For a basic rate payer that is worth 120 per week and 240 per week for the higher rate payers. Lodge with our help to maximise your refund.

Working From Home Because Of Coronavirus You Can Reduce Your Tax Bill

Multiply the number of hours worked by 080 which will give you the dollar amount that youre eligible to claim for all running expenses.

How to claim tax refund for working from home. Head over to the new HMRC tax relief microservice page and follow the instructions there. Click on Review your tax link in PAYE Services. Ad Working in Australia on a Visa.

Apply for a refund if you receive franking credits on your dividends you can claim a refund even if you dont need to lodge a tax return. However the ATOs new 80 cents deduction method covers ALL your expenses from working at home so be careful. They do not apply when you bring work home outside of normal working hours.

This will apply from right through this tax year to June 30 2021. The ATO has introduced a temporary shortcut method of calculating additional running expenses allowing those working from home to claim a rate of 80 cents per work hour during the coronavirus crisis. Avoid late fees lodge your return online with help from our experts.

Write COVID-19 hourly tax rate in your tax return. You can claim a tax deduction if you worked from home for more than half of your total working hours or for more than six months during the tax year that started in March 2020. Check what your refund could be.

Avoid late fees lodge your return online with help from our experts. If you are claiming Remote Working Relief you will need to complete an Income Tax Return. Expenses you pay because youre working from home cannot be claimed against your income.

This allows for a huge amount of flexibility plus there are numerous ways to deduct home office costs in your tax return. Youll need to have your Government Gateway ID to hand if you dont have one yet you can set it up during this process. Claim for your home office if you started working from home at the end of March and worked there for at least 6 months till the end of February 2021 to deduct this.

Whats new for individuals this tax time. The ATO may extend this period. You can claim 52c per hour you work from home.

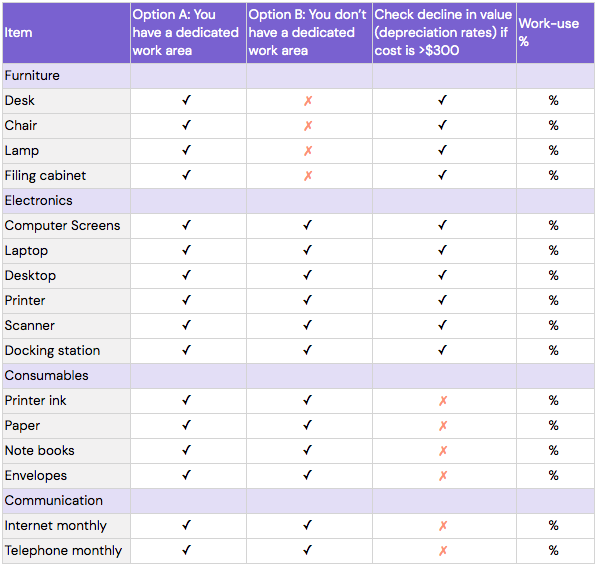

Types of individual expenses. Your employer can pay you an extra 6 per week tax-free. In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab.

HE USES THE PHONE 50 FOR WORK USAGE. Find out more at wwwatogovauhome. You cannot claim tax relief if you choose to work from home.

Can I Claim a Tax Deduction on Home Office Furniture. Many Australian businesses are making the safety of their employees and the public a priority and as such people all over the nation are currently and for at least the foreseeable future working from home. You will need to keep a record of the number of.

Write the deduction amount in your tax return in the Other work-related expenses section. The ATO introduced what they call the Shortcut Method for claiming running expenses during COVID-19. Moreover people who do claim working from home expenses shouldnt do so incorrectly - that is they use whats known as the shortcut method which enables them to claim 80 cents.

Similar to running expenses under this method available only from March 2020 onwards you can claim 80c per hour. How do I claim tax relief for working from home. The way we work is changing and for many people working from home is the new normal.

Select Remote Working Expenses and insert the amount of expense at the Amount Claimed section. Keep a record of how many hours you worked from home. Check what your refund could be.

Mark Chapman director of tax communications at HR Block said items related to working from home have been among the most overlooked deductions since the pandemic began. Ad Working in Australia on a Visa. Lodge with our help to maximise your refund.

Use our Do I need to lodge a tax return tool to check if you need. There are 2 methods of claiming. You can claim tax relief on 6 per week.

If youre self-employed you may be able to claim some of these expenses. Many people dont know they are able to claim for working from home and often miss out on valid deductions. This method means you claim 80 cents per hour for every hour worked at home.

The 2020 COVID-19 health crisis has seen our way of life turn upside down including how many of us do business. If you occasionally use your mobile phone for work purposes and the total deduction youre claiming for the year is less than 50 you can claim the following flat rate. Self-employed If you only earn income thats already taxed like salary wages or investment income then there are a few individual expenses you can claim.

Select the Income Tax return for the relevant tax year. Plus you can separately claim the work-related portion of your phone internet computer depreciation and other expenses. J PURCHASES A MOBILE HANDSET FOR 250.

Start your online application risk free here. Ad Missed the Nov 1st deadline. HE CAN CLAIM A DEDUCTION FOR 125 IN THIS YEARS TAX RETURN.

Start your online application risk free here. Work out your deduction amount. However many firms arent that generous so this might not be available to you.

There are 2 other ways you can work out deductions for working from home. Ad Missed the Nov 1st deadline. The arrangements in this section only apply to remote working.

To work out if you need to lodge a tax return there are several things to consider. This includes if you have to work from home because of coronavirus COVID-19.

How To Claim Working From Home Deductions Kearney Group

Working From Home Tax Deductions Covid 19

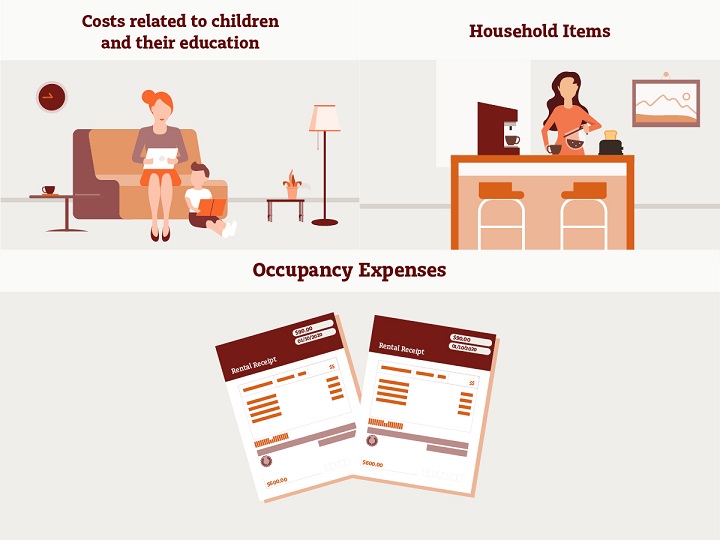

Tax Deductions For Tradies Give Your Refund A Boost

Different Ways To Claim Tax Relief When Working From Home

Tidak ada komentar:

Posting Komentar