How to Withdraw EPF EPS Balance online. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab.

Online Epf Withdrawal How To Do It In Five Steps

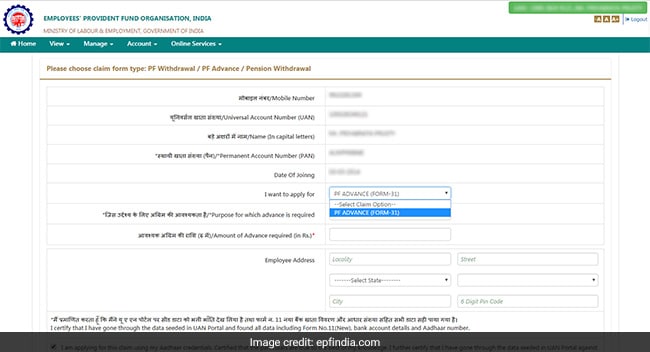

Step 6- Select PF Advance Form 31 to withdraw your funds online.

How to withdraw full pf amount online. Pf full final settlement online new process 2022 full pf withdrawal 2022 of kaise nikalepf form 19 under processpf form 19 and 10c filling samplepf f. If your PF withdrawal takes over 10 days then you can lodge a complaint on the EPF Grievance Portal. If your UAN Universal Account Number is linked to Aadhaar you can apply for withdrawal online under the Aadhaar-based withdrawal form.

Online Withdrawal of PF with UAN. How to Withdraw PF Online Online PF Kaise Nikale. You can easily withdraw you PF amount using EPFO e-SEWA portal by following steps Login Login to the portal using your UAN and Password.

Login in the UAN member portal and go to online services and click on claim form 31. TDS is deducted if the withdrawal amount exceeds 50000. It is also your HRs responsibility to give you your PF withdrawal fund along with the interest it accrues.

In case you have forgotten the password you get. Step-2 Next step is to login with your UAN and password then enter the CAPTCHA. Step 2 is to check whether the KYC details seeded are correct and verified or not.

Partial withdrawal is not taxable. PF online withdrawal procedure is as follows. Step 5- Now click on the Proceed for Online Claim option.

Epfo pfwithdrawalprocessPF Account இல உளள Full PF Amount-ய Online மலம Claim சயய Form 19 10C Apply சயய வணடம. The total PF amount comprises the contribution made by you and your employer plus accrued interest. Trust me its quite simple process.

Specially due to Covid 19 many people are searching online pf kaise nikale. The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. Form 31 is required for partial withdrawal EPF Govt.

PF withdrawal from an exempted trust. In this video session Ive explained the full in de. Read about Provident Fund in detail.

One can obtain the EPF withdrawal form from the employer or download the form from EPFO portal and submit it at a PF office. Now you can withdraw full PF Amount online from the unified member portal. Step 3 is to select the claim you require out of the 3 namely full PF Settlement PF Part withdrawal loan advance or EPS withdrawal.

Pf withdrawal process online. You will get the full amount that was subtracted from your account monthly with high interest of concerning 875 every year. Here are the steps.

Step 1 is to log on to the UAN portal and enter your details. Also as on December 2015 you cannot withdraw your PF money through any online facility in that you will have to meet your ex-employer. To withdraw PF amount from the previous company online follow the below procedure.

Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. If the facility takes off running from pillar to post for.

An individual can withdraw his PF amount either online or offline and also can opt to withdraw the amount either fully or partially. Step 7 A fresh section of the form will open wherein you have to select the Purpose for which advance is required the amount required and the employees address. However the Employees Provident Fund Organization is set to launch an online facility for provident fund withdrawal by March 2016 since the Supreme Court extended Aadhaar card usage for government schemes.

So these were the EPF withdrawal rules partial and full withdrawal in 2021. Enter your bank account number and after verification click on proceed for the claim. Steps to withdraw provident fund balance online.

Withdrawal PF Amount After Leaving the Job Employee Provident Fund EPF is a retirement corpus from which an employee can make withdrawals if heshe has been unemployed for more than 2 months. Under EPF Act 1952 you can withdraw the full PF amount if you retire from your service after having attained the age of 58 years and you can also claim the EPS amount Employees Pension Scheme amount at the same time. Step-1 Firstly you need to go to the UAN portal.

Step 2 Then input your UAN your password and the Captcha to sign in. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service. If your company is an exempted trust then you will need to contact your HR for your PF withdrawal.

Currently the EPFO allows 75 PF withdrawal if it is carried out after just 1 month of unemployment.

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Pf Step By Step Pf Withdraw Process Online By Using Uan Account Complete A Z Youtube

How To Withdraw Epf And Eps Online Basunivesh

Pf Withdrawal Online Here Is A Step By Step Guide

Tidak ada komentar:

Posting Komentar