Here are some common work-related and income-generating expenses including expenses if youre working from home due to coronavirus that you may be able to claim at tax time. 1 July 2020 to 30 June 2021 the 202021 financial year 1 July 2021 to 30 June 2022 the 202122 financial year.

Tax Deductions For Tradies Give Your Refund A Boost

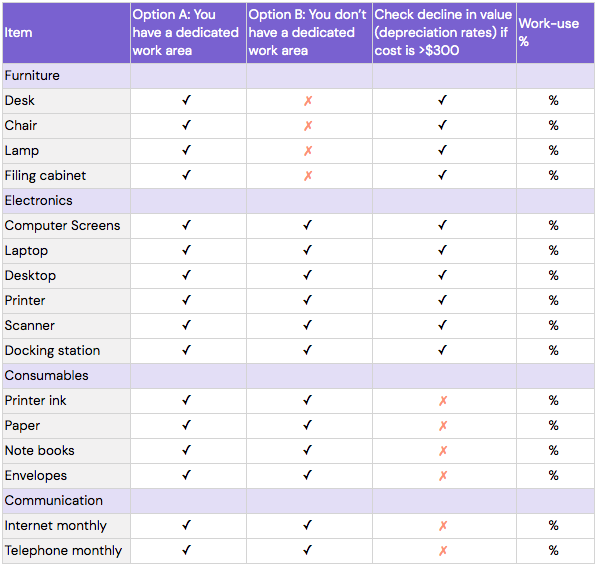

If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in maintaining a home office which will be calculated on a pro-rata basis.

How to claim work from home on tax return. A good many of us work after hours at home or spend a portion of our week working remotely. HE USES THE PHONE 50 FOR WORK USAGE. The following factors may indicate you do itinerant work.

Maximise your tax refund with our experts. The shortcut method simplifies calculating work from home deductions. Use the shortcut method calculator and enter the number of hours you worked from home between 1 March 2020 to 30 June.

Temporary shortcut method from 1 March 2020 to 30 June 2022 you may have the option of an all-inclusive 80 cents per work hour temporary shortcut method. I have been working from home since 5 March and cannot find how to claim the allowance on my tax return. A temporary method introduced last year.

HE CAN CLAIM A DEDUCTION FOR 125 IN THIS YEARS TAX RETURN. Many Australian businesses are making the safety of their employees and the public a priority and as such people all over the nation are currently and for at least the foreseeable future working from home. You can either claim tax relief on.

If you occasionally use your mobile phone for work purposes and the total deduction youre claiming for the year is less than 50 you can claim the following flat. Just keep a diary of how many hours you work from home each week and enter it on your tax return. You need your Government Gateway ID if you dont have one you can create one during the.

You make a separate claim for each of these items on your tax return. Head over to the new HMRC tax relief microservice page and follow the instructions there. If you claim a personal laptop or computer as a tax deduction it can add a good few dollars to your tax refund.

Missed the Nov 1st deadline. How do I claim tax relief for working from home. Its soon time to lodge your tax return so you should start thinking about any work-related and income-generating expenses you paid over the financial year.

Our tax return will calculate your deduction for you automatically. Using this method you can claim 80 cents per hour for each hour you work from home. Youll need to have your Government Gateway ID to hand if you dont have one yet you can set it up during this process.

You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. For example using the short cut method someone who works 375 hours a week at home for 48 weeks would be able to claim 1440 as a tax deduction. For a summary of this content in poster format see Home-based business expenses PDF 456KB This link will download a file.

You can claim a tax deduction if you worked from home for more than half of your total working hours or for more than six months during the tax year that started in March 2020. It covers all working from home expenses including phone internet electricity and decline in value of equipment and furniture. Include the calculated amount at the other work-related expenses question in your tax return and.

Can I Claim a Tax Deduction on Home Office Furniture. J PURCHASES A MOBILE HANDSET FOR 250. To claim for the working from home tax relief.

As per HMRC guidance you may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the weekThis includes if you have to work from home because of coronavirus COVID-19. The 2020 COVID-19 health crisis has seen our way of life turn upside down including how many of us do business. There are recent changes to claiming your tax deductions.

1 March 2020 to 30 June 2020 in the 201920 financial year. Similar to running expenses under this method available only from March 2020 onwards you can claim 80c per hour. Speak to our tax return experts.

As I complete a self assessment for property I own it states it must be done through this however cannot see anywhere or the form to add this. However you must genuinely use them for work all or part of the time. Ad 1 Billion claimed in deductions and counting.

This includes if you have to work from home. If you do itinerant work or have shifting places of work you can claim transport expenses you incur for trips between your places of work and your home. Claim for your home office if you started working from home at the end of March and worked there for at least 6 months till the end of February 2021 to deduct this.

6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you. Travel is a fundamental part of your work as the very nature of your work not just because it is convenient to you or your employer. You can claim 52c per hour you work from home.

Importantly the running expenses rate does not include items like phone internet office furniture or computer depreciation. If you use the shortcut method to claim a deduction in your 201920 tax return. Plus you can separately claim the work-related portion of your phone internet computer depreciation and other expenses.

Provided that you meet the requirements as set out in the Income Tax Act section 11a read in conjunction with sections.

Working From Home What You Can And Can T Claim On Tax Smartcompany

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

How To Claim Working From Home Deductions Kearney Group

Working From Home How To Claim Your Home Office Tax Deductions

Tidak ada komentar:

Posting Komentar