How much can be withdrawn from EPF account. 5 rows The EPF subscriber has to declare unemployment in order to withdraw the EPF amount.

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

EPF withdrawal for COVID-19 online.

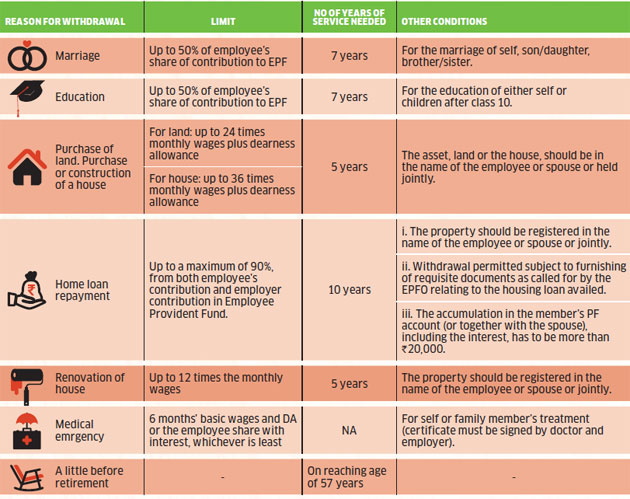

How much we can withdraw from epf. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. As per the. Unlike other EPF advance withdrawal reasons there is no maximum limit to withdraw PF advance for illness reason.

You can make final withdrawal of your EPF. 7 rows Individuals can withdraw up to 50 of their contribution to the EPF. The advance is non-refundable and the employee need not deposit the money withdrawn back into their EPF account.

EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75 of their balance after being unemployed for more than a. All EPF account-holders can withdraw up to an amount which is lower of - Three months salary here salary basic pay dearness allowance or. The maximum PF withdrawal limit in this case is.

To arrange a wedding. EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. Rajeev Kumar Updated.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. In general EPF members can get their 6 months basic wage DA or their total employee PF contribution whichever is less. A person can withdraw 75 of his or her provident fund if heshe is unemployed for more than a month.

30 of your total EPF savings will be in this account from which you can make pre. Employees Pension Scheme EPS Know how and when you can withdraw from your EPS account The Employees Provident Fund EPF corpus also has a pension component ie. However members can apply for lesser amounts as well.

Check how much you can get. May 09 2020 525 PM. You should have completed a minimum of 7 years in service.

Employees Pension Scheme EPSMost employees majorly in private sectors are members of the Employees Provident Fund EPF and have EPF accounts. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. For unemployment of more than 2 months the remaining 25 of the corpus can be withdrawn.

75 of total EPF balance in your account. EPF members can withdraw PF advance for medical reasons as many times as they need it. The funds have to be for either your education or your childs education.

You can make up to 3 withdrawals from these criteria. You need to use Form 31. You can withdraw your entire share along with interest or 6 times your monthly salary whichever is lower for a medical emergency concerning yourself or any of your family members.

But they need to have a sufficient amount in their PF account. An employee can withdraw upto 90 of total PF balance within one year before retirement advance on unemployment upto 75 of total PF balance etc. An employee can withdraw up to 50 of his PF amount from his EPF account.

The withdrawal will provide liquidity in the. How Much Can You Withdraw. You can withdraw up to 75 per cent of your EPF account balance or three months basic salary plus dearness allowance or the amount that you actually need whichever is lower.

These withdrawals too are subjected to the following conditions. As per the EPFO notification an employee will be permitted to make PF withdrawal of up to 75 per cent of the amount standing to the members credit in the EPF account or up to the amount of. You can withdraw up to 50 of your share with interest.

You can withdraw fron your EPF for your marriage if you have held your EPF account for 7 years. Have Rs 200000 in PF account. EPFO allows you to withdraw 50 of your share in the account along with interest to host a wedding.

Employees can obtain an advance from their EPF balance up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less. EPF Withdrawal Rules before 5 years of Service.

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Tidak ada komentar:

Posting Komentar