The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. Then select the Raise Claim option from the.

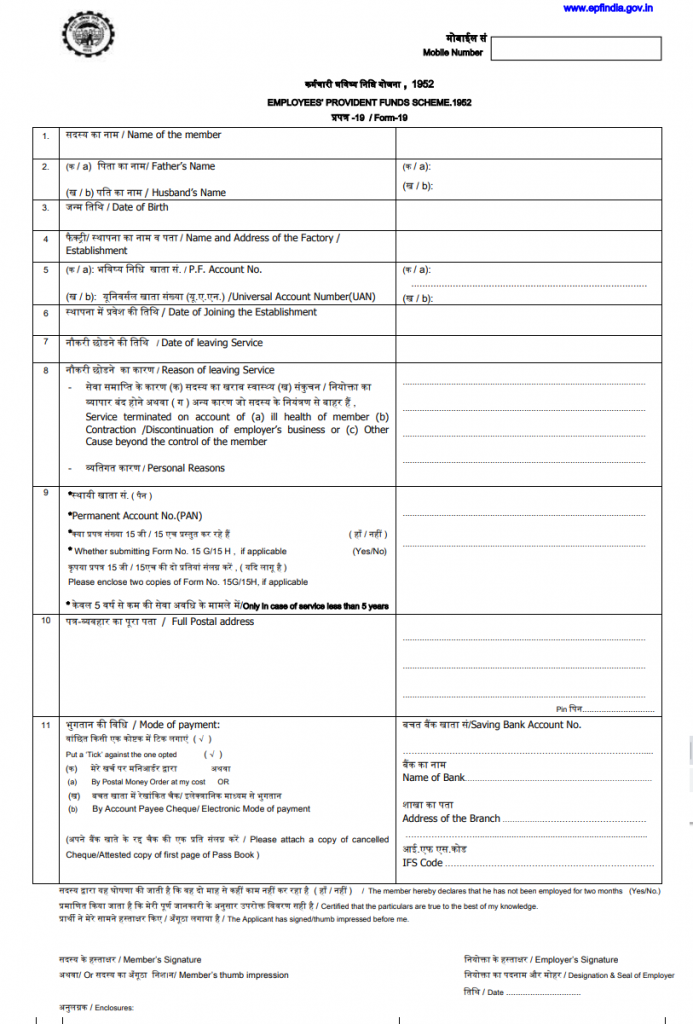

Pf Withdrawal Form Know Epf Withdrawal Procedure

Now go to online services in the primary menu and click on claim form 31 19 10C.

How to submit pf withdrawal form online. COMPOSITE CLAIM FORM Non-Aadhar 955KB Instructions 7695KB Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF Scheme 1952 Download 4916KB Want my LIC Policy to be financed through my PF Account. TAX on EPF Withdrawal Rules. As an exception if your income is below the taxable limit you can submit self-declaration form 15G to.

Tick the disclaimer and click on Get Aadhaar OTP. However to process the EPF withdrawal online your Universal Account Number UAN should be active. Now EPF members can submit or upload their.

You can now upload Form 15G Form 15H and submit along with your EPF online withdrawal claim form. Verify last 4 digits of your bank account. Kindly visit EPFO Member Interface portal and login with your credentials.

Visit the UAN portal. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online. Here are the steps.

Employees can raise PF withdrawal claim directly on the EPFO website. You can withdraw PF only if you are unemployed after 60 days from your Last Working Day You have to transfer your previous PF to your present employer by the following steps as withdrawal not permitted Online Claims. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal.

You will then have to select All Services from the drop-down menu and look for EPFO. Now in the new page you will find your details like name dob father name or husband name and mobile number along with your KYC details like Aadhar bank account details and also your service details. You can submit form 15G for EPF withdrawal online.

Further provide the purpose of such advance the amount required and the employees address. To submit form 15G for EPF Withdrawal online you should follow the steps stated below. The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva.

This is good news for all the EPF members who are struggling to submit form 15G for online PF withdrawal claims. Select the option Only PF Withdrawal Form-19 from the drop-down menu in the I want to apply for section. Visit EPFO Member portal and log in by submitting UAN and Password or click here to visit directly at login page httpsunifiedportal-memepfindiagovinmemberinterface.

The facility of passbook is not available for members of. On the next page check the disclaimer and click on Get Aadhaar OTP. It must also be linked with your KYC including bank details IFSC and Aadhar.

Next up select PF Advance Form 31 to withdraw your fund. The following steps will help you to raise the withdrawal claim online. How to Apply EPF Withdrawal Online.

Here is how to withdraw PF online via UMANG App. Bank information linked to UAN. Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active.

It is important to know about the TDS in relation to the EPF withdrawal before you start filling out the. Click on Online Services menu tab and click on Claim Form 31 19 10C option. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab.

But any issues they will clearly pinpoint it for correction so you can follow the proccess accordingly. One mobile number can be used for one registration only. Have a look at the image below to find a sample of Form 15G.

Sample of Form 15G. Step 2 Then input your UAN your password and the Captcha to sign in. In the I want to apply for drop-down menu you must select Only PF Withdrawal Form-19.

Please Apply in FORM 14 11MB. Step 1- Sign in to the UAN Member Portal with your UAN and Password. First of all log in to the unified member portal EPFO UAN Portal.

Write an email to. Here are the steps you need to follow. You need to open the UMANG App on your mobile phone and log in.

You will then be able to view EPF Withdrawal. You will receive an OTP on your registered mobile number. This video is about how to submit form 15G for online PF claims because in online UAN portal here is no opt.

To file the application for the withdrawal claim online you must have-An existing UAN number. You have to use the UAN number and password for login. How to Submit form 15G for Provident fund or EPF Withdrawal Online.

Log in with your UAN and password. Confirm the KYC Aadhaar PAN Bank with IFSC and Submit. You will need to submit the application after entering the OTP details.

How to submit form 15G for online PF withdrawal. Once you log in click on the online services drop-down list and find Online Claim Form 31 19 10C. Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 19.

You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be withdrawn in part or in whole. You must be aware that TDS is applicable on the EPF withdrawal amount if you are withdrawing EPF before 5 years of contribution to the EPF.

An additional facility is provided to you that you can submit the Form 15G on the websites of the major banks in India online. Click on the Manage tab and select KYC to check whether your KYC details such as Aadhaar PAN and the bank details are verified or not. A member can view the passbooks of the EPF accounts which has been tagged with UAN.

They will share a form fill the same and sign it and share the soft copy and your money will be in your account in 7 to 10 days prior no issues in account. Steps to Fill EPF Withdrawal Online. Generally money from an EPF account can be taken out only after retirement.

If the member is not eligible for any of the services like PF withdrawal or pension withdrawal due to the service criteria then that option will not be shown in the drop-down menu. Initiate online Claims through Online Services Menu. If you meet this condition you can follow the procedure given below to withdraw your EPF online.

PAN and Aadhar details seeded into the EPF database. Eligibility Criteria for EPF Withdrawal. Login using your UAN and password on the Official EPFO member portal.

Click on Yes to sign the Certificate of Undertaking. Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code. A new section of the form expands where you have to mention your complete address.

This facility is available on the unified member portal.

Pf Withdrawal 19 10c Online Process How To Withdraw Pf Online Pf Online Form Online Pf Claim Youtube

How To Submit Pf Form 19 Online In 2019 Youtube

Epf Form 19 How To Fill For Final Pf Settlement Online

How To Fill Pf Form 19 Online Offline Sample Filled Pf Form 19

How To Fill Pf Withdrawal Form And Get Claim Online Youtube

Tidak ada komentar:

Posting Komentar