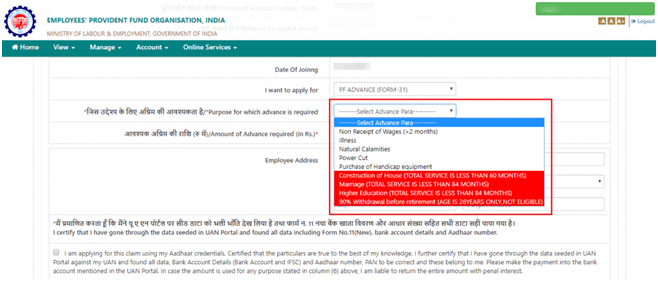

Yes in case of fewer than 90 days of leaving work you can use PF Advance Form-31 but if more than 90 days you can select Form 19 or 10C 10D. Because of the direct form submission the whole PF withdrawal process takes less time.

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

Withdraw your PF money without UAN Physically Method.

How to withdraw money from pf account without leaving job. You can transfer that one month PF transfer by submitting PF transfer form 13 offline to PF office even without date of exit. Submit two copies of Form 15G15H if applicable. Only in the case of resignation from service not retirement a member has to wait for two months for withdrawal of PF amount.

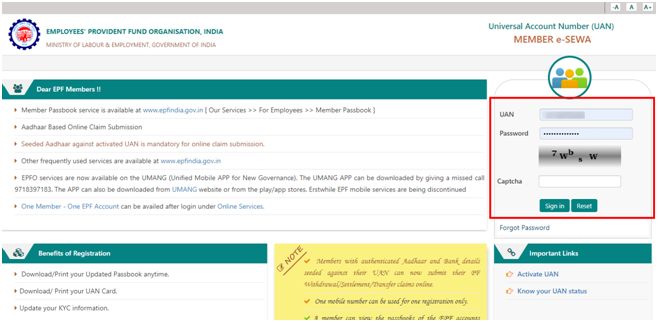

It is very small form and require few details. Make sure that you have an active UAN number and it should be linked with an Aadhaar card. In the case of not taking the next job in India you can withdraw the EPF account balance after immediately resignation.

Pin On Useful Tips And Tricks. If you have not activated the UAN then you cannot withdraw your EPF without employer signature. Pin On Epfo.

Withdrawing PF plus EPS Amount. Withdrawing PF balance plus EPS amount for below 10 years of service 2. With the advent of UAN Universal Account Number a unique number assigned to the employee for PF purposes it has become furthermore easy to track balance initiate transfers or withdraw the EPF balance.

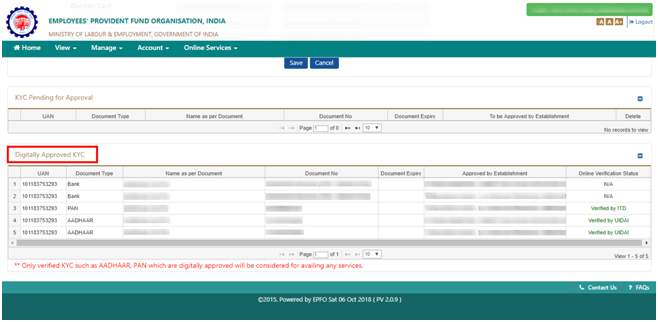

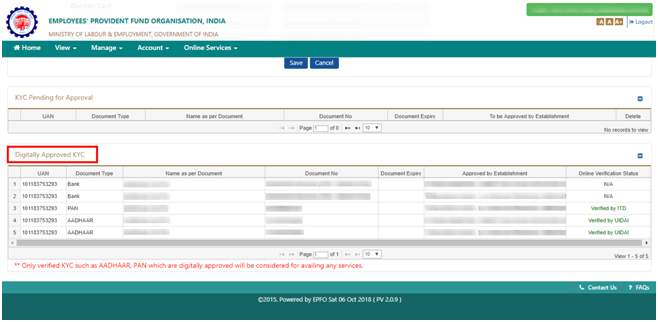

New Epf Withdrawal Forms Withdraw Without Employer Signature Make It Simple Employment Simple. 10 rows Here is the process of withdrawing of PF without leaving a job. But remember you need to be registered on the UAN portal and have the KYC details seeded in your account.

Fill the new EPF withdrawal form and submit it directly to the regional PF office. Here is the step-by-step process on how to claim PF and pens. EPFO also allows subscribers who have subsequently become unemployed to.

