For example if your EPF balance on March 31 2021 is Rs 10 lakh and your basic salary is Rs 50000 per month you will be able to withdraw only Rs 15 lakh. However in a case where a facility of advance is provided due to a pandemic.

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

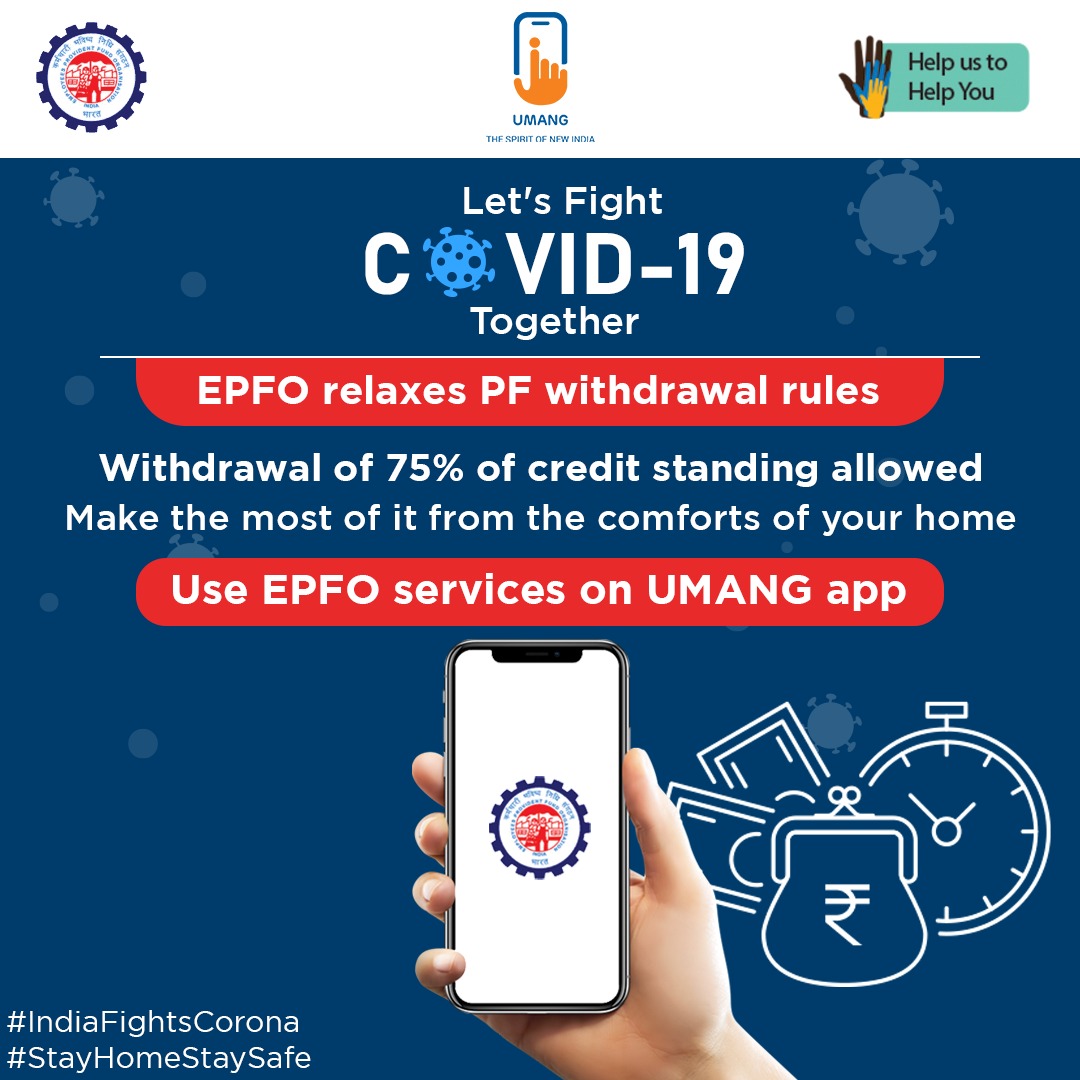

Some of these facilities are requesting a pension withdrawal a COVID-19 advance accessing the employees passbook activating your UAN number UAN allotment and many others.

How to pf withdrawal covid 19. Go to online services and select claim section. Fixed Deposits FDs In case of Fixed Deposits FD the depositor cannot avail the facility of premature withdrawal. Now select PF advance Form 31 from the drop-down menu and select the withdrawal claim as Outbreak of pandemic COVID-19.

Im very excited to be able to share with you what I have learned over the past many years of study and hands-on practice with thousands of patients. 15000 the ministry added. Select I want to apply for.

Click on Proceed Online Claim. The 75 of Rs 2 lakh is Rs 15 lakh while the three months of Basic and DA will be Rs 300003 Rs 90000. Click on Claim Form 31 19 10C and 10D Enter the last four digits of your bank account.

