Your account will turn inactive only when you reach the age of 58 years and not withdraw the EPF balance Earlier it was 3 years from the non-contributory period. While in case of partial withdrawal it can be done for reasons like medical need home loan repayment marriage education among others.

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

A total estimated value of RM70 bil to be made available for withdrawals.

How much can withdraw from epf account 1. How much can I withdraw. The accumulated EPF corpus can be defined as the balance that has been gathered by the employees contributions which is 12 of his basic salary the employers contribution which is 367 out of a contribution of 12 the employer contributes 833 to the Employees Pension Scheme and the remaining 367 to the Employees Provident Fund. Employer share of EPF can only be withdrawn in final settlement ie when the member quit the job.

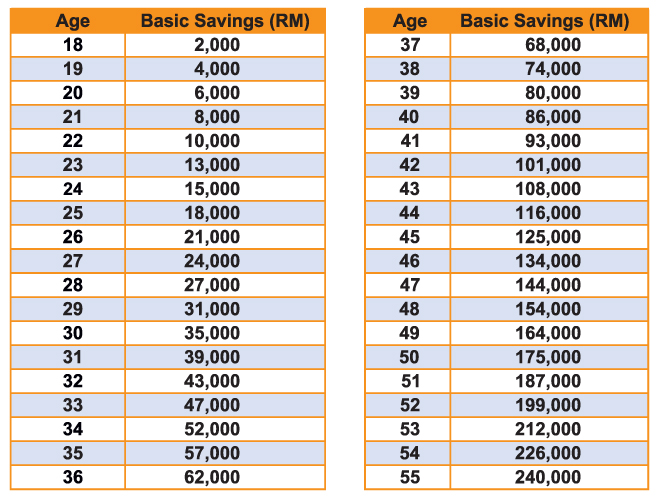

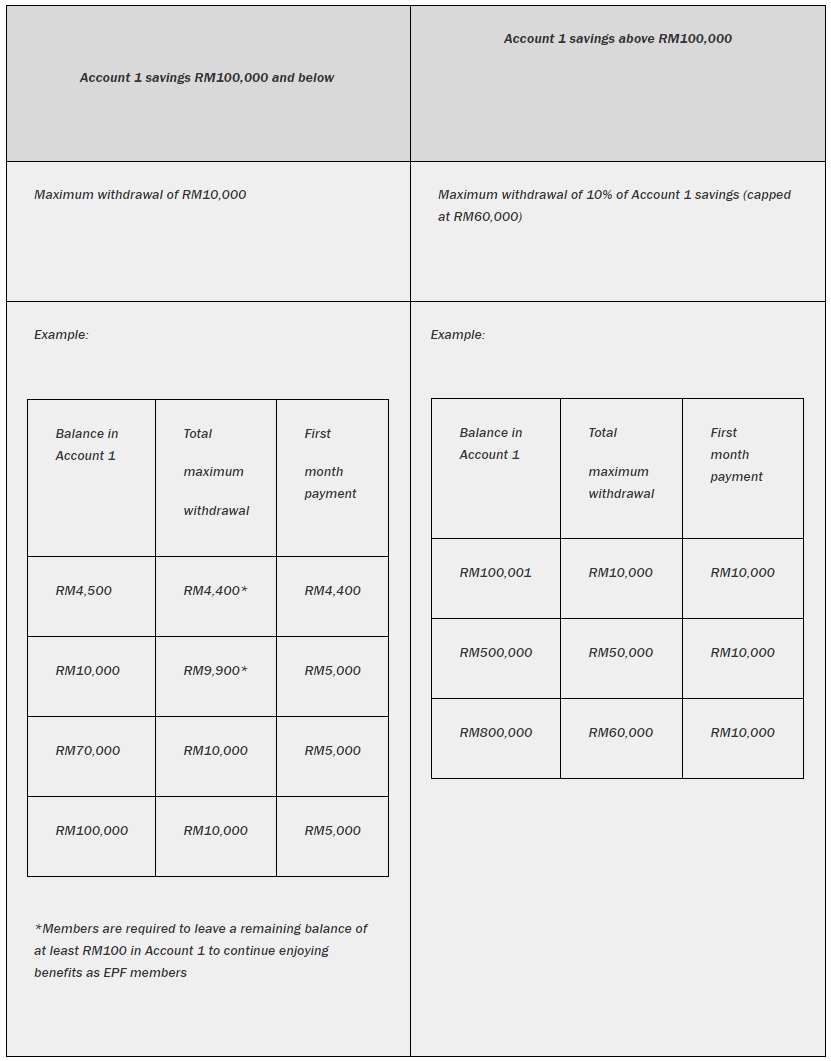

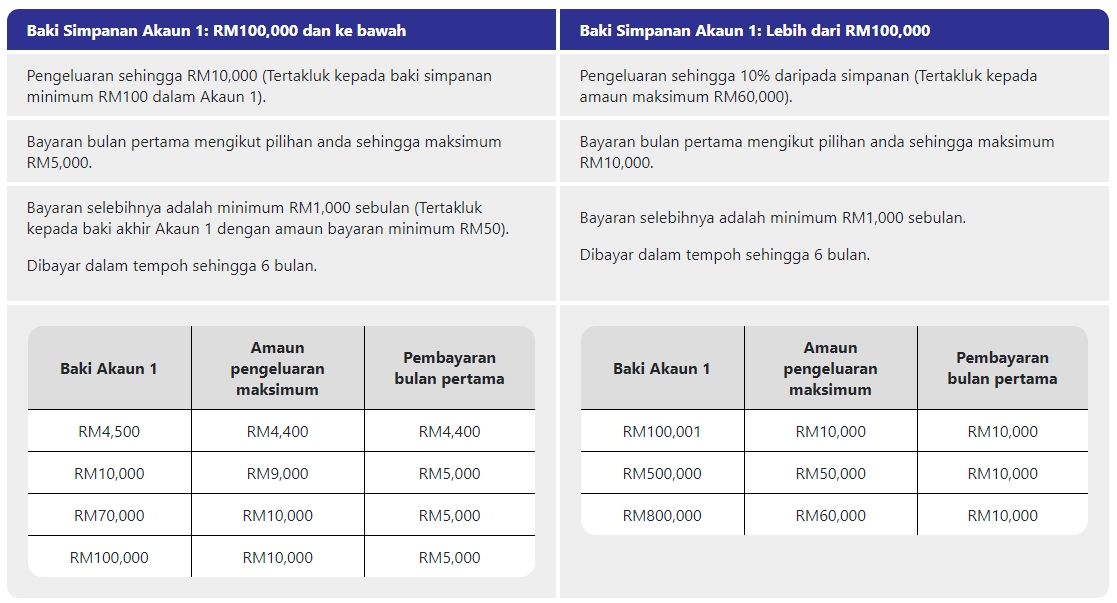

You are eligible to get a maximum of RM10000 in the first payout and the remaining amount will be staggered over the next 5 months. 90 of the EPF balance can be withdrawn after the age of 54 years. The i-Sinar facility is an extension of the i-Lestari programme which allows withdrawal of up to RM500 a month.

You can withdraw up to RM10000 in the first month. EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members. A person can withdraw 75 of his or her provident fund if heshe is unemployed for more than a month.

We show you how to withdraw PF online via UMANG App. A person can withdraw the complete EPF balance if heshe retires or is unemployed for more than two months. 1 Purchasing a home with a 100 home loan.

I-Sinar EPF is an initiative taken by the EPF Malaysia and the government under Budget 2021 to cover active members who face deep financial hardship for six months. An employee can withdraw up to 50 of his PF amount from his EPF account. For unemployment of more than 2 months the remaining 25 of the corpus can be withdrawn.

The EPF has allocated RM70 billion for the initiative which is expected to benefit eight million members who can withdraw a maximum of RM10000 or RM60000 depending on their Account 1 balance. You are also not supposed to submit. From the date of non-contributory EPF to the time of withdrawal you are eligible to.

Again this is subject to your Account 2 balance at the time of the withdrawal payment. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. Individuals who are terminated from their job will be allowed to make a withdrawal of 75 of their accumulated corpus after 1 month.

The maximum amount that one can withdraw for this purpose is 50 of his own contribution to EPF. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of. As per the EPFO notification an employee will be permitted to make PF withdrawal of up to 75 per cent of the amount standing to the members credit in.

