There is no minimum withdrawal amount required. You can not withdraw full EPF amount before attaining the retirement age.

EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old.

How much can i withdraw from epf at age 55. Retirement Age Existing rule. Though the EPF amount can be withdrawn only after retirement that is at the age of 55 early retirement is not taken for consideration. This means that if you retire at age 58 youd be able to withdraw 90 by age 57.

But as per new updated rules your age must be at least 57 to withdraw 90 EPF corpus amount. This withdrawal amount also depends on a few factors such as whether you own a property or not. The fears and concerns that Mr.

You can make up to 3 withdrawals from these criteria. Minimum transferred amount is RM 100000. Grant of Advances in special cases.

But members should also know that as long as an individual still has savings in EPF even upon reaching age 55 they will still enjoy the annual dividend said Puan Balqais. Here are the main amendments to EPF withdrawal rules-. Answer 1 of 3.

This is an account for EPF members who continue to work beyond the. Registered onafter 1 Aug 1998. 0 found this helpful.

Answered on Sep 20 2008 at 2130. We can withdraw a partial amount if we want or even multiple smaller amounts with no restrictions on the frequency or amounts we want to withdraw. You can withdraw partial amount from your EPF account only for specific reasons such as medical emergency marriage housing and higher education.

10 of the property price i think - 1 property at a time. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. There can be various reasons why people do so but it remains a liability for the EPFO towards the account holder.

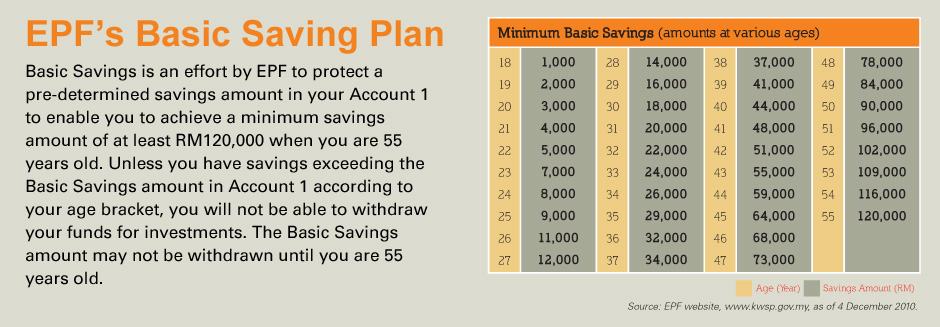

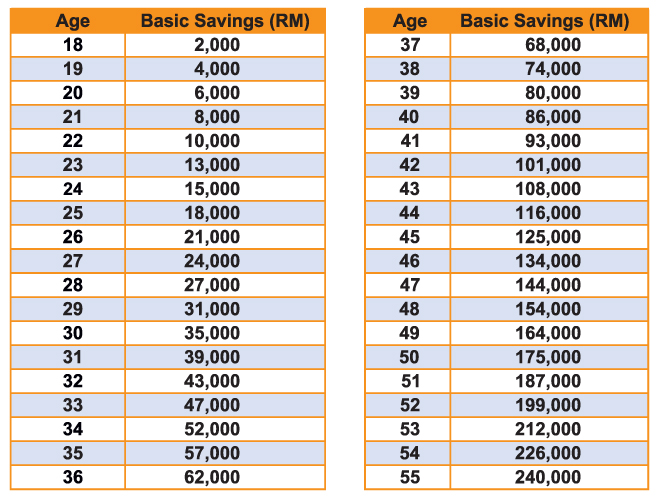

However you can take out for reducing your housing loan with 2 choices. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. I suspect that this is because it is not easy to decide on what to do with your CPF savings unless there is an understanding of CPF withdrawal rules CPF interest rates CPF-Life scheme and how they can affect the unique retirement needs of the individual.

Buy property max. This is the base case for everyone. Heres how much the CPF Retirement Sums are and how much you can withdraw from your CPF accounts.

If you already withdrew 1 time you cant withdraw the 2nd time without proof that youve sold off the 1st property. When your father reaches 55 years of age he can withdraw in cash his EPF funds with the Insolvency Department by submitting a bankruptcy declaration letter. One can withdraw the advance amount from their PF.

