Withdrawing and using your super. On the other hand if your balance is.

Covid 19 Epf Advance 2 0 Should You Withdraw Your Pf

This way the person will not have to think of borrowing from anywhere and can use his money at the time of need.

How much can you withdraw from an epf account due to covid-19. In Conclusion Apart from the aforementioned guidelines EPF account-holders must remember that the application for COVID-19 withdrawal claim can be made online as well through the EPFO portal. How much can you withdraw from an EPF account due to COVID-19 Updated on. ReutersRepresentational image Employees Provident Fund Organisation EPFO members can now avail second non-refundable Covid-19 advance in view of the ongoing health crisis said the labour ministry in a statement.

EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. You can withdraw your super. Moreover the EPFO is prioritizing the claims made during the Covid-19 and settling them in three days.

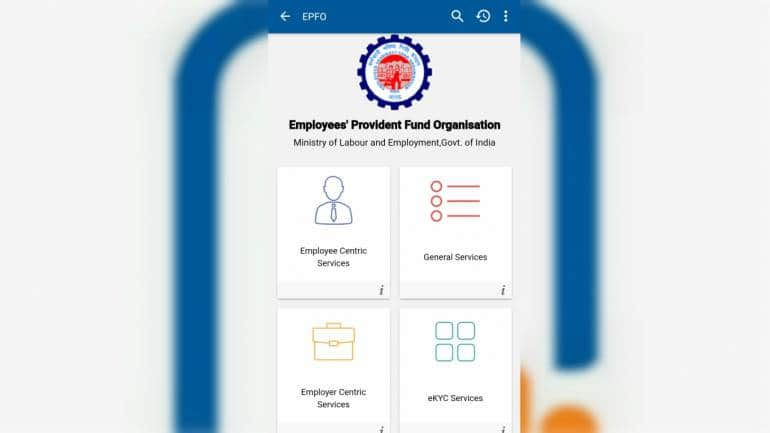

Select Outbreak of Pandemic Covid-19 as the purpose of withdrawal. Click on Claim Form 31 19 10C and 10D Enter the last four digits of your bank account. EPF withdrawal for Covid 19 treatment.

Get more PPF News and Business News on Zee Business. The EPF Scheme 1952 provides for the grant of advance to its members in case of an. All of us know that several companies have cut salaries and laid off employees amid loss of business due to the Covid-19 lockdown.

The advance is intended to help employees. The new rule of allowing 75 EPF withdrawal is notified due to COVID-19 outbreak. Under this provision non-refundable withdrawal to the extent of the basic wages and DA for three months or up to 75 of the amount standing to members credit in.

Due to COVID-19. In case of financial difficulties due to the Covid-19 the government last year announced that a person can withdraw a part of the amount from its EPF account. Are you running out of cash amid Coornavirus crisis and want to withdraw from Provident Fund account.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Click on Proceed Online Claim. EPF Withdrawal for COVID-19 Online.

All salaried employees who contribute to EPF can withdraw money from their EPF accounts. How much can you withdraw from an EPF account due to COVID-19. EPF members have been allowed to withdraw second Covid-19 advance from PF account.

Here is a step-by-step guide to withdraw the amount. Go to the Online Services section. Enter the required amount.

Nov 01 2021 - 120328 AM. May 31 2021 1912 IST. It is possible now but there are few facts you should know.

But many TSP participants who are affected by COVID-19 can take advantage of the withdrawal provisions of the CARES ACT using withdrawal types for which theyre already eligible. One mobile number can be used for one registration only. Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online.

There is now another provision where an amount which is either the persons 3 months basic salary and dearness allowance or. Amendment in rules has been notified by the government for coronavirus related need for withdrawal of money from EPF accounts. Further on May 31 2021 the government announced that an EPF member can make a second non-refundable withdrawal from their EPF accounts due to the Covid-19 pandemic.

Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme. Under the transition to retirement rules while continuing to work. Even at the time of online withdrawal you need to select the option OUTBREAK OF PANDEMIC COVID-19.

An EPF member can withdraw up to 75 percent of EPF account balance or. EPFO has allowed its members to avail the second COVID-19 advance from their PF account. For example if your EPF balance on March 31 2020 is Rs 8 lakh and your basic salary is Rs 45000 per month you will be able to withdraw Rs 135 lakh only.

There are very limited circumstances where you can access your super early. The facility of passbook is not available for members of. Now the government has declared COVID-19 as a pandemic.

The EPF Scheme 1952 provides for the grant of advance to members when a disaster or epidemic has been declared by the government. If you are keen to withdraw money from your EPF account here is a step by step process. When you turn 65 even if you havent retired when you reach preservation age and retire or.

These circumstances are mainly related to. 01 May 2021. Hence if you are facing financial trouble due to COVID 19 related lockdown situation you can make tax-free withdrawals of up to three months of salary basic pay and dearness allowance or 75 percent of the balance from the EPF accounts whichever is lower.

From the dropdown list Select PF Advance Form 31. For withdrawal it is mandatory to have a UAN Universal Account Number which is linked with their Aadhaar PAN and bank account. However in case you decide to withdraw funds from EPF account due to the COVID-19 pandemic such withdrawal will be exempt from tax.

According to norms laid down by the Employees Provident Fund Organisation EPFO employees can withdraw money for medical emergency construction or. The decision has been taken by the labour ministry due to the second wave of the Covid-19. For example if your EPF balance on March 31 2021 is Rs 10 lakh and your basic salary is Rs 50000 per month you will be able to withdraw only Rs 15 lakh.

A member can view the passbooks of the EPF accounts which has been tagged with UAN. However members can apply for lesser amounts as well. Malaysians can start applying starting 1st April 2020 and lucky for you we have.

Covid 19 PF Withdrawal Time Period- Since COVID-19 has been declared a Pandemic by the Appropriate Government for the entire country and therefore the employees working in establishments and factories across entire India who are members of the EPF Scheme 1952 are eligible. Also Read Online EPF withdrawal Claim Submission Process. Under the second withdrawal the members are allowed to withdraw an amount equal to three months of basic salary and dearness allowance DA or 75 per cent of the credit balance in the account.

You can get non-refundable withdrawal to the extent of the basic wages and dearness. This has hit employees hard forcing them to withdraw money from their investments like Public Provident Fund PPF and Employees Provident Fund EPF. If youre a current civilian federal employee or member of the uniformed services and eligible under the existing rules such withdrawals include hardship withdrawals and age-based in.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epfo File Epf Withdrawal Claim Under Covid 19 Category And Get 75 Of Epf Balance Or 3 Months Of Basic Wages Da Whichever Is Less Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Facebook

Epfo Application For Epf Withdrawal Claims Form 31 Under Outbreak Of Pandemic Covid 19 Are Being Processed On Priority By Epfo Indiafightscorona Epfo Socialsecurity Stayhomestaysafe Facebook

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Tidak ada komentar:

Posting Komentar