Initiate online withdrawal claims through Online Services menu. Here are the steps.

6 Easy Steps To Withdraw Epf Online Through Uan Planmoneytax

Click the Online Services tab on the menu bar.

How to withdraw complete pf online with uan. If you meet this condition you can follow the procedure given below to withdraw your EPF online. Tap on the Online Claims section. A member can view the passbooks of the EPF accounts which has been tagged with UAN.

In accordance with the. However an online claim requires an active UAN number EPF database seeded with PAN and Aadhar details and Bank details of the employee linked with his UAN. Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 19 10C from the drop-down menu.

Step 7 A fresh section of the form will be opened from where you have to select the Purpose for which advance is required the amount required and the employees address. Step 2 Then input your UAN your password and the Captcha to sign in. Before beginning with the steps of EPF withdrawal online it is important to note that complete withdrawal from an EPF account is only.

Claimed amount will be credited to your Bank Ac added in KYC within 15 to 20 working days 1. On the next page you will have to select withdrawal options and select PF Advance FORM-31. EPF withdrawal online is possible through UAN portal.

Step 5- Now click on the Proceed for Online Claim option. The online facility makes the process much more streamlined and less time-consuming for the employee. Step 6- Select PF Advance Form 31 to withdraw your funds online.

PF Withdrawal Process is governed by the Employees Provident Funds and Miscellaneous provisions Act 1952 EPF MP Act 1952. Once you confirm the above conditions follow the ten steps given below to withdraw from the EPF fund. Enter bank account details.

Ensure that the Universal Account Number UAN is activated and linked with a registered mobile number. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. Universal Account Number is ask your employer or find it your monthly salary slip.

2 Click Online Service. After obtaining the UAN go to the EPFO portal and activate it. Step by Step 1.

You can withdraw only if you have been without a job for 60 days. Share your UAN number with new employer for linking PF account automatically New balance can be viewed in your UAN e-passbook post account reconciliation by EPFO 1. There will be no reduction in the value of the PF for lack of a UAN.

Members with authenticated Aadhaar and Bank details seeded against their UAN can now submit their PF WithdrawalSettlementTransfer claims online. After logging in under the Online Services section choose Claim Form-31 19 and 10C. If at all you forgot your password you will have an option to reset it.

Fill in your address and the amount to be withdrawn. Also make sure that it is liked with your KYC ie bank details Aadhaar and IFSC code. Click on the checkbox to proceed with submission of.

Next select service purpose for which advance is required and the PF amount to be withdrawn. Here are the steps you need to follow. For online Provident Fund withdrawal you need to follow these things.

UAN is mentioned on your salary slip. Upon opening the claims section one can enter the. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be.

Various reasons like illness medical expenses loss of wages natural calamities house construction Etc. Visit the EPFO e-SEWA portal and login using your personal UAN and passwordThere will be a. Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code.

Here I will detailed you how to withdraw PF amount online complete process from start to end. Enter bank account. Visit the EPFO e-SEWA portal and login with UAN.

Then select the Raise Claim option from the drop-down menu. First of all we have to activate UAN to withdraw PF online. The facility of passbook is not available for members of.

If you dont have the UAN number then you can follow the old method and submit a physical application form with the regional provident fund office and then you can withdraw your PF money. Login to the website using your UAN and password. Applying to Withdraw EPF online.

Click the manage tab go to KYC option and verify if your details such as Aadhar card pan card etc. Login into your account. Click on the suitable reason to proceed.

PF address can be figured out from the PF account number. You need to open the UMANG App on your mobile phone and log in. Here are the steps.

Step 1- Sign in to the UAN Member Portal with your UAN and Password. Not having a UAN just makes the process of withdrawal more time-consuming. Log-in to the UAN.

The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva. Enter the correct password. Here tap on the Online Services tab and select Claim Form-31 19 10C from the drop-down menu.

How to withdraw PF online with UAN. Get the UAN If you dont know what your UAN ie. Click on the menu bar.

Online Withdrawal of PF with UAN. Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active. Visit the online claims section When youve logged in you can look for Claim Form-31 19 10C 10D in the.

