So if youre only working at home due to Coronavirus its best to wait until youre back at work or a few months anyway then make the whole claim at once. Cleaning costs for a dedicated work area.

This includes if you have to work from home because of coronavirus COVID-19.

How to claim covid working from home expenses. According to the Australian Taxation office ATO people working from home are able to claim the following running expenses. Your tax code will likely be adjusted so you pay less tax over the year as opposed to you getting a direct refund. In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab.

Remote working is where you are required to work. Multiply your bill by the number of remote working days. You must be able to account for each expense you intend to claim.

Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. You dont need any supporting documents for this method nor do you need a signed T2200. Our fairworkgovau website has a new look and structureRead about our website changes and what they mean for you.

Yet apportioning extra costs such as heating and electricity is tough. Fill in the form. Expenses you can claim.

In some instances your employer may provide a special allowance to cover the costs of this. Working for substantial periods outside your normal place of work. This week the Canada Revenue Agency released new guidelines making it easier for employees who have been working from home as a result of COVID-19 to claim home office expenses on their 2020.

This means keeping a record of all receipts and bills. You cannot claim tax relief if you choose to work from home. To claim the tax relief you must have and declare that you have had specific extra costs due to working from home.

Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400. We recognise that due to COVID-19 a significant number of employees and business owners started working from home from 1 March and are incurring additional running expenses in relation to their income producing activities. Your employer completes and signs this form to certify that you worked from.

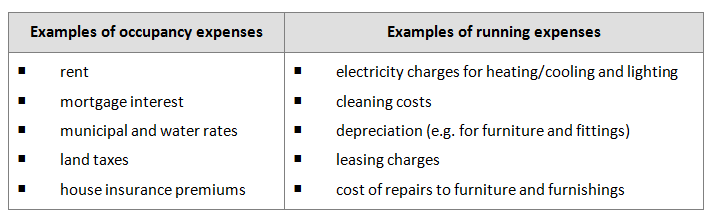

Learn about workplace entitlements and obligations for COVID-19 vaccinations returning to work quarantine and self-isolation pay leave and stand downs and more. Electricity expenses associated with heating cooling and lighting the area from which you are working and running items you are using for work. Sending and receiving email data or files remotely.

This amount will be your claim for 2020 up to a maximum of 400 per individual. Form T2200S Declaration of Conditions of Employment for Working at Home During COVID-19 is a shorter version of Form T2200 that you get your employer to complete and sign if you worked from home in 2020 due to the COVID-19 pandemic and are not using the temporary flat rate method. Cleaning costs for a dedicated work area.

Be working from home to fulfil your employment duties not just carrying out minimal tasks such as occasionally checking emails or taking calls. Provided that you meet the requirements as set out in the Income Tax Act section 11a read in conjunction with sections. Phone and internet expenses.

At home on a full-time or part-time basis. To calculate your broadband remote working cost. Electricity expenses associated with heating cooling and lighting the area from which you are working and running items you are using for work.

To help the ATO has introduced a one-off shortcut method for calculating your running costs for working from home. Work out your deduction amount. Select Remote Working Expenses and insert the amount of expense at the Amount Claimed section.

Similar to running expenses under this method available only from March 2020 onwards you can claim 80c per hour. You can claim a deduction for the additional running expenses you incur as a result of working. Once youve submitted the claim if you do it online you.

Multiply your allowable utility bills by the number of remote working days. Find out more at wwwatogovauhome. Your claim is retrospective on expenses incurred.

Phone and internet expenses. Your employer will need to determine if this allowance is taxable or not. Logging onto a work computer remotely.

To calculate your electricity and heat remote working costs. Due to that there is essentially a flat rate of 6 a week available to you. Claim the amount on line 22900 of your tax return.

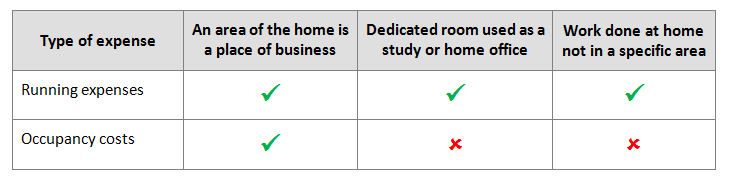

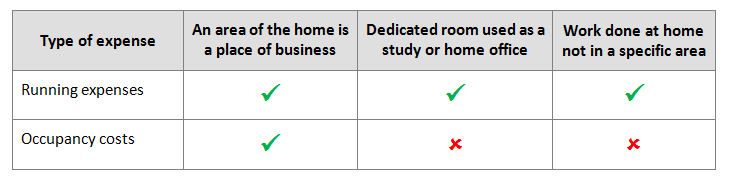

If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in maintaining a home office which will be calculated on a pro-rata basis. You can claim 52c per hour you work from home. There are 2 other ways you can work out deductions for working from home.

You must meet the eligibility criteria - Temporary flat rate method to claim your home office expenses. For every hour youve worked from March 1 to June 30 this year you can claim. Incur additional expenses as a result of working from home.

To claim your working from home expenses you must. Part of the time at home and the remainder in your normal place of work. Plus you can separately claim the work-related portion of your phone internet computer depreciation and other expenses.

Due to COVID-19 many employees are now working from home. Divided by 365 when calculating relief for 2020 divide by 366 multiply by 10 01. COVID-19 Employment allowances and reimbursements However in many cases you will be expected to bear these additional costs.

Write the deduction amount in your tax return in the Other work-related expenses section. Write COVID-19 hourly tax rate in your tax return. Keep a record of how many hours you worked from home.

If you work from home you can claim a deduction for the additional expenses you incur.

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Working From Home Tax Deductions Covid 19

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Working From Home Tax Deductions Covid 19

Tidak ada komentar:

Posting Komentar