In case youve forgotten your password you can reset it via an OTP sent to your registered mobile number. Now if subscribers decide to withdraw pension benefit on leaving employment before being eligible for the monthly pension heshe can withdraw the entire amount by filing Form 10C at the age of 58.

Pf Pension Withdrawal Process Online Form 10c How To Withdraw Pf Eps Withdrawal Youtube

How to updatechange date of exit in PF portal.

How to withdraw full pf amount with pension contribution. Withdrawal of pension between ages 50-58 with at least 10 years of service. In this case heshe will not be able to receive monthly pension payments until retirement. Step 11 Click on the certificate to submit your application.

If EPF amount is transferred EPS also will be transferred by default. The employee has complete right to withdraw PF amount even for the Single working day also but in order to withdraw Pension amount he must. If your total service is below 10 yrs then you can withdraw that amount after leaving your job.

How to withdraw your PF savings with UAN. You can withdraw that amount after 58 years of your age as a monthly pension. It is the practice in the EPFO.

Calculation of Employee Pension Scheme. You need to fill and submit Form 10D to claim your full pension. HttpsyoutubeQdbYFnzcck0PF Account me KYC update jarur kar le.

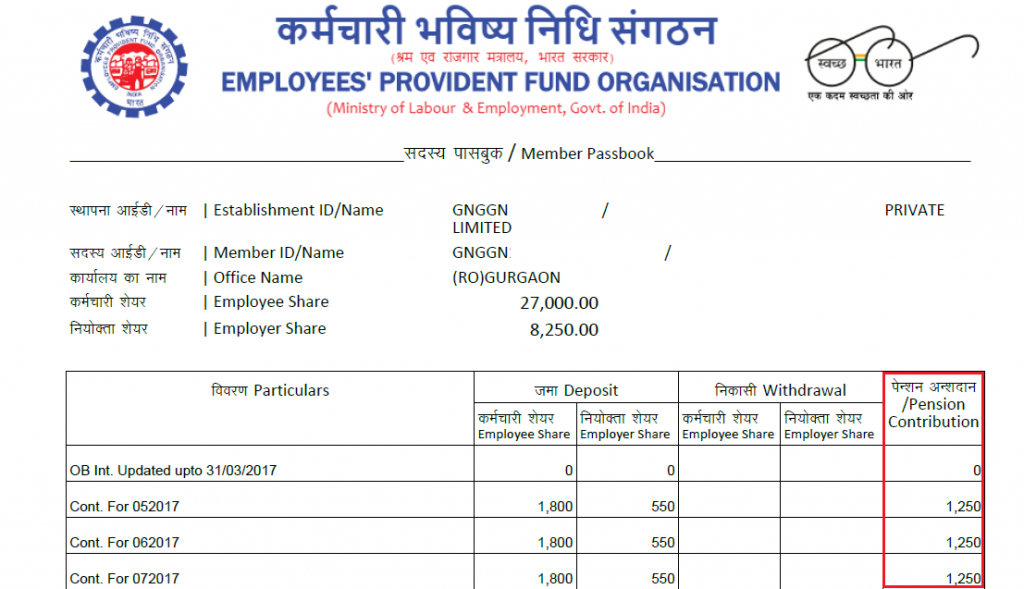

The employees contribution is diverted towards the Employment provident fund and out of the employers 12 contribution 822 diverts towards the Employee Pension Scheme. Withdraw EPF balance and full pension after 58 years of age. You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal.

Partial withdrawal is not taxable. An individual must complete ten years of service to be eligible for the Pension Benefits. EPF members can check their date of exit in UAN member portal for that just log in to UAN member portal and go to online services option in the menu bar and click on claim form 1910c and 31.

After the age of 58 you can withdraw the full EPF amount as well as the pension. But he can withdraw his PF contribution and employer PF contribution even before 6 months. Form 31 is required for partial withdrawal EPF Govt.

Furthermore when an employee dies their nominee is eligible to get the pension amount. Note that one is allowed to withdraw from EPS only if your EPF is not more than 10 yrs old. You can visibly see the amount transferred in the EPF but in case of EPS the number of years of service like 9 years and the last drawn salary details will be transferred to the new epf account.

