Earlier it was slightly possible to withdraw your amount by hiding your previous EPF details from your current employer. The reason being that they are under the impression that their money is safe with the EPFO and they can keep earning tax-free returns from it.

Pf How To Withdraw Pf Online Without Employer Signature Youtube

The person has to provide proof in this case also like wedding card etc.

How to withdraw epf money after resignation. This means an unemployed person can withdraw 100 of their PF money after two months of being jobless. After this ruling tax on EPF after resign retire or terminated changed drastically. You cannot apply for withdrawal of EPF account balance immediately after your resignation from a company.

If you are planning to work again you can submit the Form 10C and get the scheme certificate. Click on the Submit button to check the status of your PF claim. Through a official notification dated December 6 the Ministry of Labour and Employement has amended the Employees Provident Fund EPF Scheme.

Withdrawing PF balance and full pension After 58 After 58 you have to submit the same Form 10D to claim the full pension. After 60 days of leaving the current organization you can withdraw the EPF. In other words full amount cannot be withdrawn.

An employee can withdraw money from the EPF account if heshe satisfies the scheme conditions in case of leaving the job either due to laid-off at the time of retirement or due to resignation. Make sure that you have an active UAN number and it should be linked with an Aadhaar card. If you are withdrawing PF balance and EPS amount after completing 10 years of.

Enter the following details. EPF account holders are also not supposed to submit any unemployment-related documents to the EPFO to withdraw the amount since the pause in EPF deposits is considered a sign of unemployment. In the recent case the man had retired from a prominent Bengaluru-headquartered software company after 26 years of service on April 1 2002 and the total amount in his EPF account then was Rs 3793 lakh.

In the case of not taking the next job in India you can withdraw the EPF account balance after immediately resignation. In such cases employees do not require the attestation of. Click on Our Services followed by the For Employees option.

Again u r Q is hypothicatedThere is certain provisions for getting u r EPF withdrawal1If u resigned before 5 years of membership u will have file declaration with U r Pan No fill form no 15 G of ITAfter 5 years membership u will be eligible withdrawal 100 on resignation. Tax Consequences of PensionProvident fund withdrawals at resignation. Find out the things you need to keep handy before you initiate the withdrawal process - with or without Aadhaar.

Why should one withdraw or transfer PF and EPS after leaving a job. Before those 60 days if heshe joined anywhere else or in the same organization. What you should do It is advisable to transfer your PF balance when you change jobs as it is a form of forced savings.

Now they can withdraw up to 75 of their EPF deposit if they remain unemployed for more than a month. There are two situations after you resign from a company. A female EPF beneficiary can withdraw funds in case she is leaving her job to get married and does want to work in future.

Heres a good news for EPF subscribers. In normal case one can withdraw money from EPF after 2 months after resignation but in few cases one can. Most of us will experience the process of resigning from an employer at some stage of our lives and if you are lucky enough to receive a pension you will be left with an important choice to make at that point.

To know more about EPS scheme certificate and pension calculations click here. Joined Another Employer - As per rule you cannot withdraw your EPF Amount if you are continuing in your service. Employees can easily withdraw PF balance through the EPFO member portal by following the below steps.

Earlier it was slightly possible to withdraw your amount by hiding your previous EPF details from your current employer. Joined Another Employer - As per rule you cannot withdraw your EPF Amount if you are continuing in your service. There are two situations after you resign from a company.

