Houseflatconstruction of house including acquisition of site From AGENCY 68B 1a b. As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the construction of a new house.

Epf Withdrawal How To Fill Pf Form Get Claim Online

The amount can be withdrawn for the construction of a house on the plot of land owned either by you or by your wife or.

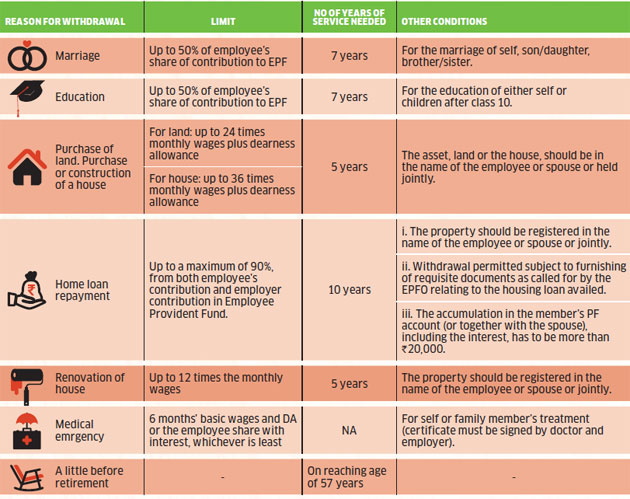

How much amount can be withdrawn from epf for house construction. Houseflat 5 FIVE YEARS For purchase of site. EPF withdrawal for house flat or construction of property How much you can withdraw. The maximum PF withdrawal limit in this case is 50 of your share of contribution to PF.

Your share employees share with interest. One can withdraw a maximum of 12 times the basic. One can opt out for this facility only if the individual has completed five years of his service ten years after the house has been constructed.

Earlier EPFO members were allowed to withdraw up to 36 months of basic salary plus dearness allowance for purchase or construction of houseflat and 24. As per the PF withdrawal rules for property purchase one can withdraw from the PF up to 90 per cent of ones PF balance for buying a home or for home construction on a land. Only the EPF account holder andor hisher spouse can apply for EPF withdrawal in this case.

In any case PF withdrawal limit cant be more than 90 per cent of the PFEPF balance. Now you can withdraw 90 of PF savings for buying flat land. EPFO recently allowed contributors to withdraw 75 of the EPF balance.

The employee must have completed at least 5 years of continuous service from the date of completion of construction of the house. 90 of the available amount can be withdrawn for the repayment of a loan. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

So these were the EPF withdrawal rules partial and full withdrawal in 2021. Renovation of a house. The withdrawal amount shall not be paid to you directly payment shall be made direct to Cooperative Society or housing agency or builder as the case may be.

These withdrawals too are subjected to the following conditions. PF withdrawal for buying property. You can withdraw up to 90 of EPF balance employee share and contribution of employer including interest or the construction cost of property whichever is less.

You should have completed a minimum of 7 years in service. The account holder must be at least 54 years and withdrawal must be made before one year of superannuation or retirement. For purchase of houseflatconstruction 36 months of basic wages and DA or total of employee and.

Partial withdrawal of EPF money is allowed for constructing a site or purchasing flathouse. EPFO allows its members to withdraw up to 24 months of basic wages and DA for purchase of land. Home loan repayment is one of the reasons why the EPF amount can be withdrawn.

Whichever is least For construction of house. Non Receipt of Wages. You can withdraw up to 90 of EPF Balance Employee share and interest on thatEmployer share and interest on that or the cost of the.

Can withdraw up to 90 of the accumulated balance plus the interest. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service. TDS is deducted if the withdrawal amount exceeds 50000.

How much amount can be withdrawn. For house individuals can withdraw up to 36 times their monthly wages and dearness allowance. An employee who has completed at least five years of contribution to his provident fund account can withdraw money for the purchase of a plot andor construction or purchase of a house.

The rest of the 25 can be moved to a new PF account after you regain employment. The funds have to be for either your education or your childs education. Partial Withdrawal before Retirement.

Land or house to be purchased should be under the name of the individual hisher spouse or their name jointly. Partial withdrawal is not taxable. However you need to declare your unemployment to withdraw the amount from your account.

According to the new rules of EPFO after one month of unemployment 75 of the EPF amount can be withdrawn. Rules explained in details below. The money can be withdrawn for the purposes of constructing a flat or a house as well.

For land purchase an amount of up to 24 times of an individuals monthly wages and dearness allowance can be withdrawn. The employee can withdraw an amount equal to 12 times. Government has notified new rules that allow EPF members to make a one-time withdrawal or use their savings to make payments for.

36 months basic wages and DA OR Total of employee and employer share with interest OR Total cost. For purchase of construction of home PF or EPF account holder can withdraw ones 36 months basic salary plus DA or the actual price of the land or amount required for construction whichever is lower. 24 months basic wages and DAfor purchase of houseflatconstruc tion.

On how much EPF or PF can be withdrawn for purchasing a house property or land Jitendra Solanki a SEBI registered tax and investment expert said The maximum amount of withdrawal permissible under the EPFO norms is restricted to 90 per cent of the accumulated balance in ones EPF account subject however to the cost of asset to be acquired. Read all the Latest News and Breaking News here. 90 of the total EPF corpus can be withdrawn.

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

6 Reasons For Which You Can Withdraw Money From Your Epf Account

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Tidak ada komentar:

Posting Komentar