An individual can withdraw from EPF account for the purpose of Higher education of children. Malaysians can start applying starting 1st April 2020 and lucky for you we have.

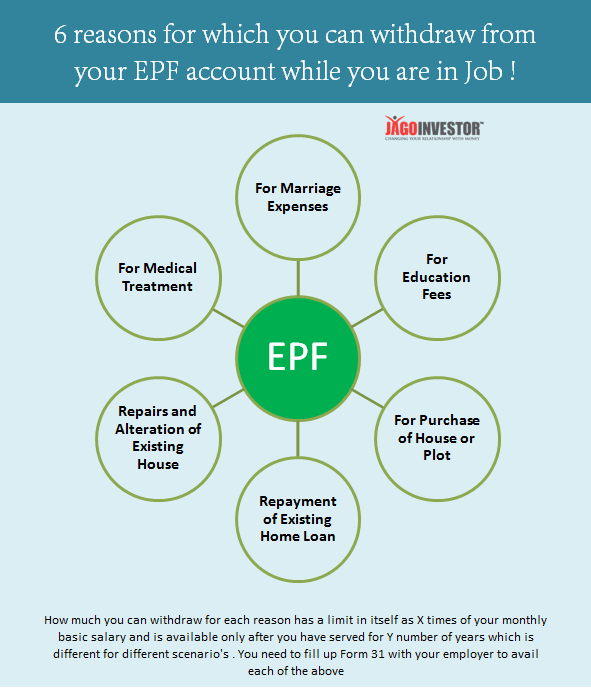

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Introduced in 2013 the e-Pengeluaran facility started with limited housing withdrawals.

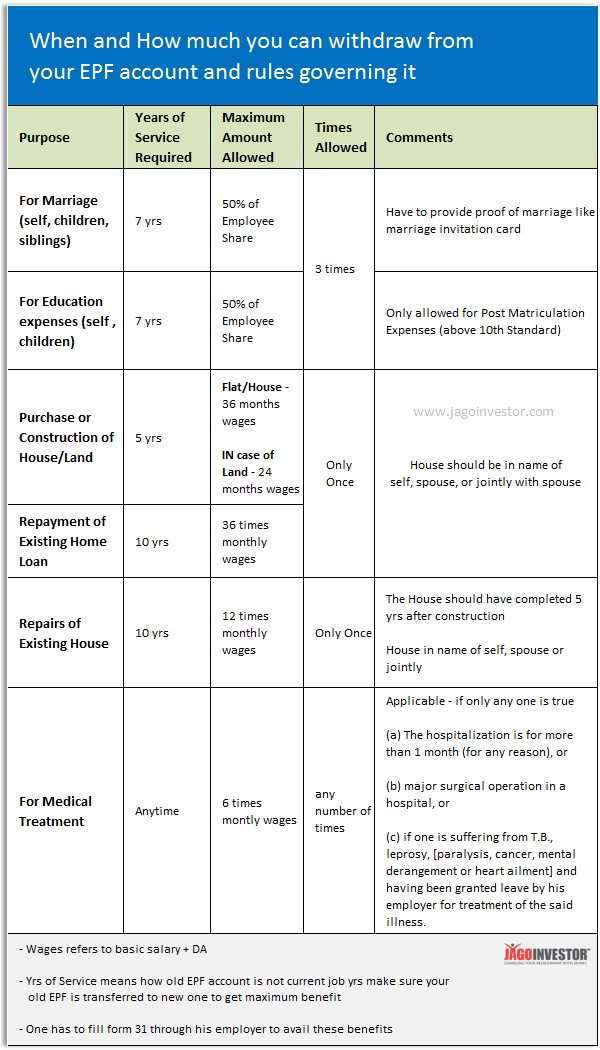

How to withdraw epf account 2 for education. Form 31 is required for partial withdrawal EPF Govt. Now you dont need to open a new EPF account on joining a new organization as you can transfer the EPF balance to the previous account. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

Members can withdraw for themselves or their. Grant of advance to members who are physically handicapped For purchasing equipment for minimizing hardship on account of handicap NA 6 months basic wages and DA. This will be applicable for all EPF Account 2 holders and.

If you are an Employees Provident Fund EPF contributor and plan on using your EPF funds to finance your own or your childrens education at local higher learning institutions HEIs you can now submit your withdrawal applications online using e-Pengeluaran. Quality education is the key to a stable career that will result in a comfortable life for you and your family. An employee can withdraw up to 50 of his PF amount from his EPF account.

