This is an area where there is not much case law but the recent cases on defaults in Islamic finance products such. Islamic banks are by far the biggest players in the Islamic finance industry and account for 175 trillion or 70 of total assets.

Eff149 65000kr 5 år kost 28730kr Tot93730kr.

How islamic bank gives loan. More Islamic financial institutions have surfaced recently that provide various forms of Islamic financing and riba interest free loans. If you said that the indian govtagainst islamic banking so how you shall provide interest free loan to needed indian muslimIf you are unable to do so dont make bakara to indian muslim Wael - April 16th 2012 at 1042 am none Comment author 552 on Interest-Free Islamic Loan in India. Find out if you get credit in Norway.

Islamic finance is a way to manage money that keeps within the moral principles of. A home loan made by the sharia or Islamic law which precludes the instalment or receipt of intrigue. The personal loans are preferred means of short-term credit in countries where Islamic banking applies.

We can help you verify your creditworthiness. One partner lends to money to another so they can invest in a property and each partner shares a responsibility in the loan. So you may hear Islamic financial services described as Islamic finance or Shari.

The pair-wise Granger causality tests 2 lags show one-way causality that is profit rates are affected by interest rates and consistent with the findings of previous studies Chong and. The results are similar to the results for banks but profit rates of Islamic finance are less affected by deposit rates of conventional finance companies as compared to Islamic banks. But thats admittedly difficult for a student loan where theres no hard asset against which to.

The Islamic Welfare Society Bhatkal provides interest-free Islamic loans to those who need it unlike traditional banks that often charge high interest rates. A few that Salaam Gateway spoke to said they are offering moratorium facilities without charging any additional cost to their borrowers. According to a 2019 State of Global Islamic Economy report total sharia-compliant assets are expected to grow to 35 trillion by 2024.

Many have wondered how a personal loan from an Islamic bank differs from a conventional bank. But it is kind of a business agreement between the bank and the. Find out if you get credit in Norway.

An Islamic home loan might be an intrigue free credit however frequently it is a more unpredictable exchange. Business finance operates differently from the conventional loans provided by the conventional banks operating on interest based loans. Islamic Banks Islamic Loans and other loans for Muslims.

In the bank give you the. مصرفية إسلامية or sharia-compliant finance is banking or financing activity that complies with sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint. As a result this is a very convenient option for borrower many who are poor.

For instance a bank could purchase a house for money and after that re-pitch it to the borrower for a benefit through. Answer 1 of 2. Ad A loan in Norway for any purpose.

Unlike a conventional house loan Meezan Banks Easy Home works through the Diminishing Musharakah where you participate with Meezan Bank in joint ownership of your property. The main concept of the Islamic banking is the prohibition on collection of interest and its utilization for the business purposes. Ad A loan in Norway for any purpose.

But the whole process is different than conventional loans. The moral principles many Muslims live their lives by are sometimes known as the Shariah. You wont have to after today because weve got you covered with the facts you need to know to help you understand Islamic personal loans to.

Some of these services may include basic personal loans business loans loan consolidation opportunities and more. HSBC is the most significant UK bank and at one point it branched off into Islamic financing under its Amanah Finance brand name. Easy Home is a completely interest Riba free solution to your home financing needs.

In this the bank will buy the property and will sell it back at a profit to you you just need to pay fixed monthly installments without any interest. And they provide various services and charges money for that also. An Islamic bank also lends money to people.

Easy Home - Islamic House Finance. Leasing deals buy sell deals are most common where lease rental and profit margins are transparently negotiated and agreed upon. Eff149 65000kr 5 år kost 28730kr Tot93730kr.

Normally Islamic banking gets around the problem of interest by having the bank co-own an asset while the loan is being paid down Islamic mortgages are essentially rent-to-own deals. Again they take money from other people and pay them interest with lesser rate. Payment default is contemplated by Islamic finance.

It covers things like saving investing and borrowing to buy a home. By Islamic Banking Information. India has no Islamic banks but there are other types of lenders offering Shariah-compliant products and services.

Perhaps what is not contemplated is the unintended consequences of a default in relation to the shariah contract. The money being lent out is. There are 5 types of Islamic bank loan.

Islamic banking is a finance management system that is based on the Islamic rules of Sharia. Islamic personal loan or Islamic finance is a loan based on the Sharia law the Islamic religious law as stated in the Quran Hadith and Sunnah. A traditional bank makes money by lending people money and charging interest on that.

All legal documentation in Islamic finance does provide for payment default. Islamic banking or Islamic finance Arabic. Unlike conventional loans where the.

Banking in Islam is a saving money framework that depends on the standards of Islamic law additionally. We can help you verify your creditworthiness. Nevertheless this is no longer running and HSBC has actually not remained in the marketplace to.

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

How Does An Islamic Personal Loan Work Comparehero

Understanding Islamic Banking And Its Prospect In The Uk Grin

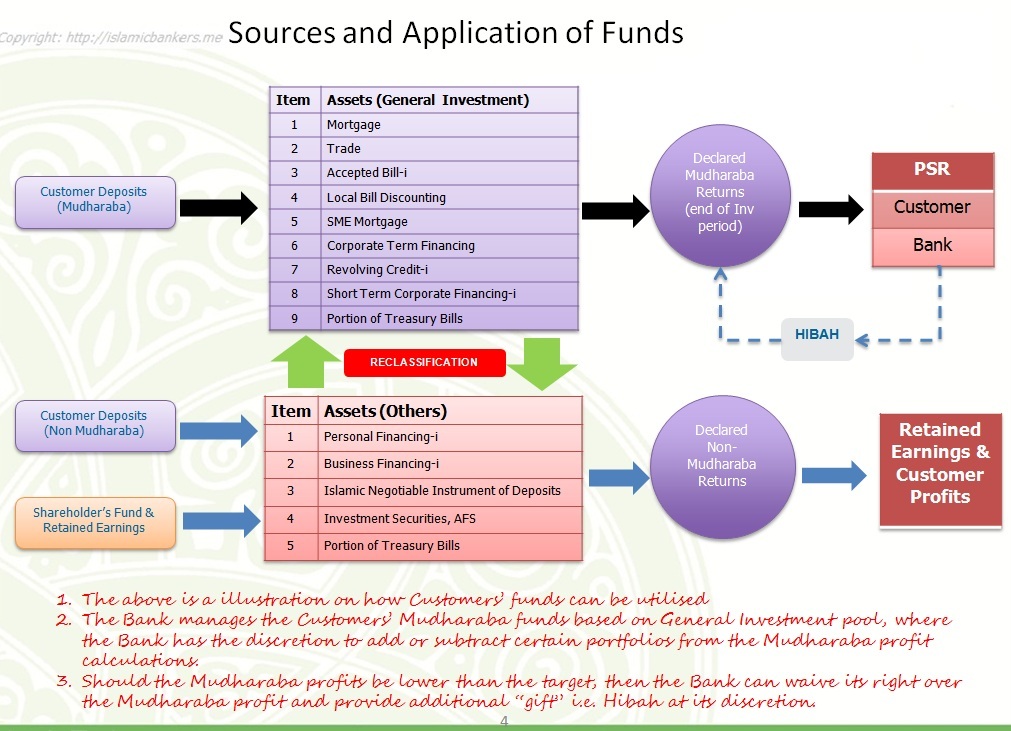

Sources Application Of Funds Islamic Bankers Resource Centre

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)

Tidak ada komentar:

Posting Komentar