Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

You cannot withdraw the PF as you are working in the current establishment paying their EPF contribution in your UAN.

How to apply withdraw epf account 1. For more details on types of withdrawal and how to go about checking their website is highly recommended. This article covers the EPF Withdrawal online and offline procedures in detail. Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 19 10C from the drop-down menu.

It is possible for you to apply for withdrawals online using your i-Akaun. One can withdraw the advance amount from their PF. You will be given a temporary username and password.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. Open the app and select New User. An employee can withdraw up to 50 of his PF amount from his EPF account.

We show you how to withdraw PF online via UMANG App. How to Apply EPF Withdrawal Online. Over two million Malaysians will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programmeThe idea is that this will help those who have been impacted by the prolonged pandemic to make ends meet.

If you meet this condition you can follow the procedure given below to withdraw your EPF online. Here is how to withdraw money from ones EPF account using UMANG app. Tengku Zafruls announcement then was greeted.

Enter your mobile number on the Registration screen and select Proceed. He personally said contributors may apply to withdraw their funds online or even visit any EPF office. There are several ways to apply.

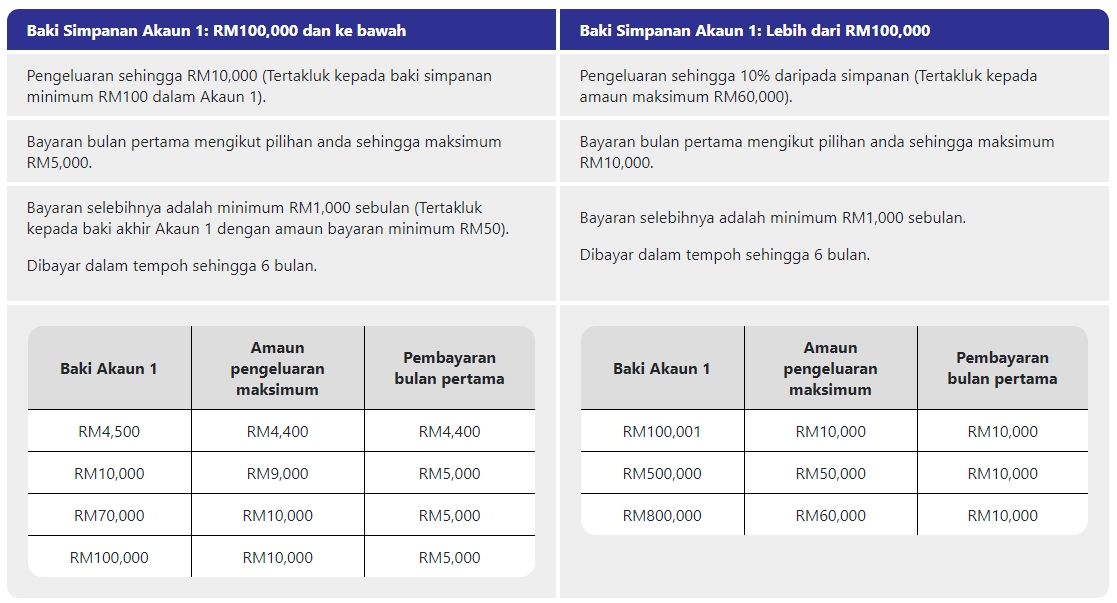

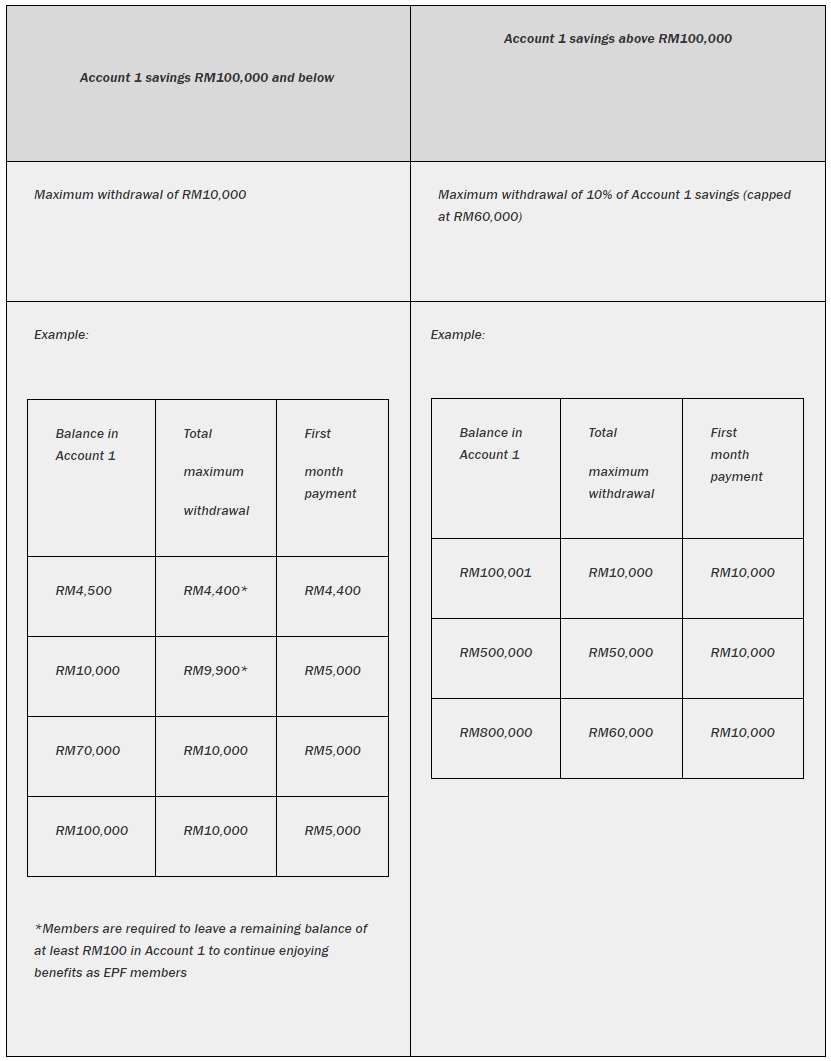

Also EPF allows premature withdrawals under certain conditions. However to process the EPF withdrawal online your Universal Account Number UAN should be. From the earlier announcement eligible members with savings of RM90000 and below can withdraw up to RM9000 as an advance provided theres RM100 remaining in Account 1 at all times.

Visit your nearest EPF office to verify your thumbprint. Enter the OTP and then proceed to set the MPIN. Login to i-Akaun click on Withdrawal tab.

For applications after April 2020 withdrawal payment will be made from the date the withdrawal application is received by the EPF. If you have Akaun 1 balance of RM70000 you will be allowed to withdraw up to a maximum of RM10000. More than 8 million members will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar programme.

If you have Akaun 1 balance of RM4500 you will be allowed to withdraw a maximum of RM4400. Download UMANG App from Google Play Store or Apple App Store Step 2. Nowadays Malaysias government done a good job on published the KWSP service online Online EPF Account.

Some two million eligible contributors can now withdraw between RM9000 and RM60000 from Account 1 in the Employees Provident Fund EPF under i-SinarSome two million contributors. The mobile number verification page will appear. Within 30 days visit wwwkwspgovmy.

Step 2 Then input your UAN your password and the Captcha to sign in. Apply For Withdrawal Through i-Akaun. A person can withdraw the complete EPF balance if heshe retires or is unemployed for more than two months.

Register for your i-Akaun at your nearest EPF kiosk or counter. Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code. Application must be made within 1 year from the incapacitation case of the member.

It is not advisable to close the UAN for withdrawing the amount as if the amount was credited in the same UAN for 10 years then you will be eligible to get the pension after your retirement ie 58 years. You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal. If you have not registered yet then follow these steps.