Partial PF Withdrawal Rules for Medical Treatments. Land purchase If you have been in service for 5 years you can withdraw up to 2 years of your monthly pay along with the Dearness Allowance to purchase land in your or your spouses name or jointly. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Members of the Employees Provident Fund EPF who wish to settle their higher education loans using their Account 2 savings will soon be able to do so irrespective of their loan agreement dates. And first time withdrawal from same institution and programme. Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme.

EPF scheme member can withdraw the money from the EPF scheme for various reasons like marriage buying a house etc. Account 1 is off limits. Education of sondaughter NA A certificate regarding course of study and estimated expenditure from Head Of Institution VI Para 68 N.

Information is for general reference only is an unofficial summary based on EPFs official website. At first of course. So these were the EPF withdrawal rules partial and full withdrawal in 2021.

This is part-2 of our post on patrial PF withdrawal. Also you can withdraw your EPF money for any other professional course. You can make up to 3 withdrawals from these criteria.

Amount Eligible for Withdrawal. If a salaried person wishes to withdraw from EPF account for the purpose of either construction of house or purchase of a plot the property must be registered in his name spouse or jointly held. 1 and Account 2.

You need to have balance in your EPF Account 2 and does not reach 55 years old when applying for the withdrawal. If you are withdrawing it before 5 years of service it is taxable. Until you reach the age of retirement but you can tap into your funds in.

Aadhar number must be linked and verified with UAN. Employees Provident Fund Account II Withdrawal Scheme for Education. Instead of taking a loan you can withdraw funds from your PF in whole or in part.

To withdraw your PF amount using the EPFO portal you will need to ensure the following. You can choose to withdraw your savings from Account 2 to help finance your own children spouse andor parents education at approved institutions locally or abroad. Housing withdrawal as this allows a member to have a roof over their head when they retire.

Education If you have been in service for 7 years you can withdraw up to half of the employees quota of EPF fund for your education. Savings in Account 2 can be withdrawn under specific conditions Puan Balqais. How to apply for Education Withdrawal from your EPF Account 2.

This scheme allows EPF members to withdraw from their Account II for further studies in local or overseas institutions for their children or themselves. Puan Balqais shares that EPF members can withdraw savings from Akaun 2 for the following purposes. This will save paperwork and keep your PF account active in a continuous series.

Members may withdraw the maximum amount of the total fees or all of balance in Account II. EPF withdrawal before 5 years of service is taxable which means you may experience a cut on the credited amount. Account 1 while the remaining 30 goes to Account 2.

The 15 different categories of withdrawals have been divided into Account 1 only Account 2 only both accounts withdrawals. We will cover the following topics. The withdrawal limit is the price of the home plus 10 or all the money in Account 2 whichever is lower and not less than RM500.

Account 2 for various investments such as buying a house or paying for a higher. You can withdraw with the help of your. Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy.

The documentation requirements for your application to withdraw and purchase a home are fairly straightforward but will differ with the specifics of your withdrawal. Another condition that needs to fulfilled before applying for withdrawal is that you have to complete seven years as EPFO member. Answer 1 of 2.

The following steps are meant for applicant who study in IPTS since my institution UTAR is an IPTS. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service. In part-1 we saw partial withdrawal rules for house purchase renovation and home loan.

Employee Share with interest OR. This means the funds can be withdrawn for any course at a college or university for graduation and above. Every month 70 of your EPF contribution is allocated to.

Details on Malaysias EPF KWSP Account 1 VS Account 2 withdrawals. When making an application what documents will you need. TDS is deducted if the withdrawal amount exceeds 50000.

One can withdraw the advance amount from their PF. However to make these withdrawals there are certain conditions that must be met by the EPF member. EPF relaxes Acc 2 withdrawal rules for education loan repayment.

In this post we will look into partial PF withdrawal rules on education health and marriage. Additional forms documents required. KUALA LUMPUR July 5.

Partial withdrawal is not taxable. Yes you can withdraw it completely.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Application To Withdraw From Epf Account 2 Begins Today

Kwsp Epf Partial Withdrawal Education

Afifplc How To Apply For Epf Education Withdrawal

Tidak ada komentar:

Posting Komentar