The period you will be away from home is greater than 21 days. To be eligible for the zone tax offset a taxpayer must reside in a specified remote area for more than 183 days in an income year.

How To Claim The Living Away From Home Allowance Universal Taxation

Did your Great Resignation lead you to start a business or become your own boss this year.

How to claim living away from home tax deduction. Living Away From Home Allowance Declarations. Accommodation at the permanent or primary location for up to 21 days. It also has to be connected to your work and you have to have a record to substantiate the expense.

LAFHA is a fringe benefit and recent changes to taxation law mean that there are new rules for. It is an allowance you pay your employee in respect of the employment of that employee. Generally an employee travelling for business for less than 21 days will receive a travel allowance not a LAFHA.

If you are entitled to goods and services tax GST input tax credits you must claim your deduction in your income tax return at the GST exclusive amount. These are taxable and you can claim deductions against them. Can I deduct living expenses when I work away from home.

Your employment contract or temporary move must be of fixed-term defined by date or completion of work no greater than 12 months with an employer. Depending on what your per diem covers there may be additional out-of-pocket costs that you can deduct. At the time of applying for LAFHA and.

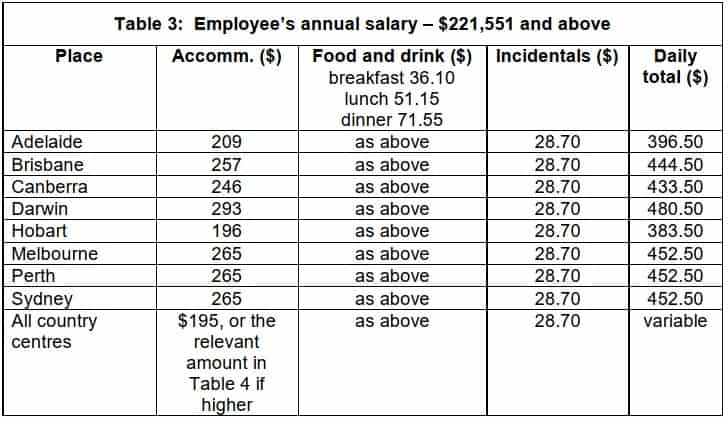

This deduction is limited to the regular federal per diem rate for lodging meals and incidental expenses and the standard mileage rate for car expenses plus any parking fees ferry fees and tolls. If your per diem is included in your wages you can enter that amount and deduct it. It is classified as a fringe benefit that is given to compensate for the additional expenses that crop up from having to live somewhere other than your own home in order to be gainfully employed although the term additional expenses does not include expenses that you will be able to claim as tax deductions anyway.

LAFHAs are often confused with travel allowancesTravel allowances are paid to employees who are travelling on business but not living away from home. I think if you can demonstrate that you are maintaining a permenant home as well as a secondary residence and the secondary residence is where you live to work then you can claim LAFHA. The Cap In The Home Tax Deduction Very first the 2017 laws set a limit regarding the quantity of the home taxation deduction.

Living Away from Home and Travelling for Work Distinguishing between these two forms of travelling is vital in claiming deductions. To claim expenses for overnight travel you must have a permanent home elsewhere and your business must require you to stay away from home overnight. An employee will not be able to move to a location and subsequently find employment and then claim to be living away from home.

If it is not reported as wages to you you cannot deduct the cost. You can now subtract a maximum of 10000 in condition and local homes taxes if youre solitary a mind of home or if perhaps youre married and processing collectively and 5000 if youre partnered and submitting separately. However if you are Living Away from Home your expenses are considered to be private or domestic in nature and henc eyou cant claim a deduction.

And the stipulation that the residence must be available for use means a taxpayer cannot rent out the premises for example while they are away from it and still claim the allowance. The duties of their employment require them to live away from their normal residence. If the expenses incurred by the employee for food or drink do not exceed the amount we consider reasonable they dont need to complete the Food or drink section of the declaration.

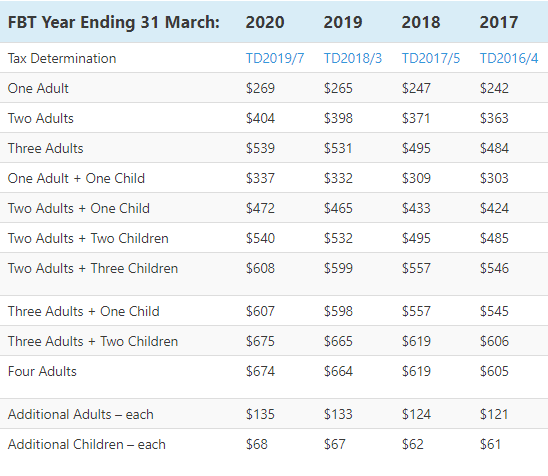

You also generally cant claim accommodation expenses if you are living away from home as the result of a choice you made to work away from where you live. Living Away From Home Allowance LAFHA LAFHA is intended to subsidise the costs an employee incurs for living away from home while still maintaining their usual place of residence for a period generally greater than 21 days. Zircosil is right on one point you can only claim what youve incurred.

You need to meet certain criteria to claim travel expenses as part of your tax return as travel between your home and your place of employment is usually considered to be a private expense. The current ATO samples for a Living Away From Home Allowance declaration are here. You can receive LAFHA or a benefit for family members who also live away.

For a payment to an employee to be considered a LAFHA there are three conditions that must be met. But there are certainly other expenses that can also be included as claimable expenses under the Living Away from Home Allowance. Claim these expenses on Form 2106 Employee Business Expenses and report them on Form 1040 or Form 1040-SR as an adjustment to income.

Employees should use the Living-away-from-home declaration section 31G to provide their employer with information about their accommodation and food or drink expenses. The interpretation of ownership interest means that for example adult children living in the family home who move away from that home for work are not entitled to LAFHA. Those FIFO workers whose normal residence is in one zone but who work in a different zone will retain the zone tax offset entitlement associated with their normal place of residence.

What you can claim under LAFHA will vary a lot depending on your own circumstances. The Tax Office defines living away from home by you having a usual place of residence that. To reduce the taxable value of a LAFHA fringe benefit the employer must obtain a declaration from the employee.

Individual living and working away from home can claim for expenses fooddrink and accommodation. Reform of the living-away-from-home allowance and benefit rules 13 Item 1 paragraphs 25-1151a-d 219 The employer must require the employee to live away from their usual place of residence. The taxpayer must demonstrate that they are on business travel as opposed to living away from home as living away from home costs are not usually deductible.

In my situation can I claim the rent I paid in NSW as tax-deductible.

Ato Reasonable Travel Allowances 2021 Atotaxrates Info

Tax Deductions For Tradies Give Your Refund A Boost

Working From Home Tax Deductions Covid 19

How To Claim The Living Away From Home Allowance Universal Taxation

Tidak ada komentar:

Posting Komentar