EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service. Members may withdraw the maximum amount of the total fees or all of balance in Account II.

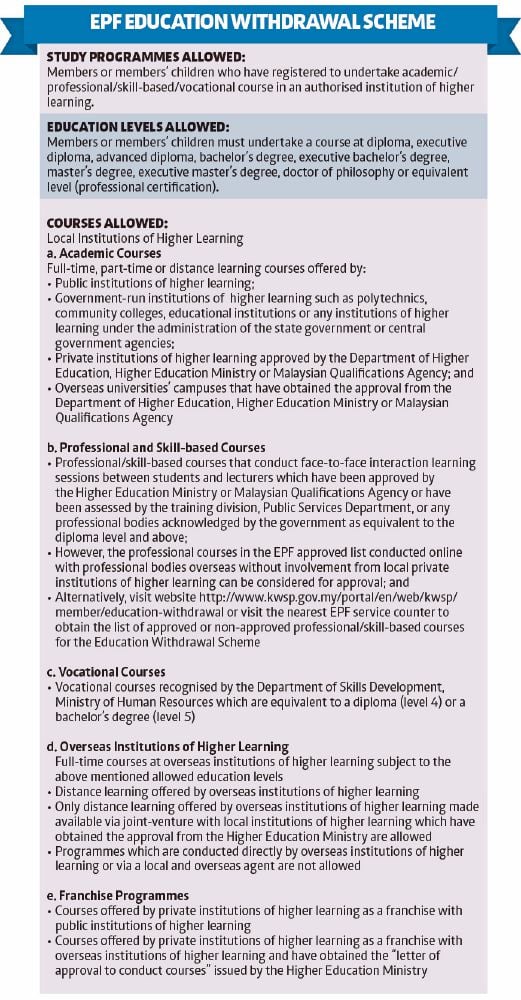

This scheme allows EPF members to withdraw from their Account II for further studies in local or overseas institutions for their children or themselves.

How to withdraw money from epf for education. On switching jobs an employee can apply for transfer of money from his or her EPF account through a form which is required to be filled by the employee and attested by the designated authority at the organisation he or she is. PF withdrawal conditions to keep in mind. Members can withdraw for themselves or their children.

Before you can withdraw money from EPF online there are two things you must ensure. Land purchase If you have been in service for 5 years you can withdraw up to 2 years of your monthly pay along with the Dearness Allowance to purchase land in your or your spouses name or jointly. Also you can withdraw your EPF money for any other professional course.

Amount Eligible for Withdrawal. Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code. You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time.

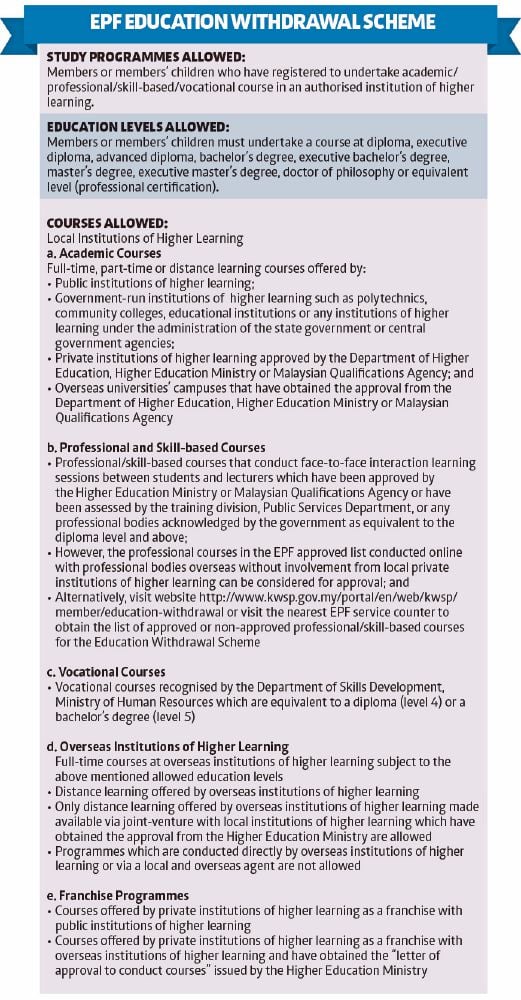

This means the funds can be withdrawn for any course at a college or university for graduation and above. Visit the online claims section When youve logged in you can look for. EPFO allows partial withdrawals for certain circumstances such as medical emergencies education marriage.

