EPS is managed by EPFO and is also sometimes also called EPF Pension. Employee Provident Fund is a scheme instated by the government as per the Employee Provident Fund Act of 1952 wherein you and your employer contribute a specific amount each.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Earlier the pecuniary limit was Rs.

How much amount will i get on epf withdrawal. EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. Interest earned on EPF is the equivalent of a high pre-tax rate. The following illustration will show how much amount you can withdraw from the account.

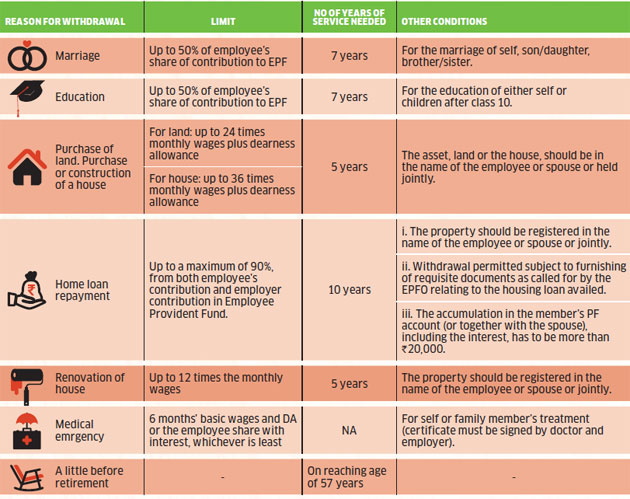

The Employees Provident Fund Organization EPFO has laid down certain rules for EPF members to withdraw their PF amount. Partial withdrawal before retirement NA 68NN After 54 years of age and within one year of retirement superannuation 90 of amount in PF of the member 1 one NA Member. The key points with respect to this scheme are as follows.

This tool will help you estimate how much balance you will have in your employers provident fund account when you retire. Only thrice during the EPF accounts duration. You unemployed for more than 2 months.

EPF Withdrawal before 5 years of Service. Considering that the EPF is paying 875 this year this is the equivalent of a 1250 rate of interest for somebody in the 30 tax bracket. To provide relief to employees an advance can be obtained as EPF withdrawal by employees up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less.

EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75 of their balance after being unemployed for more than a month. As per current laws an employee contributes 12 per cent of hisher monthly salary basic plus dearness allowance to hisher EPF account and the employer matches this contribution. Note that you cannot withdraw more than 50 of your personal contribution.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of. The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is. You can make up to 3 withdrawals from these criteria.

You will get full refund of your EPF EPS accumulation including current intrest rate ie 12current intrest rate367current interst rate-Through Cheque1. The rest of the PF amount will be transferred to a new account. An employee can withdraw up to 50 of his PF amount from his EPF account.

If an EPF pension member who is 56 years of age wishes to withdraw reduced pension monthly then he or she will get the payouts at the rate of 92 of the original pension amount. Invest Online 2 min read. Submissionof Permanent Account Number along with Form 15g15H and Form 19 is excluded in cases where the EPF members have rendered continuous service of 5 years or more including service with former employer.

After you have completed 7 years of service. You can withdraw 367 employers contribution when you wish 833 employers contribution that is transferred to eps can be withdrawal subject to some conditions mentioned below. TDS is applicable in case of EPF withdrawal amount is more than Rs50 000.

833 of the Employers monthly contribution up to a max of INR 1250 per month goes towards EPS This maximum was INR 541 per. Every employee with a provident fund account will also have a Universal Account Number UAN. Your minimum service completed to 6 months.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. In an employees provident fund account contributions are made by the employee 12 of the salary and the employer. 833EPS-Through cheque-2 The accumulation directly credited to your account through 2.

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment. In such cases the pension value is reduced to a rate of 4 per year until the employee reaches the age of 58 years. Under this reason employees can withdraw PF advance only once and the amount is also 75 of employee employer contribution or last 3 months basic wage DA whichever is less.

Employees Provident Fund Organization EPFO is a governmental body and its function is to administer the provident fund. Filling this form will cause the withdrawal of only pf amount which is the combination of ur total share and employershare minus 833 percent. You can only withdraw the money for personal purposes.

Coming back to the question if u want to withdraw ur PF amount and I am assuming u have not retired then u need to file a form called form 19. So technically speaking u will not receive ur eps amount. Related News SGB 2021-22.

Withdrawal within one year before retirement. As per the new EPFO rule a person can withdraw around 75 of their total PF amount in the case of one month of unemployment. Out of the employers contribution 833 per cent is contributed to EPS account subject to a maximum of Rs 1250 per month.

Two common questions about EPF withdrawal Can I withdraw my EPF money. Here are the steps to withdraw your Provident Fund PF amount online using Universal Account Number UAN. When can I withdraw the money from my EPF account.

You are also not supposed to submit. This interest rate is guaranteed and risk-free. Out break of pandemic Covid 19 reason was introduced to help the EPF members during the lockdown in India.

And your service is not more than 10 years.

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Epfo Application For Epf Withdrawal Claims Form 31 Under Outbreak Of Pandemic Covid 19 Are Being Processed On Priority By Epfo Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Stayhomestaysafe Facebook

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Tidak ada komentar:

Posting Komentar