If your company is an exempted trust then you will need to contact your HR for your PF withdrawal. Visit the UAN Member Portal and login using the UAN and password.

Pf Step By Step Pf Withdraw Process Online By Using Uan Account Complete A Z Youtube

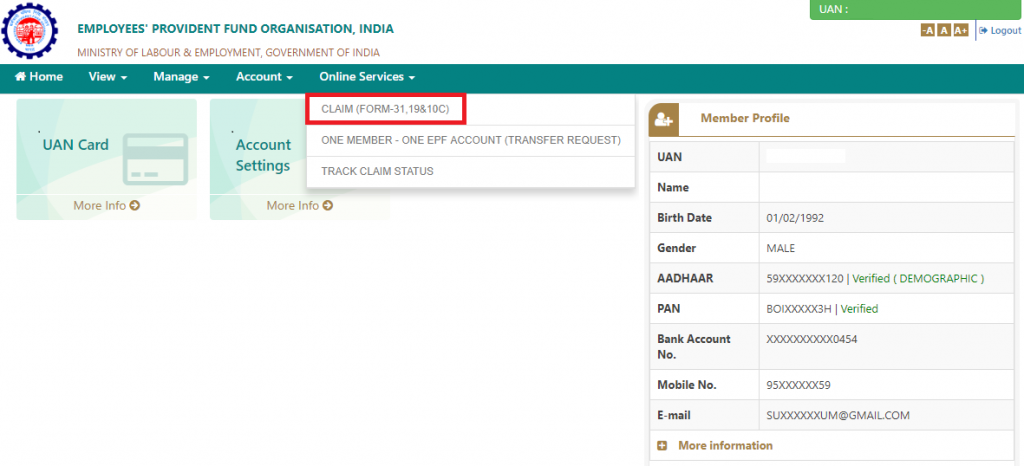

Once logged in click on Claim Form-31 19 10C 10D under the Online Services tab.

How to withdraw pf amount online in india. Click on the checkbox to proceed with submission of. Members registered on the EPFO portal can use the online withdrawal facility for processing their withdrawals. Login on UAN Portal with your ID and password httpsunifiedportal-memepfindiagovinmemberinterface Verify KYC details provided against your UAN details.

Click on the Claim Form-31 19. Step 2 is to check whether the KYC details seeded are. It must also be linked with your KYC including bank details IFSC and Aadhar.

Select purpose as Outbreak of pandemic COVID-19 from the drop down. Verify KYC details by clicking on the Manage tab. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab.

Employees Provident Fund Organisation EPFO allows you to withdraw the entire amount if you meet the following criteria. Download 4916KB Want my LIC Policy to be financed through my PF Account. Click on Proceed For Online Claim 5.

Answer 1 of 2. How to Withdraw EPF EPS Balance online. Employees can easily withdraw PF balance through the EPFO member portal by following the below steps.

Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. Withdrawing Full PF Amount. Click the Online Services tab on the menu bar.

PF withdrawal from an exempted trust. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be. This is possible if you left the Indian company in 2013 or later.

Step 2 Then input your UAN your password and the Captcha to sign in. The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. Furthermore if you are unemployed for more than two months you can withdraw the PF balance completely.

Step 1 is to log on to the UAN portal and enter your details. COMPOSITE CLAIM FORM Aadhar 1MB Instructions 6927KB. You can withdraw the entire EPF balance upon retirement.

Also as on December 2015 you cannot withdraw your PF money through any online facility in that you will have to meet your ex-employer. Visit Member e-Sewa portal httpsunifiedportal-memepfindiagovinmemberinterface on the EPFO portal. It is also your HRs responsibility to give you your PF withdrawal fund along with the interest it accrues.

Before you pack your bags and fly abroad to work and settle there make sure to pay heed to your Employees Provident Fund EPF account. How to Withdraw Employee Provident Fund EPF Online in India. Click on the suitable reason to proceed.

If your PF withdrawal takes over 10 days then you can lodge a complaint on the EPF Grievance Portal. The Umang app is a unified app that can be used to access a variety of pan-India e-government services ranging from Aadhaar gas bookings and even PF withdrawals. Early retirement can be considered if you are 55 years old.

Here is the process of withdrawing of PF without leaving a job. If your EPFO online profile has been setup and verified while you were employed in India you will be able to claim the final settlement online. If the facility takes.

However the Employees Provident Fund Organization is set to launch an online facility for provident fund withdrawal by March 2016 since the Supreme Court extended Aadhaar card usage for government schemes. Login to the EPFO portal using the UAN and password. Fill in your address and the amount to be withdrawn.

While working in India if you are contributing to EPF then you are eligible to withdraw the amount and close the account. Online Claim for PF Withdrawal. If you have reached the age of 58 you can claim the whole EPF amount tax-free.

Various reasons like illness medical expenses loss of wages natural calamities house construction Etc. The steps to file an online claim for PF withdrawal are as follows. Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active.

Select PF Advance Form 31 from the drop down. If you left the Indian employer before 2013 you have to submit the. Make sure that you have an active UAN number and it should be linked with an Aadhaar cardIn such cases employees do not require the attestation of documents from their employers to make PF.

Log in to your account by entering UAN password and captcha code. Enter the OTP received on Aadhaar linked mobile. Once you confirm the above conditions follow the ten steps given below to withdraw from the EPF fund.

Click on Get Aadhaar OTP 9. Here are the steps. Also EPF allows premature withdrawals under certain conditions.

EPFO users can withdraw money from their PF accounts by using the UMANG app on their mobile phones. The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva. Enter amount required and Upload scanned copy of cheque and enter your address.

COMPOSITE CLAIM FORM Non-Aadhar 955KB Instructions 7695KB Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF Scheme 1952. EPF withdrawal online. Next visit the Our Services tab and click on the option titled Claim from the drop-down list.

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

How To Withdraw Epf And Eps Online Basunivesh

How To Submit Pf Form 19 Online In 2019 Youtube

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Tidak ada komentar:

Posting Komentar