You can then invest 30 as of 1 January 2017 from the excess of RM11000 which amounts to RM3300 into fund management which has institutions which has been approved by EPF. 75 of total EPF balance held at the time 75 x 400000 Rs.

Epf Withdrawal How To Check Change Bank Account Details In Your Epf Account The Economic Times

Note that the advantage of not withdrawing 100 of the amount is that your PF account membership remains intact allowing you to transfer your remaining balance to.

How much amount can be withdrawn from epf account. You can withdraw your contributions interest portion only. One can withdraw the advance amount from their PF. In general EPF members can get their 6 months basic wage DA or their total employee PF contribution whichever is less.

Employer share of EPF can only be withdrawn in final settlement ie when the member quit the job. Answer 1 of 2. This means that the employee can withdraw a maximum of Rs.

It becomes taxable if you are in tax limits. The announcement for an advance withdrawal was made by the Finance Minister Nirmala Sitharaman on 26 March 2020. However members can apply for lesser amounts as well.

On the other hand 100 can be withdrawn after 2 months of constant unemployment. You can make up to 3 withdrawals from these criteria. But as per new updated rules your age must be at least 57 to withdraw 90 EPF corpus amount.

EPF members can utilize the fund accumulated in their EPF account to facilitate their housing needs after three years of account opening. When a member switches jobs heshe can transfer the EPF amount to a new account or withdraw the amount by submitting an EPS scheme certificate and filling the necessary EPS form. If an employee withdraws full EPF amount after resigning from the job hisher PF membership is deemed to be terminated.

EPF account holders are also not supposed to submit any unemployment-related documents to the EPFO to withdraw the amount since the pause in EPF deposits is considered a sign of unemployment. EPF in India is administered by a statutory body called the Employees Provident Fund Organisation EPFO. While still in service he can apply for advance under housing where 90 ot both EE and ER will be given.

But they need to have a sufficient amount in their PF account. The employers portion can be withdrawn after attaining the retirement age 58 years. The advance is non-refundable and the employee need not deposit the money withdrawn back into their EPF account.

15 lakh and also place a withdrawal request for an amount lower than 15 lakh. If an EPF member does not reach the basic saving requirement they cannot utilize the money from Akaun 1 to invest in unit trusts said Puan Balqais. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less.

As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the. Accessing PF funds through the physical application method You can submit an application form at your local EPFO office. How much can one withdraw from EPS account.

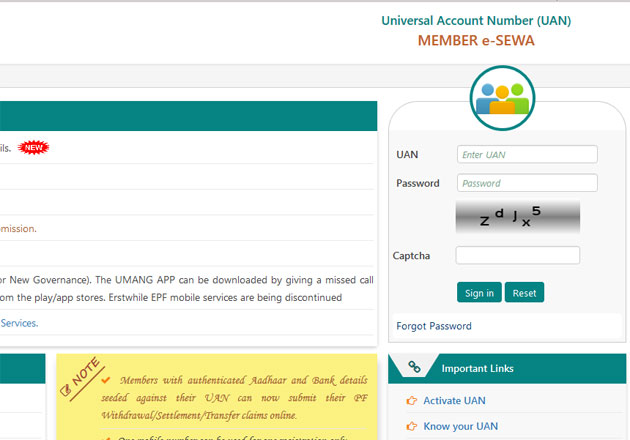

The lesser the number of years of service the lower will be the amount given to you in case of lump sum withdrawal before completion of 10 years. For this your universal account number UAN should be activated and linked to your Aadhaar PAN or bank details. Amount of money that can be withdrawn from the EPF account due to COVID-19.

According to the PF withdrawal rules you can submit a PF withdrawal application through the EPF portal. Check how much money you can withdraw from your PF account Premium You can make final withdrawal of your EPF accumulations on retirement or two months after ceasing to be an employee. But if youre planning for a job change then you can transfer the EPF amount to the company youd join.

Through this rule an employee can get the opportunity to plan the early retirement before the actual age of retirement. Continuity of your EPF membership Existing rule. Answer 1 of 3.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. EPS Form 10C however can be used to withdraw the accumulated pension amount after a continuous service of 180 days and before the completion of 10 years of active. Second the application can be made online through.

Till today 90 EPF corpus amount can be withdrawn at the age of 54. In case you are facing any financial difficulties due to the coronavirus outbreak you can withdraw a certain amount of money available in the EPF account. An employee can withdraw up to 50 of his PF amount from his EPF account.

Although you can withdraw the entire EPF amount even upon joining another company but its not legal to do so. When and how much you can withdraw after being jobless Premium On EPF withdrawal subscribers will get the calculation statement via email or on their registered mobile number. Therefore in this case the employee shall be eligible to withdraw funds from his EPF account up to Rs.

EPF members can withdraw PF advance for medical reasons as many times as they need it. First you can take out up to 75 per cent of the amount standing to your credit in the account or three months of BasicDA whichever is lower. How much can be withdrawn from EPF account.

There are certain EPF withdrawal rules and regulations involved in the withdrawal of the EPF corpus. Saraswathi Kasturirangan Partner Deloitte India says The lump sum withdrawal from the EPS scheme is allowed only if the service period is less than 10 years. The amount can be withdrawn only if individuals can furnish the required documents.

Employees can obtain an advance from their EPF balance up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less. The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemic.

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Tidak ada komentar:

Posting Komentar