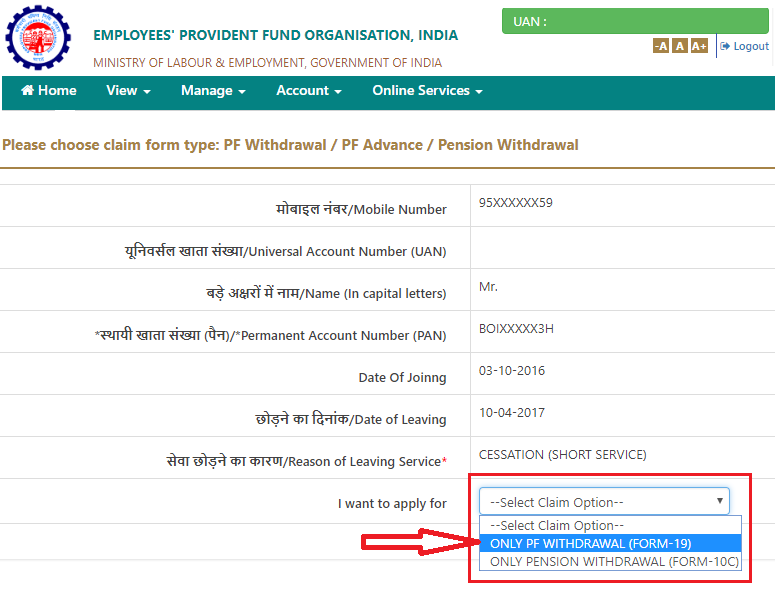

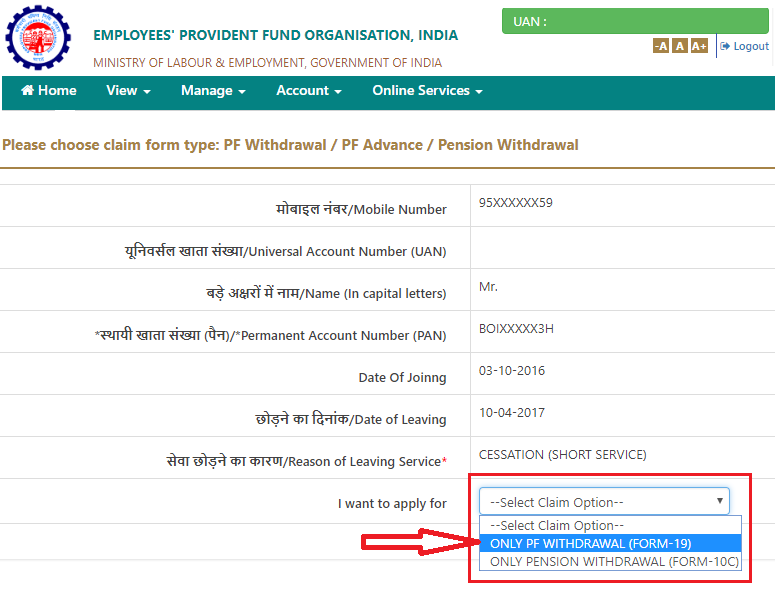

The online procedure for withdrawing PF is way more streamlined and hassle-free for employees. Visit the UAN Member Portal and login using the UAN and password. Click Verify 4 Fill in reason for leaving service 5 Choose Only PF withdrawal Form 19 from Drop Down Menu.

Now follow the below mentioned steps carefully to withdraw PF amount online. Next accept the terms and conditions by clicking on Yes and then click on Proceed for Online Claim option. Go to the EPFO e-SEWA portal.

Now to withdraw your funds online you need to select the PF Advance Form 31 option This will open a new section of the form asking you to select the Purpose for which withdrawal advance is required. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. From Drop Down Menu select claim Form 31 19 and 10C 3 Enter Linked Bank Account Number.

To activate UAN go to EPFO website there you will find Our Services Click on Our Services For Employees Member UAN online service OCSOTCP. Click here to redirect UAN page. Select I want to apply for 6 Fill in the Complete address and Upload a scanned copy of the Original Cheque Passbook.

One mobile number can be used for one registration only. You will need your UAN universal account number and PF office address for the same. It must also be linked with your KYC including bank details IFSC and Aadhar.

Here is how to withdraw PF online via UMANG App. Login to the portal. Click on the Claim Form-31 19.

Then the next screen will appear with the details of the person an. You will then have to select All Services from the drop-down menu and look for EPFO. Log-in to the UAN account 2.

There is a form FORM 13 which can be filled to claim the amount. Legal Framework of Provident Fund. At this stage you will be able to see all the details on.

How To Submit Pf Form 19 Online In 2019 Youtube

How To Withdraw Epf And Eps Online Basunivesh

Submitting Online Claims Withdrawal Settlement Ibm India Separations

Here S How To Withdraw Pf Online With Uan Step By Step

Pf Step By Step Pf Withdraw Process Online By Using Uan Account Complete A Z Youtube

Tidak ada komentar:

Posting Komentar