The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be. As per the EPFO notification an employee will be permitted to make PF withdrawal of up to 75 per cent of the amount standing to the members credit in.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical.

How much money you can withdraw from epf account. You must pay 00 per month. EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75 of their balance after being unemployed for more than a month. You can withdraw up to 50 of your share with interest.

To withdraw your PF amount using the EPFO portal you will need to ensure the following. In addition to the time it takes to generate the code and when it is used additional activity on your PayPal account may affect how much cash you. You or your nominee can claim the EPF amount from SCWF through EPFO during this period of 25 years.

An employee can withdraw up to 50 of his PF amount from his EPF account. In case of partial withdrawals of the amount of the EPF it is limited to certain. You should have completed a minimum of 7 years in service.

Aadhar number must be linked and verified with UAN. When making an application what documents will you need. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

The contribution including your employers contribution and the accrued interest on it may have become a. Do remember that such movement to SCWF will not happen. The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva.

Instead of taking a loan you can withdraw funds from your PF in whole or in part. 90 of the EPF balance can be. People prefer to keep their.

The maximum PF withdrawal limit in this case is 50 of your share of contribution to PF. Cash withdrawals are limited to 500 for cash-out. You need to use Form 31.

The withdrawal limit is the price of the home plus 10 or all the money in Account 2 whichever is lower and not less than RM500. To get back the money you have to knock the court. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

You can withdraw fron your EPF for your marriage if you have held your EPF account for 7 years. Epf withdrawal India. The full EPF withdrawal can be done after the employees retirement or if an employee remains unemployed for more than 2 months.

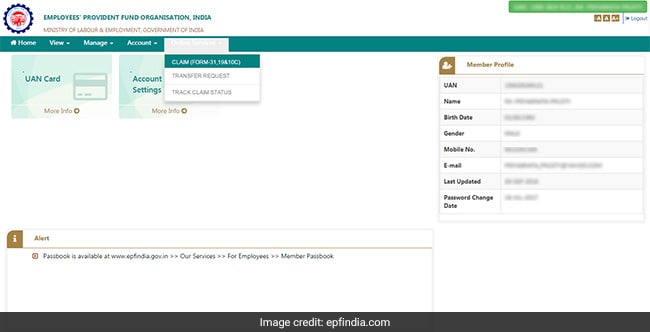

How much can be withdrawn from EPF account. Members registered on the EPFO portal can use the online withdrawal facility for processing their withdrawals. The funds have to be for either your education or your childs education.

UMANG App can even be used by members to withdraw their EPF money from their Provident Fund PF account. After the completion of 25 years with SCWF if you still not withdraw your EPF account then Government will forfeit the money. Employees can obtain an advance from their EPF balance up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less.

6 rows Here are the main amendments to EPF withdrawal rules-. You can withdraw the entire EPF balance upon retirement. The cost per day is 1000 or 3500 per day.

Savings in Account 2 can be withdrawn under specific conditions. In also addition if an employee has been unemployed for 1 month then heshe can also withdraw 75 of their total money from the pension fund. You can make up to 3 withdrawals from these criteria.

The advance is non-refundable and the employee need not deposit the money withdrawn back into their EPF account. One can withdraw the advance amount from their PF account for their medical. Also EPF allows premature withdrawals under certain conditions.

Only the EPF account holder andor hisher spouse can apply for EPF withdrawal in this case. These withdrawals too are subjected to the following conditions. Here we have told about the rules related to tax liability on withdrawing money from EPF accountTax on EPF Withdrawal.

If you are planning to withdraw your PF amount then you need to know that you can do so in parts or withdraw the complete. Employee can withdraw an amount equal to 24 times the monthly salary for purchasing a new property or 36 times the monthly salary for purchasing and constructing a new property at the most. Members of the Employees Provident Fund Organisation EPFO can avail various EPFO services on the UMANG App.

Check Wealth Planning Checklist for NRIs And in the long journey of your career in India you may have contributed a significant sum towards your retirement corpus the Employees Provident Fund or the Indian EPF accounts. You are also not supposed to submit. Furthermore if you are unemployed for more than two months you can withdraw the PF balance completely.

Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. The documentation requirements for your application to withdraw and purchase a home are fairly straightforward but will differ with the specifics of your withdrawal. The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser.

EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members.

Online Epf Withdrawal How To Do It In Five Steps

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Tidak ada komentar:

Posting Komentar