However as we all come across milestone events that compel us to rely on our savings there are some cases when this rule to EPF withdrawal is not applicable. An employee can withdraw the Provident Fund only after retirement.

How To Withdraw Epf And Eps Online Basunivesh

There is no tax on the EPF balance till the date of retirement.

How to withdraw epf amount after retirement. Maximum amount that can be withdrawn is 90 of the EPF balance including the interest. Once filled the application can be submitted to. 90 of the EPF balance can be withdrawn after the age of 54 years.

Even more worrying 54 from the 146 million EPF members now have less than RM50000 in their retirement savings. You can withdraw the entire EPF balance upon retirement. Furthermore if you are unemployed for more than two months you can withdraw the PF balance completely.

2 Log in with your UAN password and captcha. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. You can withdraw the entire EPF amount only after retirement.

However statistics on the recent withdrawals by EPF members paint a grim picture for the future. You are not employed for 2 months or more. 63 million EPF members have less than RM10000 left in their EPF Account 1 and 93 million have less than RM10000 in their EPF Account 2.

There is one thing that you should keep in mind before starting the withdrawal procedure and that is to merge all your previous PF accounts. Employee Provident Fund EPF is a retirement corpus from which an employee can make withdrawals if heshe has been unemployed for more than 2 months. You are retired from the workforce.

Build a complete financial plan with our Robo Advisory. 4 You will be directed to. Members registered on the EPFO portal can use the online withdrawal facility for processing their withdrawals.

After retirement you should withdraw your PF. Provident fund PF in India is mandatory by law. However according to a recent ruling any interest credited to.

The interest on the EPF amount is taxable as per applicable income tax slab rates. EPF withdrawals post-retirement age of 58 years is completely tax-free. The contribution is largely for an individual to take care of his needs post retirement and hence one should touch the EPF amount only in case of.

1 Provident fund withdrawals before five years of completion of service will attract tax deducted at source TDS at 10 per cent. To withdraw your PF amount using the EPFO portal you will need to ensure the following. 2 If the accumulated provident fund balance is less than Rs 30000 TDS would not be applicable.

Age should be 57 years. If you do not withdraw the EPF funds post three years of retirement you will have to pay tax on the interest earned. Hi Prateek Post retirement or after leaving the job people often do not withdraw or delay withdrawing the accumulated amount from the EPF account.

Withdrawal PF Amount After Leaving the Job. Amit Maheshwari Partner Ashok Maheshwary and Associates replies. Currently the EPFO allows 75 PF withdrawal if it is carried out after just 1 month of unemployment.

Currently the EPFO allows 75 PF withdrawal if it is carried out after just 1 month of unemployment. As it is a mandatory scheme employees cannot withdraw the EPF amount until they have retired. However Section 68-NNN of the Employees Provident Funds and Miscellaneous Provisions Act 1952 EPF MP Act 1952 states that an early withdrawal comes into effect only when the employee has attained an age limit of 55 years and beyond.

Submit an application to withdraw EPF online. The amount accrued in the EPF earns an annual interest and serves as a corpus during retirement. EPF withdrawal using Form 19.

Aadhar number must be linked and verified with UAN. Yes you can keep the money in the EPF account after retirement but the account becomes inoperativeno interest is paid on the accumulated sumafter the person turns 58 or three years after he retires. EPF Withdrawal Procedure Online 1 Go to EPFO Member e-SEWA portal.

While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so. Also EPF allows premature withdrawals under certain conditions. Answer 1 of 3.

You need to be over 55 years of age to withdraw the fund in case of early retirement as per rules stated by the EPFO. 3 TDS will be deducted at 34 per cent if subscriber fails to submit PAN. You can withdraw your PF and EPS amount by filling the composite form launched by EPFO which will take care of your withdrawal transfer advances etc.

There can be various reasons why people do so but it remains a liability for the EPFO towards the account holder. The EPF can be withdrawn by the employee when the employee retires or is not in employment for a minimum period of 2 months or if the employee moves abroad or when the employee is dead. Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request.

You can withdraw the full EPF amount under the following conditions only. Form-19 can be downloaded from the EPFI website. Here are the main amendments to EPF withdrawal rules-.

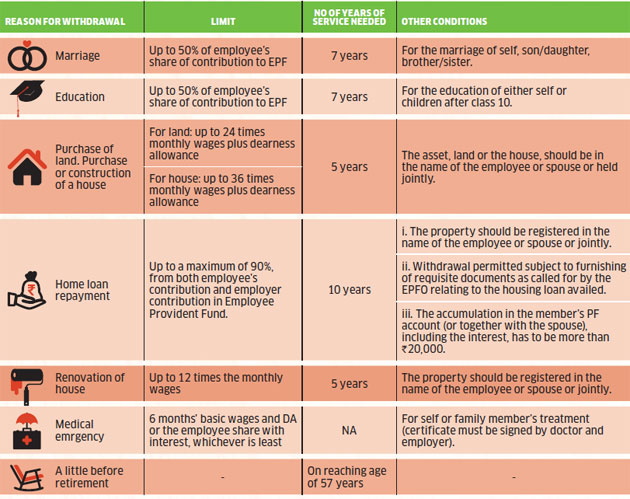

3 On the top menu bar click on the Online Services tab and select Claim Form 31 19 and 10C option from the. One can withdraw the advance amount from their PF account for their medical issues. You can make partial withdrawals in case of financial needs such as house construction or purchase higher education or a medical emergency.

This is because early withdrawals from the EPF are not a part of the tax-deductible income of the employees. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. The bank account where you want to receive the amount must be the same as the bank account registered with your Aadhaar.

Link your Aadhaar to UAN b. EPF withdrawal via UAN Online claim submission If you know your Universal Account Number UAN then you can directly apply for pf withdrawal without the need for employer attestation. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of.

Employee Provident Fund EPF is a retirement corpus from which an employee can make withdrawals if heshe has been unemployed for more than 2 months.

Pf Pension Withdrawal Process Online Form 10c How To Withdraw Pf Eps Withdrawal Youtube

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Full Epf Withdrawal Not Allowed 4 New Changes Of Epf Withdrawal Changing Jobs Investing Money Retirement Age

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Tidak ada komentar:

Posting Komentar