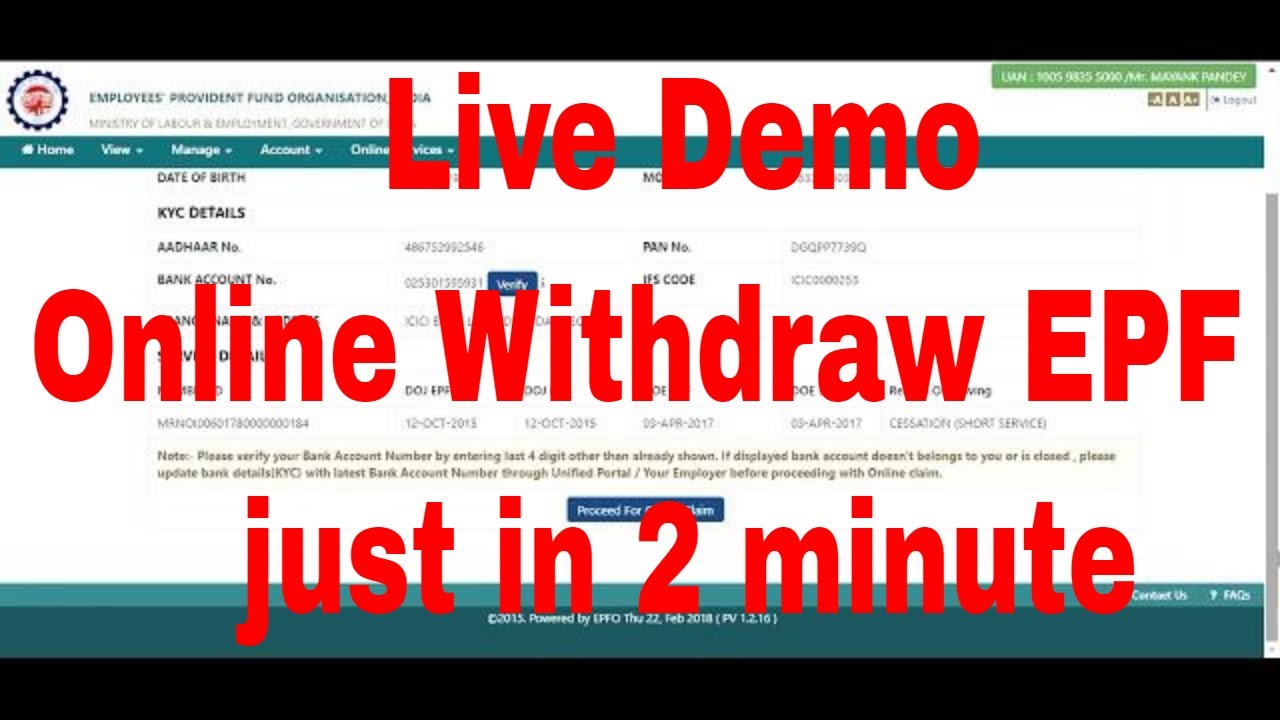

Withdrawal of PF and EPS can be in any of the following situations. Employees can easily withdraw PF balance through the EPFO member portal by following the below steps. Instead of taking a loan you can withdraw funds from your PF in whole or in part.

To withdraw your PF amount using the EPFO portal you will need to ensure the following. See which one fits you and choose the form accordingly. Can I withdraw PF without a UAN after leaving work.

U cannot withdraw your pf without leaving your job. How To Withdraw PF Without Aadhaar Card Updation. There should be no break in the 5 years.

Now your PF withdrawal claim has been submitted without using a UAN number and once approved it will be deposited in your bank account. Pin On Rdn Technical. In order to claim PF without Aadhaar card updation we need to submit EPF composite claim form non aadhaar to PF office.

Aadhar number must be linked and verified with UAN. Pin On Money Investment. Epf Withdrawal Taxation New Tds Tax Deducted At Source Rules Tax Deducted At Source Tax Help Financial Management.

Better withdraw your previous company PF amount either in online or offline If online doesnt support and next times onwards whenever you join in new job continue the same UAN. EPF members can withdraw their full PF amount after 2 months from the date of leaving their job. The employee is free to either withdraw the monies held in the fund after leaving the job or transfer the balance over to the new employer.

Withdraw without Aadhar Card. 3 If you have changed job. There is no time limit for withdrawal of Provident Fund dues.

There is generally a 2 month waiting period after resignation after which you can opt to withdraw your PF money. In such cases employees do not require the attestation of documents from their employers to. Furnish your UAN if available if not then submit your PF account number.

There is one thing that you should keep in mind before starting the withdrawal procedure and that is to merge all your previous PF accounts. To go through this method of PF withdrawal you have to download the new withdrawal form. Furnish your PAN card number if the service period has been less than five years.

Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. The money withdrawn from EPF accounts can be exempt from tax under certain conditions. However u can apply for advances for marriagepost matric education of self or family members purchase of sitehouse illness and various other contingencies.

You can withdraw your PF and EPS amount by filling the composite form launched by EPFO which will take care of your withdrawal transfer advances etc. You can withdraw your EPF Amount using UAN forms without employer signature if your UAN is activated with your KYC details like Aadhaar and Bank Account Details. Pin On Pf Rti.

If you dont have the UAN number then you can follow the old method and submit a physical application form with the regional provident fund office and then you can withdraw your PF money. Tax deducted at source TDS is deducted on the premature withdrawal only if the amount exceeds Rs. You cannot apply for withdrawal of EPF account balance immediately after your resignation from a company.

Contribution period must be over 5 years. So if you keep your money lying in the inoperative PF account for a long time you lose out on the interest benefit. To withdraw the PF balance and the EPS amount the EPFO has launched a composite form to take care of withdrawals transfer advances and other related payments.

Withdrawing PF balance plus EPS amount over 10 years of service 3. Pin On Epf. The employee is free to either withdraw the monies held in the fund after leaving the job or transfer the balance over to the new employer.

Submit a filled Composite Claim Form Non-Aadhar to the concerned EPFO office. Taxation on EPF withdrawal. EPF composite claim form non aadhaar is a PF withdrawal form which was replacement of PF form 19 10 C and also PF form 31.

EPFO says the employer must attest the application form for PF withdrawal. Find out the things you need to keep handy before you initiate the withdrawal process - with or without Aadhaar. With the advent of UAN Universal Account Number a unique number assigned to the employee for PF purposes it has become furthermore easy to track balance initiate transfers or withdraw the EPF balance.

The Employees Provident Fund Organisation EPFO allows subscribers to withdraw money from their PF account prematurely for several reasons such as medical requirements house construction educational needs etcThe limit for withdrawal will depend on your reason. What happens when your employer doesnt attest withdrawal form.

Pf How To Withdraw Pf Online Without Employer Signature Youtube

Can I Withdraw My Epf Money Without Employer S Help As I Had Left The Job Without Telling My Employer Quora

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

How To Withdraw Pf Without Leaving My Job Quora

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

Tidak ada komentar:

Posting Komentar