Here are the one more criteria that you can withdraw advance money from PF account. If you are planning to withdraw your PF amount then you need to know that you can do so in parts or withdraw the complete amount.

Pf Withdrawal Form Know Epf Withdrawal Procedure

For withdrawal of money from PF account after quitting the job you must remain unemployed for 2 months.

How to withdraw money from previous pf account. If your UAN is already linked to the Aadhaar then you can submit the withdrawal claim online on the Member e-Sewa Portal or by visiting the regional EPFO office along with duly filled this composite form. In between if you take up a new job you can get your previous PF Account including UAN number transferred to new employer and. Form 10C and Form 10D.

There is great news for PF account holders. Both companies have different uan and different pf accounts but same bank account. Members of the Employees Provident Fund Organisation EPFO can avail various EPFO services on the UMANG App.

You can withdraw the full PF amount only after 2 months from your last working date. Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. Hi SirI have transferred my pf from previous company account to current company.

Documents required for PF withdrawal. To withdraw EPF from old UAN you need to have your KYC approved. In case you are a salaried worker in India likelihood is that youve got an account with the Workers Provident Fund Organisation EPFO.

Download the Umang app from Google Play Store or Apple App Store Step 2. You can withdraw money from your old PF account but keep in mind only EPF balance can be withdrawn. But you can take EPF advance by logging in to your UAN portal.

How to Withdraw PF Amount from Previous Company Online with Same UAN. But remember you need to be registered on the UAN portal and have the KYC details seeded in your account. If you are a salaried employee in India chances are that you have an account with the Employees Provident Fund Organisation EPFO.

Than you can take the same forms to your old company and with the help of your HR dept you can fill it and get the form signed from the authorized person. Even though the main purpose of the EPFO service is to provide financial security and savings for retirement you can also withdraw a certain amount of the money in your PF account if you are in need from the comfort of your home. Remember your UAN must be activated.

Instead of taking a loan you can withdraw funds from your PF in whole or in part. Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active. An employee can withdraw up to 50 of his PF amount from his EPF account.

EPS contribution can only be recovered as monthly pension. You cannot withdraw the PF as you are working in the current establishment paying their EPF contribution in your UAN. Now I want to withdraw some money from current account for covid emergency but it is showing that ur bank account is attached to another pf account.

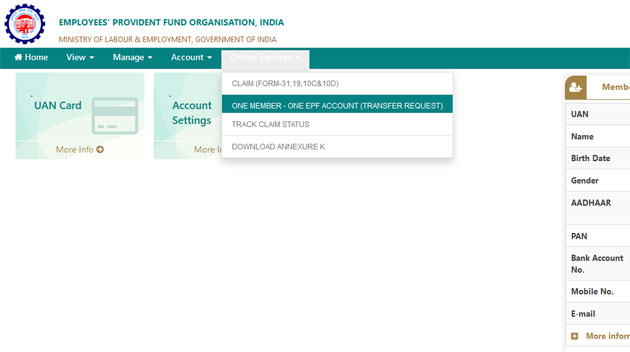

Login in the UAN member portal and go to online services and click on claim form 31. Withdraw your PF money without UAN Physically Method. The Umang app is one of the routes an Employees Provident Fund EPF member can take to withdraw money from their PF account.

Nevertheless Employee Provident Fund Organization has imposed certain restrictions on early withdrawal of whole provident fund amount to benefit employees even after retirement. Now if you need money then EPFO you can get the benefit of one lakh rupees PF withdrawal rule and. Provident Fund being a social security scheme the money could be withdrawn prematurely.

Withdrawing PF plus EPS Amount. The documents required to withdraw money from your PF account are listed below. There is one thing that you should keep in mind before starting the withdrawal procedure and that is to merge all your previous PF accounts.

Enter your bank account number and after verification click on proceed for the claim. The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. If you want to withdraw money from your EPFO account at home using the UMANG app follow the step-by-step guide mentioned below.

Answer 1 of 4. All you need to be required to avail the amount under marriage criteria is that you should have been in to service period for a minimum period of 7 years. Withdrawing using Aadhaar card number.

EPFO users can withdraw money from their PF accounts by using the UMANG app on their mobile phones. You can withdraw your PF and EPS amount by filling the composite form launched by EPFO which will take care of your withdrawal transfer advances etc. If you dont have the UAN number then you can follow the old method and submit a physical application form with the regional provident fund office and then you can withdraw your PF money.

It is not advisable to close the UAN for withdrawing the amount as if the amount was credited in the same UAN for 10 years then you will be eligible to get the pension after your retirement ie 58 years. To withdraw the PF you can go to the nearest PF office and ask for PF withdrawal form the forms are Form 10c and Form 19 for this you need to know your pf number. It must also be linked with your KYC including bank details IFSC and Aadhar.

In case of emergency you can withdraw PF advance whenever you want for that submit form 31 and select the reason as illness. Open the app and select New User Step 3. The transfer option is ideal for all subscribers whose EPF account in question is less than 5 years old.

You may either choose to withdraw the funds or transfer them to your current or existing EPF account. Having a Provident Fund PF account can be beneficial for all. A blank and cancelled cheque with IFSC code and account number.

Bank account number and IFSC approved. To withdraw your PF amount using the EPFO portal you will need to ensure the following. Aadhar number must be linked and verified with UAN.

UMANG App can even be used by members to withdraw their EPF money from their Provident Fund PF account. This is because the proceeds from a PF account if withdrawn within 5 years of setting up the account will attract taxes in the form of TDS. Enter your mobile number on the Registration.

Here are the steps. In case the UAN is not available you can mention only the PF account number. Now select PF advance form 31.

You will get a new UAN number associated with the new PF Account.

Epf Withdrawal Process How To Withdraw Pf Online Updated

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

How To Withdraw Epf And Eps Online Basunivesh

Epf Transfer Process Online How To Transfer Your Epf Account Online Employees Provident Fund Account Transfer

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Tidak ada komentar:

Posting Komentar