If you are wondering how to withdraw PF online. The Universal Account Number UAN of the member should be active.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

The money withdrawn from EPF accounts can be exempt from tax under certain conditions.

How to withdraw pf account. Now you can easily withdraw your PF through online facility within 3-4 days. If the EPF withdrawal amount is more than Rs50000. You can make up to 3 withdrawals from these criteria.

However there are certain terms and conditions for withdrawing money from EPF account online. Hence considering all these rules it is always best to transfer your old EPF accounts to the existing active EPF account immediately. Some Points to know for PF withdrawal.

PF is a great financial instrument to help you save a little amount every month and that too at a great interest rate of 85 pa. Earlier the limit was Rs30000. How to Withdraw PF Online with UAN.

One can withdraw the advance amount from their PF. Answer 1 of 2. Link your Aadhaar to UAN b.

You can make PF withdrawals under the following circumstances. Form-19 can be downloaded from the EPFI website. How to Withdraw Previous Account PF From Present PF AccountAbout EPF e-nomination.

How to withdraw money from EPF online. Many people after COVID arrived have started to withdraw PF Online. The Universal Account Number UAN is a unique number issued to an individual by the Employee Provident Fund Organisation when they start contributing to their Employee Provident Fund EPF or PF.

Before you start the withdrawal process make sure all your previous PF accounts are merged into one. Answer 1 of 2. Now select PF advance form 31 option.

EPF members can utilize the fund accumulated in their EPF account to facilitate their housing needs after three years of account opening. Submit an application to withdraw EPF online. As per the EPF act 1952 any person who retires after completing service of 58 years minimum is eligible to withdraw the full PF amount and claim the EPS amount.

TDS on PF withdrawal will be applicable if. Sometimes it may be necessary to withdraw money from the EPF. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

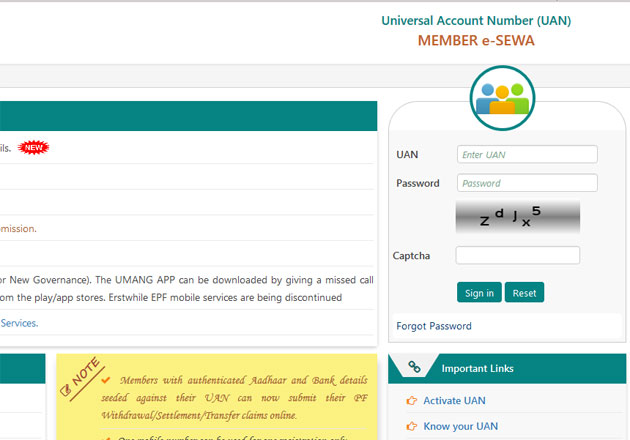

EPF withdrawal via UAN Online claim submission If you know your Universal Account Number UAN then you can directly apply for pf withdrawal without the need for employer attestation. Now you will find a new option called select service. PF withdrawals within 5 years of opening an account are taxable 2.

The main reason is you employer has to contribute exact equal amount of money to your PF account as what you do. You cant withdraw PF balance from your current job. Due to one or the other reason if you withdraw from your PF account before 5 years of opening the account then you have to pay tax on the interest that you have got.

In case of lump sum withdrawal the lesser the number of years of service the lower the amount a person will receive. Checklist to file withdrawal from EPF account online Once you have ensured that the conditions minimum membership requirement etc for the purpose for which claim is being filed are satisfied certain additional eligibility conditions must be satisfied to be eligible for filing a claim online. This interest earned on your PF account is tax-free if withdrawn after 5 years of PF account opening.

I am not sure I follow your question right but If both your member IDs are correctly linked to the same UAN you must get the amount transferred from your old EPF AccountMember ID to the new one you are using at the current employer. Enter your bank account number and after verification click on proceed for the claim. PF withdrawal conditions to keep in mind.

PF amount is a corpus that you gradually build so as to ensure enough money on retirement. To read about how to merge all previous PF accounts click here. Write an email to.

There should be no break in the 5 years. To withdraw PF amount from the previous company online follow the below procedure. Attestation of the employer is not necessary for PF withdrawal if your PF account is linked with UAN.

Know EPF Withdrawal Claim Rules due to Coronavirus July 2020. As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the construction of a. How to withdraw PF online.

If you still not respond and not withdraw then they move to SCWF. Login in the UAN member portal and go to online services and click on claim form 31. The total service in the present establishment as well as previous organisations will be taken into account and therefore it is advisable to merge your accounts.

Tax deducted at source TDS is deducted on the premature withdrawal only if. If the employee has not completed five years of his her continuous service. Now PF Balance withdrawal without UAN Number follow the guide How to Withdraw PF Online without UAN at httpsunifiedportal-memepfindiagovin Many times employees who have a PF account are in need of money and in such a case they withdraw the PF amount from their account for their use.

Taxation on EPF withdrawal. Moreover Your bank account recorded in EPF account should be linked with Aadhaar. Before beginning with the steps of EPF withdrawal online it is important to note that complete withdrawal from an EPF account is only possible if.

It is illegal as per the rule to withdraw the PF Account Balance of an earlier job if you are stilling doing the job. However there is an upper cap of either 10 or 12 of Basic Salary DA amount. All the money from your old and new accounts.

Contribution period must be over 5 years. Instead EPFO will inform you through the contact details you linked to EPF accounts. An employee can withdraw up to 50 of his PF amount from his EPF account.

EPF withdrawal using Form 19. PF withdrawal for a particular purpose. How Much Can a Person Withdraw from EPS Account.

Otherwise withdraw the EPF balance immediately after 2. Or else the interest on the PF account is Tax-free. How to Withdraw Previous Account PF From Present PF AccountAbout EPF e.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Pf Withdrawal Form Know Epf Withdrawal Procedure

Epf Withdrawal How To Check Change Bank Account Details In Your Epf Account The Economic Times

Tidak ada komentar:

Posting Komentar