Wherein it is mandatory to make sure that the Universal Account Number UAN is in an active state and the mobile number used for activating the UAN is functional at the time of processing the application. Note that the amount applied and approved for is fixed and cannot be changed. With Online EPF service you can check your EPF balance printing the EPF statement EPF details like when your employer bank in the EPF money into your account EPF Account 1 and Account 2 detail and so on.

Application must be made within 6 months from the date of death of the EPF member by their next of kin. Click on the Members. While in case of partial withdrawal it can be done for reasons like medical need home loan repayment marriage education among others.

Here are the steps you need to follow. The first payout is up to RM10000 and the remaining balance will be staggered across the next 5 months. You also need to bring along all the required documents which will be shared in the message.

The government will allow all Employees Provident Fund EPF contributors to withdraw up to RM10000 from their EPF Account 1 through i-Sinar said Finance Minister Tengku Zafrul Aziz said in Dewan Rakyat today. Open the app and select New User. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December.

Check your application status through SMS or messages under Secured Messages inbox. You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time. RM5000 as token of sympathy if a member becomes incapacitated on top of being able to withdraw all of their EPF money in full NOTE.

The maximum amount that you can take out from Account 1 depends on your current balance. Complete the application form to the EPF beginning 1 April 2020 via. If you have more than RM100000 in Account 1 you may take out 10 of the current balance with a maximum cap of RM60000.

Under e-pengeluaran click New Application and fill in all required details. You can make up to 3 withdrawals from these criteria. You can withdraw up to RM10000 in the first month.

On the Registration screen enter your mobile number and select Proceed. Here is a look at how to withdraw money from ones EPF account using the Umang app. You can apply for withdrawal through i-Akaun.

If your application is submitted and approved in December you will receive the first payout in January 2021. But you can take EPF advance by logging in to your UAN portal. The online application for the EPF withdrawal of an employee has to be effectuated through the EPF portal.

Should you wish to withdraw the maximum amount out under i-Sinar you will receive a single payment of RM4400 in the first month. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. For this lower eligibility members will be able to take out a maximum.

How to register for UMANG App using mobile number Step 1. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. Step 1- Sign in to the UAN Member Portal with your UAN and Password.

The i-Sinar facility is an extension of the i-Lestari programme which allows withdrawal of up to RM500 a month from Account 2 slated to end in March next year. Employees can raise PF withdrawal claim directly on the EPFO website.

Need To Withdraw More Funds Epf I Sinar Applications Can Now Be Amended Online

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar How To Withdraw Money From Account 1 And What Are The Requirements

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Tidak ada komentar:

Posting Komentar