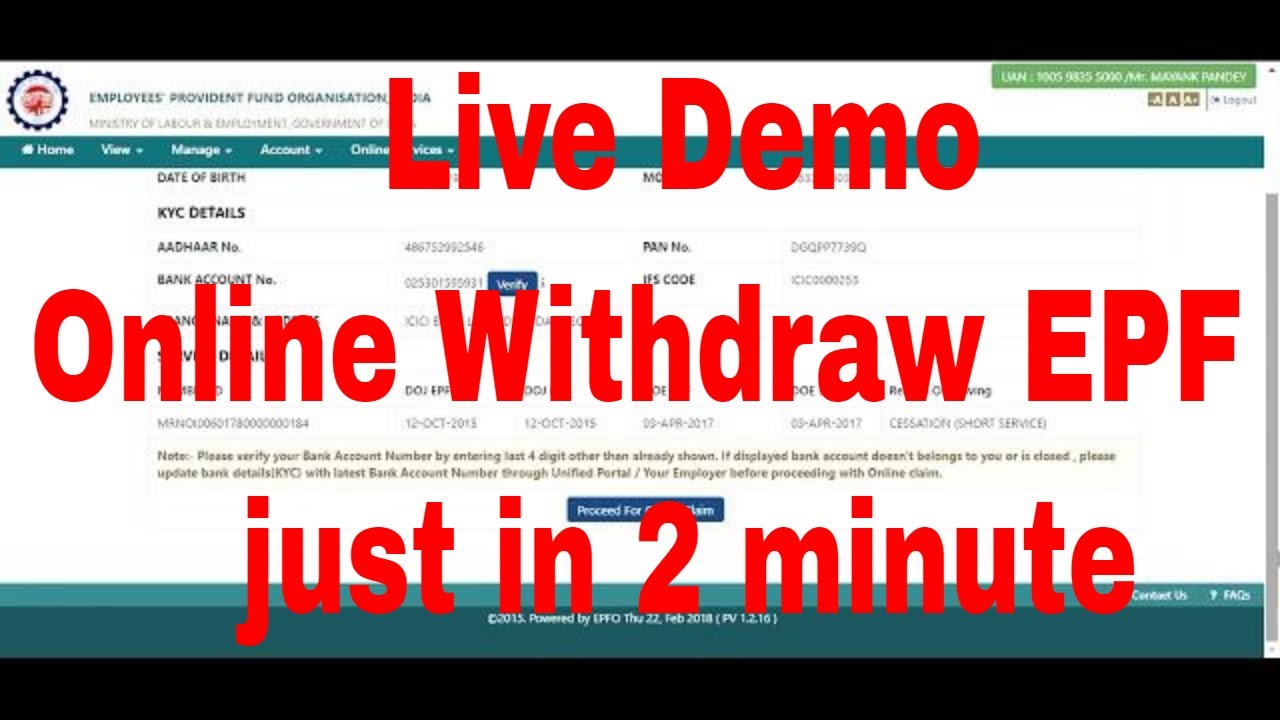

Go to the EPFO portal. Earlier it was slightly possible to withdraw your amount by hiding your previous EPF details from your current emp. The EPF can be withdrawn by the employee when the employee retires or is not in employment for a minimum period of 2 months or if the employee moves abroad or when the employee is dead.

If his her motive was to withdraw the EPF Fund then the left member must be unemployed for 60 days from the date of leaving then only heshe can withdraw the EPF Fund. There are other cases under which one can partially withdraw money from EPF. It is never advised to withdraw funds immediately as this may also lead to tax burden also.

To withdraw the PF balance and the EPS amount the EPFO has launched a composite form to take care of withdrawals transfer advances and other related payments. Click on Know Your Claim Status. So to avoid getting taxed you will have to either transfer the PF balance to the new employer or withdraw the amount at the earliest after the exit.

After you have resigned from any company and want to withdraw your Employees provident fund what is the procedure and how you can withdraw that money. 19 10 C 2 revenue stamps and 1 cancelled cheuqe of your active account then visit your last company for further formalities. To withdraw the PF balance and the EPS amount the EPFO has launched a composite form to take care of withdrawals transfer advances and other related pay.

Rather you should apply for withdrawal after. There are two situations after you resign from a company. EPF Withdrawal Rules After Resignation.

For those who are still in service and have not started their own. There is generally a 2 month waiting period after resignation after which you can opt to withdraw your PF money. In November 2017 the Bengaluru bench of the Income-Tax Appellate Tribunal ITAT ruled out tax-exemption on the interest earned on EPF account after an employee has quit.

A lot of people after quitting their jobs neither withdraw their PF nor do they get it transferred to their new employer. An employee can withdraw money from the EPF account if heshe satisfies the scheme conditions in case of leaving the job either due to laid-off at the time of retirement or due to resignation. PF withdrawal reason Minimum service PF.

You have to take 2 withdrawal forms form no. Joined Another Employer - As per rule you cannot withdraw your EPF Amount if you are continuing in your service. You will just have to fill the Composite Claim Form and choose both the options Final PF balance as well as pension withdrawal.

Enter your UAN and enter the captcha image. Build a complete financial plan with our Robo Advisory.

Tax On Epf After Resign Retire Or Terminated Basunivesh

Is There A Way To Withdraw Pf Money While Changing Company Quora

How To Get Your Epf Just After Resignation Epf India Epf Epf Fund Epf Status Epf Balance Epf Claim

Epf Withdrawal Rules After Resignation Changed Here S How You Can Benefit Zee Business

Pf Withdrawal After Leaving Job How To Apply

Tidak ada komentar:

Posting Komentar