For members with more than RM100000 in Account 1 you can only withdraw 10 of your savings with a cap of RM60000. EPF says that permitted amount under the scheme ranges from MYR50 to a maximum of MYR500 per month. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Answer 1 of 3. The Employees Provident Fund Organization EPFO has laid down certain rules for EPF members to withdraw their PF amount. Based on the changes of EPFO ITAT and SCWF we can conclude as below for the simplicity.

You can make up to 3 withdrawals from these criteria. As per the new EPFO rule a person can withdraw around 75 of their total PF amount in the case of one month of unemployment. EPF Withdrawal Rules before 5 years of Service.

The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser amount of the two. 3 Purchase of landpurchase or construction of a house. EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75 of their balance after being unemployed for more than a month.

You can submit your applications for i-Lestari Withdrawal starting 1 April 2020 until 31 March 2021. The requirement of 2 months of waiting period does not apply to women who resign from their job to get married. The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees.

Here are the main amendments to EPF withdrawal rules-. This depends on the specifics of your purchase. Malaysians can start applying starting 1st April 2020 and lucky for you we have.

Employees can obtain an advance from their EPF balance up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less. Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme. Members can now withdraw up to RM10000 if they have less than RM90000 in Account 1.

The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment. For the purchase of land one can withdraw 24 times of hisher monthly wages including dearness allowance DA and for purchaseconstruction of a house one can withdraw 36 months of wages including DA.

While still in service he can apply for advance under housing where 90 ot both EE and ER will be given. The advance is non-refundable and the employee need not deposit the money withdrawn back into their EPF account. Savings in Account 2 can be withdrawn under specific conditions.

30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical. The i-Sinar facility is an extension of the i-Lestari programme which allows a monthly withdrawal of up to RM500 from Account 2 but is scheduled to end this March. The rest of the PF amount will be transferred to a new account.

The same goes for members with any amount of savings below RM10000. You can file a withdrawal claim using your UAN on the EPFO portal. There are four options available and each carry a maximum withdrawal limit.

Applications will begin from mid-December 2020 and the money will be paid out starting 1 month after the application is approved. However if the members total savings amount to RM10000 the total maximum amount that can be withdrawn will be RM9900 as a minimum balance of RM100 is required to be kept in their Account 1 in order to be maintained as an EPF member. How much can be withdrawn from EPF account.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Tidak ada komentar:

Posting Komentar