RM5000 as token of sympathy if a member becomes incapacitated on top of being able to withdraw all of their EPF money in full NOTE. You cant withdraw PF balance from your current job. You are permitted to a withdrawal amount of 50 of his share along with interest.

Introduced in 2013 the e-Pengeluaran facility started with limited housing withdrawals. EPF withdrawal is also possible if an employee leaves the job and stays unemployed for at least two months. Application must be made within 1 year from the incapacitation case of the member.

Form 31 is required for partial withdrawal EPF Govt. PF withdrawals within 5 years of opening an account are taxable 2. For more details on types of withdrawal and how to go about checking their website is highly recommended.

One can withdraw amount for his her daughter or sons higher education. Here are the main amendments to EPF withdrawal rules-. PF withdrawal for a particular purpose.

If you want to know how to withdraw money from EPF this article can help you understand the process. Link your Aadhaar to UAN b. Education If you have been in service for 7 years you can withdraw up to half of the employees quota of EPF fund for your education.

In case youve forgotten your password you can reset it via an OTP sent to your registered mobile number. Repayment of home loan 6. Construction of house or land purchase 4.

Form-19 can be downloaded from the EPFI website. So these were the EPF withdrawal rules partial and full withdrawal in 2021. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.

Procedure for EPF withdrawal online. In also addition if an employee has been unemployed for 1 month then heshe can also withdraw 75 of their total money from the pension fund. Submit an application to withdraw EPF online.

EPF withdrawal using Form 19. If you are wondering how to withdraw PF online with UAN read this article till the end. Another condition that needs to fulfilled before applying for withdrawal is that you have to complete seven years as EPFO member.

Employees can withdraw their EPF money totally or partially. You can apply for withdrawal through i-Akaun. Withdrawal from EPF after leaving an organisation.

Employees Provident Fund Account II Withdrawal Scheme for Education. The PF can be withdrawn online partially or completely depending on the individuals preference. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

You are allowed to make withdrawals up to 3 times under these criteria. EPF withdrawal via UAN Online claim submission If you know your Universal Account Number UAN then you can directly apply for pf withdrawal without the need for employer attestation. A few years before retirement.

Partial withdrawal is not taxable. Purchase Construction of House. The full EPF withdrawal can be done after the employees retirement or if an employee remains unemployed for more than 2 months.

TDS is deducted if the withdrawal amount exceeds 50000. Here are the steps you need to follow. One can make advance withdrawal of money from their PF account for the purchase or.

If you are an Employees Provident Fund EPF contributor and plan on using your EPF funds to finance your own or your childrens education at local higher learning institutions HEIs you can now submit your withdrawal applications online using e-Pengeluaran. Sometimes it may be necessary to withdraw money from the EPF. Over two million Malaysians will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programmeThe idea is that this will help those who have been impacted by the prolonged pandemic to make ends meet.

If you want to withdraw money before retirement it can only be for specified needs. 90 of the EPF balance can be withdrawn after the age of 54 years.

Financing Your Studies Through Epf

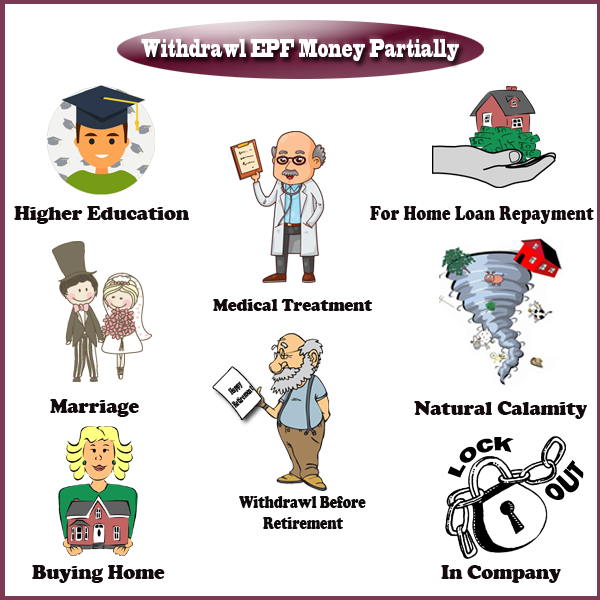

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How To Withdraw Epf Money Partially Non Refundable Loan Epf India Epf Epf Fund Epf Status Epf Balance Epf Claim

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Tidak ada komentar:

Posting Komentar