from home expenses such as. You can claim 2 for each day you worked from home up to a maximum of 400.

This week the Canada Revenue Agency released new guidelines making it easier for employees who have been working from home as a result of COVID-19 to claim home office expenses on their 2020. You dont need any supporting documents for this method nor do you need a signed T2200. February 18 2021 426 PM.

They include mortgage interest insurance utilities repairs maintenance depreciation and rent. Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. There are certain expenses taxpayers can deduct.

This amount will be your claim for 2020 up to a maximum of 400 per individual. How much you can claim. You also dont need to.

Eligible employees working from home in 2020 due to the COVID-19 pandemic. 300 hours x 080. You can claim 2 for each day you worked from home in 2020 due to the COVID-19 pandemic up to a maximum of 400.

Form T2200S Declaration of Conditions of Employment for Working at Home Due to COVID-19 is a shorter version of Form T2200 that your employer will use if you worked from home in 2020 due to the COVID-19 pandemic and choose to use the Detailed method to calculate your home office expenses. You cannot claim for anything else. In other words you can claim up to 200 days.

Employees are not eligible to claim the home office deduction. With the work-from-home set-up becoming the new normal in 2020 thousands more Canadians could be eligible for lucrative tax deductions. By using the temporary flat rate method you can make a claim without a signed form from your employer or receipts for your expenses.

The Canada Revenue Agency CRA expects the number of.

Deducting Work From Home Expenses From Canada Taxes 2020 2021

T2200s Form Covid 19 Home Office Expense Tax Deductions Enkel

Canadian Psa If You Re An Employee Who Worked From Home You Can Claim A Home Office Credit Save Spend Splurge

Canadian Work From Home Tax Forms To Claim Homes Expenses During Covid 19 Pandemic Stock Image Image Of House Economy 205679479

Canadian Work From Home Tax Forms To Claim Homes Expenses During Covid 19 Pandemic Stock Photo Alamy

Tidak ada komentar:

Posting Komentar