Employees who work at home represent a growing segment of the work force. Before you claim these deductions be sure you meet the criteria set out by the IRS or you could face additional taxes or penalties.

Working From Home Tax Deductions Claims 2021 Greater Bank

How to claim work from home expenses for tax in South Africa according to SARS.

How to claim work from home on taxes. Visit the ATO to view the documentation and eligibility requirements for using the fixed-rate method. If you did work from home prior to July 1 2020 and you are submitting your 2019-2020 financial year tax return also then you may need to use a combination of methods to determine your deduction amount. Its soon time to lodge your tax return so you should start thinking about any work-related and income-generating expenses you paid over the financial year.

If as is more typical you carry on your work or business elsewhere at an office perhaps but do some work at home occasionally you cannot claim occupancy expenses even if you have a home work area set. There are certain expenses taxpayers can deduct. 1 March 2020 to 30 June 2020 in the 201920 financial year.

Claim your Home Office expenses and increase your tax refund. Provided that you meet the requirements as set out in the Income Tax Act section 11a read in conjunction with sections. So all you need to do is work out how many hours you worked from home and then multiply this by 80c.

1 July 2020 to 30 June 2021 the 202021 financial year 1 July 2021 to 30 June 2022 the 202122 financial year. However the ATOs new 80 cents deduction method covers ALL your expenses from working at home so be careful. It also needs to be the principal place of your.

If you would like to claim a deduction in your tax return all of the following must apply. You must have a record to prove it. Running expenses and occupancy expenses.

The home office deduction Form 8829 is available to both homeowners and renters. Here are some things to help taxpayers understand the home office deduction and whether they can claim it. To claim for the working from home tax relief.

The expense must be directly related to earning your income. Temporary shortcut method from 1 March 2020 to 30 June 2022 you may have the option of an all-inclusive 80 cents per work hour temporary shortcut method. To claim the home-office deduction in 2021 taxpayers must exclusively and regularly use part of their home or a separate structure on their property as their primary place of.

We share how to claim work from home expenses for tax purposes as the South African Revenue Services SARS allows you to claim for home office expenses but under very specific circumstances. These include expenses related to operating a home office including phone internet and designated home office furniture. Traditionally you could make a claim two ways for work-from-home tax deductions.

If your home is indeed your place of work and you have an area set aside exclusively for work activities you may be able to claim both occupancy and running expenses. You must have spent the money. For a summary of this content in poster format see Home-based business expenses PDF 456KB This link will download a file.

It allows people to claim 80 cents for every hour they work from home. You need your Government Gateway ID if you dont have one you can create one during the. The tax collector said that these deductions are outlined in the Income Tax Act as follows.

Shoprite has its own police force and now makes over 200 arrests a year Next article. The good news is that yes if you are an employee now working from home due to the coronavirus outbreak you may be eligible to claim deductions for expenses that relate to that work. If youre thinking about starting a side gig Taylor said you can set up a home office for that business and claim the home office deduction even if you are a W-2 employee at your day job.

If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in maintaining a home office which will be calculated on a pro-rata basis. Expenses You Cant Claim. The ATO introduced what they call the Shortcut Method for claiming running expenses during COVID-19.

Claimed at 52c per hour for heating lighting cooling etc. According to the ATO website if you are working from home you cant claim. The space must be regularly and exclusively used for your side gig.

Plus you could separately claim the work-related portion of your phone internet computer depreciation and other expenses. Visit CRAs industry news blog page for more relevant articles. Employees are not eligible to claim the home office deduction.

This method means you claim 80 cents per hour for every hour worked at home. Keep in mind that setting up a desk in your kitchen wont work. Here are some common work-related and income-generating expenses including expenses if youre working from home due to coronavirus that you may be able to claim at tax time.

You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. Establish what percentage of your internet use is for work purposes just as you did for your computer and claim that percentage of your annual internet bill as a tax deduction. This includes if you have to work from home.

There are recent changes to claiming your tax deductions. Remember you can also claim a tax deduction for internet usage. In many cases those employees may be eligible for tax deductions that are unavailable to in-office employees.

Working From Home Tax Deductions Covid 19

Working From Home Tax Deductions Covid 19

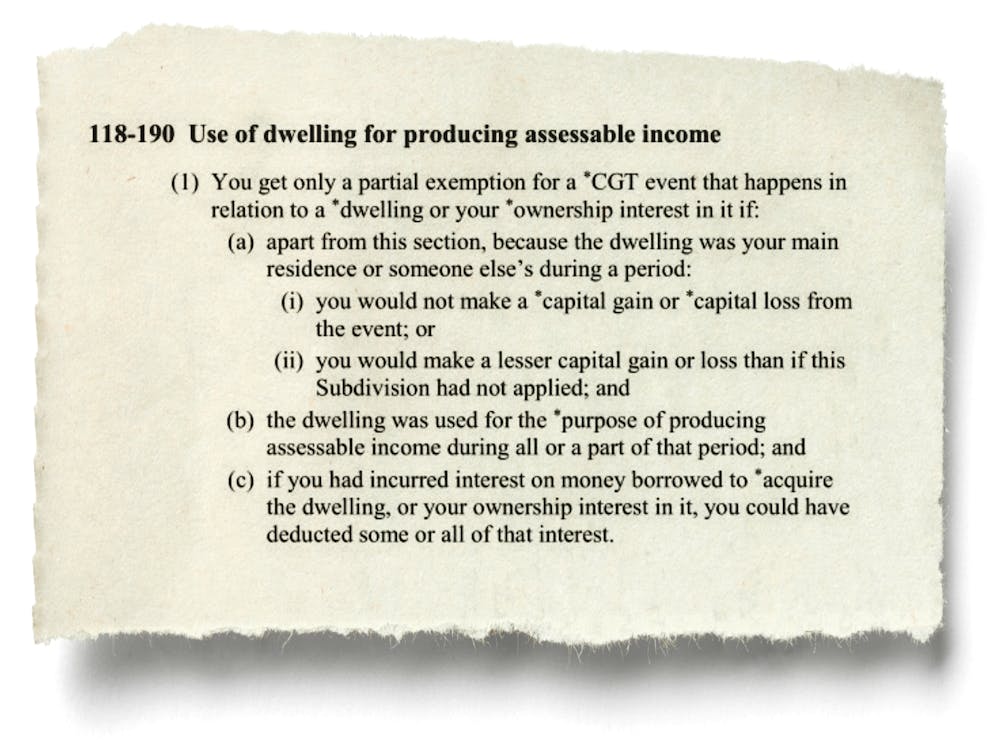

Be Careful What You Claim For When Working From Home There Are Capital Gains Tax Risks

Work From Home Tax Deductions You Can Claim This Year Abc Everyday

Working From Home How To Claim Your Home Office Tax Deductions

Tidak ada komentar:

Posting Komentar