The Employees Provident Fund Organization EPFO has laid down certain rules for EPF members to withdraw their PF amount. We show you how to withdraw PF online via UMANG App.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

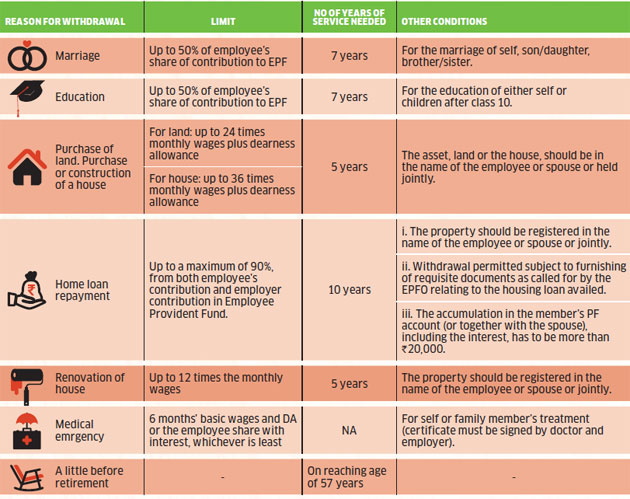

Here are the main amendments to EPF withdrawal rules-.

How much money we can withdraw from epf. You should have completed a minimum of 5 years in service. This means that the employee can withdraw a maximum of Rs. Enter the OTP and then proceed to set the MPIN.

You can withdraw money from your PF account if you are buying a house or a piece of land to build a house. You can take loan or withdraw 50 of third year balance after 5 years of deposit and full amount only on maturity of 15 years. You can withdraw up to 50 of your share with interest.

You can also withdraw money for funding the construction of your house. Enter your mobile number on the Registration screen and select Proceed. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment. Therefore in this case the employee shall be eligible to withdraw funds from his EPF account up to Rs. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less.

The mobile number verification page will appear. One can withdraw the advance amount from their PF account for their medical. Employees can obtain an advance from their EPF balance up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less.

The advance is non-refundable and the employee need not deposit the money withdrawn back into their EPF account. An employee can withdraw upto 90 of total PF balance within one year before retirement advance on unemployment upto 75 of total PF balance etc. You can withdraw fron your EPF for your marriage if you have held your EPF account for 7 years.

As per the EPFO notification an employee will be permitted to make PF withdrawal of up to 75 per cent of the amount standing to the members credit in. The withdrawal conditions are. 7 rows Individuals can withdraw up to 50 of their contribution to the EPF.

90 of the EPF balance can be withdrawn after the age of 54 years. The number of times that an EPF member can withdraw PF advance amount will vary with each reason of PF advance withdrawal. Open the app and select New User.

EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members. 11 EPF withdrawal of up to 90 per cent of the total corpus at any time after attaining the age of 55 years by the member is allowed if the amount is. The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva.

As per the new EPFO rule a person can withdraw around 75 of their total PF amount in the case of one month of unemployment. You can make up to 3 withdrawals from these criteria. Under this reason employees can withdraw PF advance only once and the amount is also 75 of employee employer contribution or last 3 months basic wage DA whichever is less.

There is no limit if EPF member withdraw PF for illness reason and for construction of house only 1 time and for the marriage 3 times and for higher education 3 times and for power cut only 1 time and for physically handicapped persons no 2nd advance. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be. The provision to withdraw money from EPF accounts was first announced last year in March 2020 under the Pradhan Mantri Garib Kalyan Yojana.

30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. You are also not supposed to submit.

How much can be withdrawn from EPF account. Here is a look at how to withdraw money from ones EPF account using the Umang app. It is withdrawn simply by filling up a closure form prescribed by the bank and signed by the depositor over the Revenue stamp affixed.

While in case of partial withdrawal it can be done for reasons like medical need home loan repayment marriage education among others. 15 lakh and also place a withdrawal request for an amount lower than 15 lakh. EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75 of their balance after being unemployed for more than a month.

You need to use Form 31. Out break of pandemic Covid 19 reason was introduced to help the EPF members during the lockdown in India. You can make final withdrawal of your EPF.

The rest of the PF amount will be transferred to a new account. The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser. An employee can withdraw up to 50 of his PF amount from his EPF account.

A person can withdraw the complete EPF balance if heshe retires or is unemployed for more than two months.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Tidak ada komentar:

Posting Komentar