Minimum withdrawal is RM600 RM100 per month for at least 6 months The minimum payment period is 6 months and maximum up to 12 months Registered before 1 Aug 1998. There are some other partial withdrawal rules also. Although the EPF corpus can be withdrawn only after retirement early retirement is not considered until the person reaches 55 years of age.

Hi Prateek Post retirement or after leaving the job people often do not withdraw or delay withdrawing the accumulated amount from the EPF account. 90 of the EPF balance can be withdrawn after the age of 54 years. This is opposed to the Age 55 and Age 60 withdrawal policies that allow members to withdraw a minimum of RM2000 once every 30 days.

Age 60 too late for EPF withdrawal. An employee can withdraw up to 50 of his PF amount from his EPF account. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of.

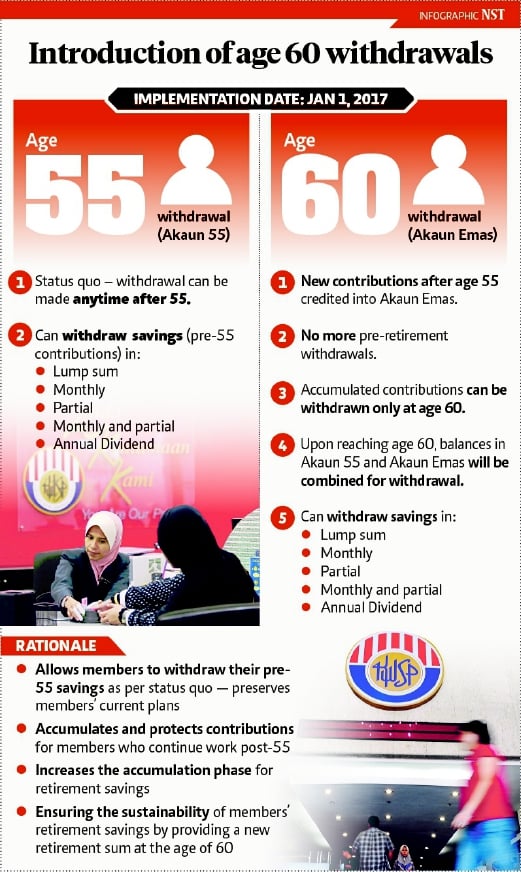

Till today 90 EPF corpus amount can be withdrawn at the age of 54. The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. The total corpus accumulated in the EPF account can be withdrawn only upon retirement of the employee Note that early retirement is also possible only after 55 years of age and not before that Employees can withdraw 90 of their EPF corpus before 1 year of their retirement.

I believe that concept of In-operative EPF ac may cease to exist. In such cases you can claim for partial withdrawal in online. Age 55 Years Investment Application can be made anytime.

Through this rule an employee can get the opportunity to plan the early retirement before the actual age of retirement. Withdraw via i-Akaun plan ahead for your retirement. But if you retire at age 55 youd be able to withdraw 90 of the EPF by age 54.

They can opt to withdraw any amount at any time. The retirement age is considered as 55 years. When we turn 55 we are able to withdraw our CPF savings after we have set aside our Full Retirement Sum FRS in our CPF Retirement Account RA.

Withdrawal from the fund for repayment of loans in some special cases. So you will still be the member of EPF even if you cease to be an employee of a EPF covered establishment. They can perform a lump sum withdrawal monthly withdrawals or partial withdrawal.

Tan experiences are common to what most people experienced when they are nearing age 55. EPF withdrawals are available for eligible members who are Malaysian citizens or non-Malaysian citizens residing in Malaysia who have an EPF account but they must be between 55 and 59-years old and hold their savings in Account 55. If we have more CPF savings we may also able to withdraw more than 5000 from our CPF at age 55 depending on whether we are able to save our retirement sum.

The account holder can request online for partial withdrawal. The proposal to increase the age limit for full withdrawal of Employees Provident Fund EPF.

What You Need To Know About Epf S New Akaun Emas

Epf Introduces Akaun Emas For Withdrawal At Age 60 The Edge Markets

Tidak ada komentar:

Posting Komentar