So up to 58 yrs of your age you can continue your contribution towards your PF pension account. Httpsyoutube4s8-Lw4W3KoPF aur Pension ka pais. The purpose of EPF pension is to give security to the EPF member after retirement so when you transfer your PF amount then your new PF passbook will not show the transferred pension contribution.

Click This Link to Participate in Quiz Get Rs. If you need the proof of it you can put a. The pension contribution under EPF is not shared by employees and employers unlike the EPF contribution.

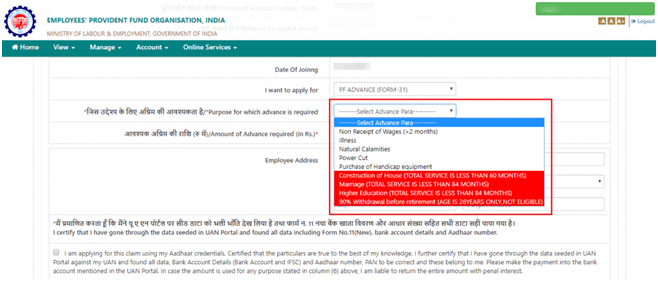

It conducts an eligibility check of services like pension withdrawal or PF withdrawal and if ineligible it. From the I want to apply tab select the claim you need full EPF settlementpension withdrawalEPF part withdrawal etc. As per the EPF Act both the employer and employee must contribute 12 of their remuneration.

In the claim form mention the claim amount ie full EPF settlement pension withdrawal or partial withdrawal under the tab I Want To Apply For. Now firstly click on the drop-down list of I want to apply for and select the option of PF ADVANCE FORM 31 for withdrawing the PF fund. Withdrawing PF balance only and full pension After 58 1.

If your total service reaches 10 years remember even 9 yrs 6 months will be round figured to 10 yrs then you cannot withdraw pension amount by submitting form 10C. So when an employee resigns or leaves an organization before 6 months then he cant able to withdraw pension amount ie 833 of employer contribution. Step 10 Select PF Advance Form 31 and provide the details of the amount you need the reason to withdraw etc.

Form 10-C UAN You can fill up this form in order to withdraw from your EPS amount. So these were the EPF withdrawal rules partial and full withdrawal in 2021. TDS is deducted if the withdrawal amount exceeds 50000.

EPS Pension Formula. Here are the steps you need to follow. Httpsbitly2CclsPsClick Here to See Detail Upcoming Higher Pension Related Cases Hearing Detai.

Now you can find your date of exit and date of joining in PF and pension. Complete the form by filling the employee address and amount of advance required. Withdrawing PF balance plus EPS amount for below ten years of service If service period has been less than 10 years both PF balance and the EPS amount will be paid.

Along with EPF there are funds in the EPS which the employee can either withdraw or carry-over to the new employer using the scheme certificate. Once you select the declaration form FROM -31 choose the purpose for which the advance is required. If not you can submit a physical form 13 to.

But still the pension fund transfers. All you need to do is fill the Composite Claim Form and choose the Final PF balance option and Pension withdrawal option. Login to UAN WEBSITE click on the Request for transfer of funds and enter the PF numbers of your previous and current employer.

Pension Scheme of Employees. EPS account is a seperate account linked to your EPF which is for the purpose of pension. If you have done an offline transfer It seems there is a composite form that serves for both PF and Pension withdrawal.

If you also want to withdraw your pension amount and as you have lesser than 10 years of service you can submit form 10c to withdraw the pension amount. To get EPS amount in the Composite Claim Form Aadhaar or Non-Aadhaar along with choosing Final PF balance also choose the pension withdrawal option. Withdrawal of PF balance and EPS amount more than 10 years of service If you have served for more than 10 years then you are not eligible to withdraw the EPS amount but you can fill the Composite Claim Form and Form 10C to acquire the scheme certificate.

Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service. Online transfer is very easy.

Withdraw your full PF Amount from Home.

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

How To Withdraw Epf And Eps Online Basunivesh

How To Withdraw Pension Contribution In Epf After Leaving The Job Abc Of Money

Eps Employee Pension Scheme Eps Eligibility Calculation Formula

How To Withdraw Cash From A Pension Fund India Dictionary

Tidak ada komentar:

Posting Komentar