Partial withdrawal of fund from PF account is taxable with few exceptions such as employment termination and medical emergencies. Amid Coronavirus crisis soon Pandemic can be cited by EPF subscribers as the reason to withdraw up to 75. Enter Bank Account Number as seeded against UAN and verify 4.

The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemic. On May 31 2021 the EPFO made an announcement allowing subscribers to make a second non-refundable advance to accord top priority to COVID-19 claims. A member can view the passbooks of the EPF accounts which has been tagged with UAN.

However the withdrawal becomes tax-free after the completion of the five-year tenure. From the drop down menu you will be required to select PF advance Form 31. Ratings 78 December 2021 News.

Once the bank account number is verified then click on Proceed for online claim. Upload a scanned copy of a cheque or the passbook. The Employees Provident Fund Organisation EPFO has allowed subscribers to withdraw amounts from their balance so as to help them tackle financial emergencies due to the COVID crisis.

You can go directly to this link to download the form. Fill OTP received on Registered Mobile Number and submit an application. How To Withdraw Pf Online For Covid 19 - Safely Save Your money.

Tick Disclaimer and click on Get Aadhaar OTP. Select Request for Advance COVID-19. Enter your UAN details and click on.

You will be required to select purpose of withdrawal as Outbreak of pandemic COVID-19 from the drop down menu. Enter the required amount. The amount should be lower of 3 months basic and dearness allowance or 75 of EPF corpus amount.

One mobile number can be used for one registration only. Select Outbreak of Pandemic Covid-19 as the purpose of withdrawal. - frequently asked questions on epf advance to fight covid-19 pandemic dated 26 apr 2020 - Consolidated Guidelines of Ministry of Home Affairs for Containment of COVID-19 reg - Extension of due date for payment of contributions and administrative chargesInspection charges due for wage month march 2020 from 15042020 to 15052020 to establishments disbursing wages for March 2020.

New information that I find in the course of my daily studies will appear on this site on a weekly. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. Now the government has declared COVID-19 as a pandemic.

Now you will get directed to a new webpage having all your details like name date of birth and last four digits of your Aadhaar number. An EPF withdrawal is tax-exempt only if the employee renders a continuous service for five years. Employees Provident Fund EPF withdrawal for Coronavirus Covid-19 Pandemic.

However members can apply for lesser amounts as well. Employees are given the option of using their EPF savings to meet their financial needs. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online.

From the dropdown list Select PF Advance Form 31. Withdrawing funds from a PF account could help ease short-term cash-flow issues but it could also impact the retirement goals of an individual. Click on Proceed For Online Claim 5.

Select purpose as Outbreak of pandemic COVID-19 from the drop down. The COVID-19 advance has been a great help to the EPF members during the pandemic especially for those having monthly wages of less than Rs. Added to this mucormycosis or black fungus has been.

Hence in this case you will be able to withdraw Rs 90000 for COVID-19 pandemic. PF Withdrawal Covid 19 Online Claims Process 1. Select PF Advance Form 31 from the drop down.

Login to the EPFO portal - unifiedportal-memepfindiagovin using UAN and password. Then go to online services and select claim Form -31 1910C and 10D. Upload scanned copy of cheque and enter your address.

The facility of EPF withdrawal and obtaining a non-refundable advance is to help employees in need of money amidst the COVID-19 lockdown. A PF account holder can download the new composite claim form Aadhaar or composite claim form Non-Aadhaar from the EPFO website. Put simply your accumulated PF corpus.

The new PF advance or PF withdrawal rule will apply to all establishments across the country. Now enter the amount that you want to withdraw and enter your. Choose Only PF Withdrawal Form 19 from Drop Down Menu.

This is because COVID-19 has been declared a pandemic by appropriate authorities for the entire. The stepwise process to withdraw PF using UMANG app. Fill Complete Address and upload a scanned copy of Original ChequePassbook.

Enter the amount you want to withdraw from your account. Hence if you are facing financial trouble due to COVID 19 related lockdown situation you can make tax-free withdrawals of up to three months of salary basic pay and dearness allowance or 75 percent of the balance from the EPF accounts whichever is lower. Login to Member Interface of Unified Portal 2.

The facility of passbook is not available for members of. Verify the bank account number. Go to the Online Services section.

Go to Online ServicesClaim Form-311910C 10D 3. Fill in your bank account number in the required space and tap on verify.

Mygovindia On Twitter Due To Covid 19 The Government Has Amended The Employees Provident Fund Withdrawal Rules Allowing Subscribers To Withdraw 75 Of The Credit Standing In Their Epf Account Or Three Months

Epfo File Epf Withdrawal Claim Under Covid 19 Category And Get 75 Of Epf Balance Or 3 Months Of Basic Wages Da Whichever Is Less Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Facebook

Epfo Application For Epf Withdrawal Claims Form 31 Under Outbreak Of Pandemic Covid 19 Are Being Processed On Priority By Epfo Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Stayhomestaysafe Facebook

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Tidak ada komentar:

Posting Komentar