Step 5- Now click on the Proceed for Online Claim option. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service.

Pf Pension Withdrawal Process Online Form 10c How To Withdraw Pf Eps Withdrawal Youtube

You can withdraw your PF and EPS amount by filling the composite form launched by EPFO which will take care of your withdrawal transfer advances etc.

How to withdraw full pf and pension amount online. There is one thing that you should keep in mind before starting the withdrawal procedure and that is. In case of emergency you can withdraw PF advance whenever you want for that submit form 31 and select the reason as illness. How to withdraw EPS Online.

Step 2 is to check whether the KYC details seeded are correct and verified or not. Step 1 is to log on to the UAN portal and enter your details. Here are the steps.

Pf full final settlement online new process 2022 full pf withdrawal 2022 of kaise nikalepf form 19 under processpf form 19 and 10c filling samplepf f. Form 31 is required for partial withdrawal EPF Govt. After submitting this form you will receive your monthly pension.

Epfo pfwithdrawalprocessPF Account இல உளள Full PF Amount-ய Online மலம Claim சயய Form 19 10C Apply சயய வணடம. It must also be linked with your KYC including bank details IFSC and Aadhar. To withdraw this monthly pension amount you need to submit a form called form 10 D.

Before you apply for an online withdrawal make sure your UAN is active and the mobile number linked to your UAN is working. A member can view the passbooks of the EPF accounts which has been tagged with UAN. To get EPS amount in the Composite Claim Form Aadhaar or Non-Aadhaar along with choosing Final PF balance also choose the.

From the I want to apply tab select the claim you need full EPF settlementpension withdrawalEPF part withdrawal etc. If you cross the service period of 10 years you cannot withdraw the amount. UMANG App can even be used by members to withdraw their EPF money from their Provident Fund PF account.

However to meet specific needs an employee can withdraw a partial provident fund amount or withdraw in the event of any emergency including medical emergency marriage. Withdrawing PF balance plus EPS amount for below ten years of service If service period has been less than 10 years both PF balance and the EPS amount will be paid. If your total service period is less than 10 years you are not eligible for the pension.

One mobile number can be used for one registration only. Now you can submit the monthly pension withdrawal form 10D online also at the UAN member portal. Httpsbitly2CclsPsClick Here to See Detail Upcoming Higher Pension Related Cases Hearing Detai.

Namaskar Dosto es video me maine bataya hai ki online PF or Pension ke liye kaise claim karte hainEPF india website- wwwepfindiagovin How to Withdraw P. PF Pension withdrawal Process online Form 10C How to withdraw PF EPS withdrawal PF withdrawal process onlinePension withdrawal process is explained in. How to Withdraw EPF EPS Balance online.

Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active. If an EPF member dies then the nominee such as wife or minor children will receive the monthly pension. Step 11 Click on the certificate to submit your application.

TDS is deducted if the withdrawal amount exceeds 50000. Get What You are Entitled to. Nevertheless Employee Provident Fund Organization has imposed certain restrictions on early withdrawal of whole provident fund amount to benefit employees even after retirement.

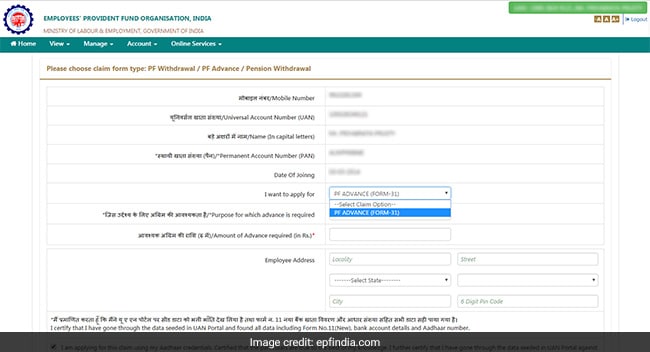

Step 7 A fresh section of the form will open wherein you have to select the Purpose for which advance is required the. So these were the EPF withdrawal rules partial and full withdrawal in 2021. Step 3 is to select the claim you require out of the 3 namely full PF Settlement PF Part withdrawal loan advance or EPS withdrawal.

Step 6- Select PF Advance Form 31 to withdraw your funds online. You can apply for withdrawal. Step 10 Select PF Advance Form 31 and provide the details of the amount you need the reason to withdraw etc.

You also need to ensure that your UAN is linked with your Aadhaar. Here is how to withdraw PF online. Click This Link to Participate in Quiz Get Rs.

Partial withdrawal is not taxable. EPFO members can withdraw PF amount via UMANG App. You can request for online PF withdrawal using EPFO member portal or the UAN portal using Composite Claims Form.

You can withdraw the full PF amount only after 2 months from your last working date. The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. Members of the Employees Provident Fund Organisation EPFO can avail various EPFO services on the UMANG App.

Withdrawal from EPS is same as the withdrawal of EPF. Ad Have Someone on Your Side. The UAN restricts the duplication of EPF account number.

Withdrawing PF balance only and full pension After 58 1. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online. The facility of passbook is not available for members of.

How To Withdraw Full Pf Pension Amount Online How To Withdraw Eps Money After Leaving Your Job Youtube

Online Epf Withdrawal How To Do It In Five Steps

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

How To Withdraw Epf And Eps Online Basunivesh

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Tidak ada komentar:

Posting Komentar