But you cannot withdraw the full amount what has been accumulated so far in the PF account. Employees can withdraw 90 of their EPF corpus before 1 year of their retirement.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

How much partial withdrawal from epf account. This means that the employee can withdraw a maximum of Rs. Basic salary for three months. Savings in Account 2 can be withdrawn under specific conditions.

The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser. Considering the COVID-19 pandemic or similar situations when there might a lockdown in the entire country EPFO has allowed withdrawal of EPF if an employee faces unemployment before retirement due to lockdown or retrenchment. 15 lakh and also place a withdrawal request for an amount lower than 15 lakh.

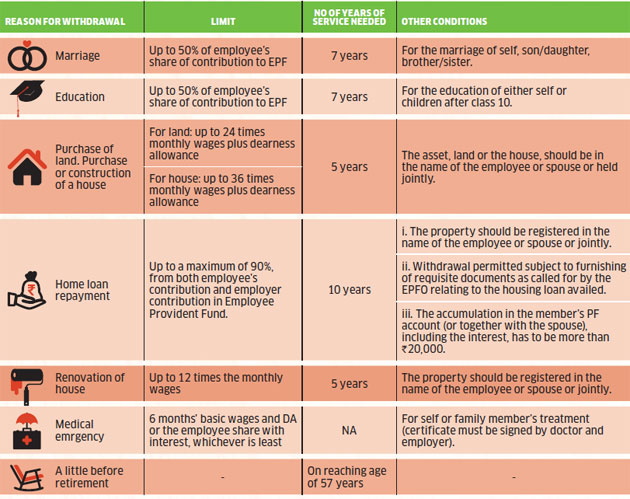

Answer 1 of 3. 7 rows EPF Form 31 is utilised to file a claim for partial withdrawal of funds from EPF or. An EPFO member can withdraw up to 50 of the PF amount from the EPF account but the condition is that the marriage should be of hisher the marriage of his or her daughter son sister or brother.

However the EPF contribution by the member should have extended 7 years. However to meet specific needs an employee can withdraw a partial provident fund amount or withdraw in the event of any emergency including medical emergency marriage. 30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical.

You have to fill up the form 31 and submit to EPFO for withdrawal of amount. Mr Z can withdraw Rs 75000 as non-refundable advance from his EPF account. After the minimum period as per pf rules loans and withdrawals are permitted for marriage of children house construction medical treatment education etc.

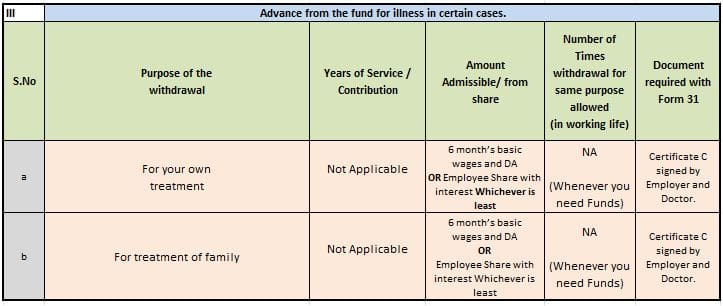

Nevertheless Employee Provident Fund Organization has imposed certain restrictions on early withdrawal of whole provident fund amount to benefit employees even after retirement. You can withdraw your entire share along with interest or 6 times your monthly salary whichever is lower for a medical emergency concerning yourself or any of your family members. Relief under EDLI Scheme Under the EPF EDLI Employees Deposit Linked Insurance Scheme if a member of the EPF dies due to any reason including Covid 19 their family is eligible to get up to Rs.

You can make up to 3 withdrawals from these criteria. According to the EPF withdrawal rules one can make a partial withdrawal of an amount equal to 3-months of their basic salary and dearness allowance DA or 75 per cent of the credit balance in. Rs 75000 75 of Rs 100000.

75 of the balance standing in the members account. You can withdraw only 50 of your contribution with interest towards PF and the withdrawal is applicable for a maximum of three times in your life. Whichever is lower Therefore in this case the employee shall be eligible to withdraw funds from his EPF account up to Rs.

75 of total EPF balance held at the time 75 x 400000 Rs. After 54 years of age and within one year of retirementsuperannuation whichever is later an EPFO member can withdraw up to 90 per cent of his EPF accumulation as partial withdrawal before. EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members.

Procedure for EPF withdrawal. One can make partial withdrawal from his EPF account for the purpose of education of self children after class 10 once he completes 7 years in service. Here Mr Z can withdraw lower of the below amounts.

An employee can withdraw up to 50 of his PF amount from his EPF account. They are allowed to withdraw up to 75 of the balance available from their EPF account. To arrange a wedding.

Once you complete seven years in service you can withdraw up to 50 of your own contribution from your EPF account for the marriage of self sondaughter brothersister. In March 2020 the government of India announced a special provision allowing the EPF members to withdraw basic pay and dearness allowance DA of up to 3 months or 75 of total EPF corpus whichever is lower as advance withdrawal. After leaving a job one can withdraw 75 per cent of their provident fund balance if heshe remains unemployed for 1 month and the remaining 25.

Rs 90000 Rs 300003. EPFO allows you to withdraw 50 of your share in the account along with interest to host a wedding. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Tidak ada komentar:

Posting Komentar