The provision and process for withdrawal of second COVID-19 advance is same as in the case of first advance. Covid 19 PF Withdrawal Time Period- Since COVID-19 has been declared a Pandemic by the Appropriate Government for the entire country and therefore the employees working in establishments and factories across entire India who are members of the EPF Scheme 1952 are eligible.

Covid 19 Know How Much You Can Withdraw From Your Epf

However since the motive behind allowing premature withdrawal of Employee Provident Fund is to offer liquidity during the pandemic no tax or TDS is imposed on the amount.

How to withdraw from epf for covid. The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemic. The government has allowed employees to withdraw money from their EPF accounts due to coronavirus pandemic. You can apply for a claim of 75 of the EPF amount and it just takes 72 hours.

20 lakhs assuming you retire in 20 years and the current rate continues. The government announced back in March 2020 that an individual can withdraw a certain sum from their Employees Provident Fund EPF account if heshe is facing financial problems due to the coronavirus-related lockdown. PF WITHDRAWAL RULES AMID COVID-19 CRISIS.

Do you want to make an EPF withdrawal due to COVID-19 in order to satisfy your financial needs. Such a withdrawal if more than Rs 50000 is taxed at 10 under Section 192A if PAN card is furnished. The government announced back in March 2020 that an individual can withdraw a certain sum from their Employees Provident Fund account if heshe is facing financial problems due to the coronavirus-related lockdown.

PF New Rules And How To Withdraw EPF Amount. While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so. For example Mr Z an employee of a factory with an annual salary of Rs 72 lakh desires to obtain an advance from his EPF account as the factory is shut down due to the.

Members who have already availed the first COVID-19 advance can now opt for a second advance also. Funds withdrawn from the EPF for reasons other than covid before the completion of five years of continuous service attract tax. You can get non-refundable withdrawal to the extent of the basic wages and dearness.

Malaysians can start applying starting 1st April 2020 and lucky for you we have. The government has notified the amendment in EPF scheme rules regarding withdrawal of funds from the EPF account to deal with coronavirus. If Yes then feel free to read further.

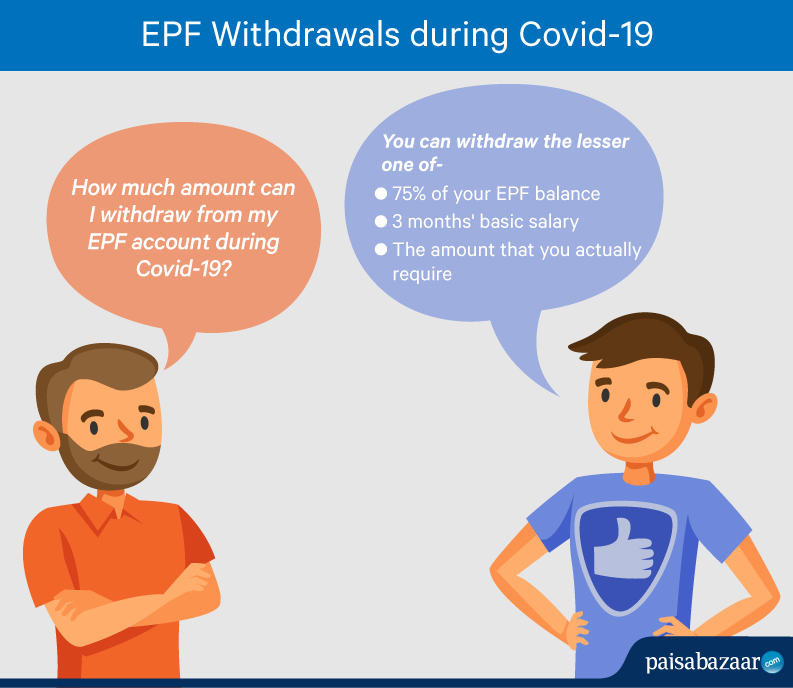

The question is how to withdraw the amount from EPF due to corona. However members can apply for lesser amounts as well. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less.

Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. However since the motive behind allowing premature withdrawal of Employee Provident Fund is to offer liquidity during the pandemic no tax or TDS is imposed on the amount. Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme.

Before applying its important to know how. Under this relief measures relating to the Covid 19 pandemic the members of EPF are allowed the following benefits. For example an Rs.

The EPFO has released a set of frequently asked questions FAQs for the benefit of those who wish to avail the PF advance. If the PF outstanding balance is. The government in March 2020 announced that an individual can withdraw a sum of money from EPF account during a final crisis caused due to covid-19.

However funds withdrawn for reason other than Covid stress before the completion of five years of service attract tax. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Tax rules applied on EPF withdrawal due to COVID-19 Generally EPF withdrawal is tax-free only if you have worked for the company for five years continuously.

Generally EPF withdrawal is tax-free only if you have worked for the company for five years continuously. This is because early withdrawals from the EPF are not a part of the tax-deductible income of the employees. The withdrawal will provide liquidity in the hands of employees during the COVID-19 lockdown.

EPFO has allowed its members to avail the second COVID-19 advance from their PF account. PF Withdrawal COVID 19. In this period of the pandemic it may happen that you run out of cash or funds for your daily expenses.

EPF savings can also be withdrawn after two months of unemployment. Such withdrawal is permissible for all the members of EPF. In such trying times EPFO endeavours to lend a helping hand to its members by meeting their financial needs.

Here is a step-by-step guide to withdraw the amount. For NPS the difference will be even higher at Rs. The ministry noted that the COVID-19 advance has been a great help to the EPF members during the pandemic especially for those having monthly wages lower than Rs 15000.

Now if you are someone yet not affected by COVID-19 and its economic impact it is a good. The government on March 26 announced that an individual can withdraw a certain amount from their Employees Provident Fund EPF account if heshe is facin. 5 lakh partial withdrawal from EPF would mean your retirement corpus will go down by around Rs.

Under this provision non-refundable withdrawal to the extent of the basic wages and DA for three months or up to 75 of the amount standing to members credit in. Tax rules applied on EPF withdrawal due to COVID-19. Withdrawal from EPF due to Covid 19 was first declared in March 2020 as part of the Pradhan Mantri Garib Kalyan Yojana.

Employees seeking an advance can make an online application using their login on the EPFOs website. The government of India has taken into account the damage and effect that Coronavirus has on the Indian economy as well as the global economy.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epfo Application For Epf Withdrawal Claims Form 31 Under Outbreak Of Pandemic Covid 19 Are Being Processed On Priority By Epfo Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Stayhomestaysafe Facebook

Epfo File Epf Withdrawal Claim Under Covid 19 Category And Get 75 Of Epf Balance Or 3 Months Of Basic Wages Da Whichever Is Less Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Facebook

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Tidak ada komentar:

Posting Komentar