While closing an old account before 5 years the amount becomes taxable. Advantages of EPF Transfer.

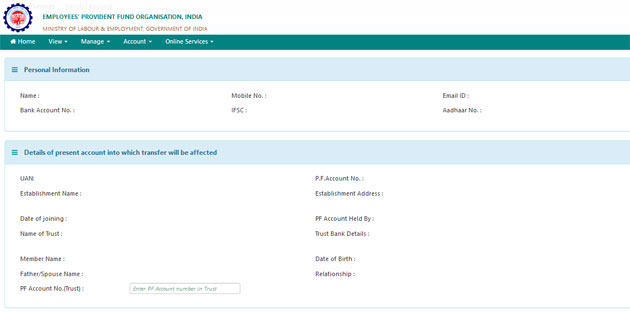

Pf Transfer Online Procedure For Epf Transfer Through Epfo Portal

After the completion of 25 years with SCWF if you still not withdraw your EPF account then Government will forfeit the money.

How to get money from old pf account. This 12-digit UAN is extremely useful and is all you need to check. An employee will be allowed to withdraw the pf amount of 90 if he decides to withdraw the advance amount from PF account before one year of retirement. Instead EPFO will inform you through the contact details you linked to EPF accounts.

So how can I withdraw money is my old account will close if yes then how many days require to close the same. All you will need to do is fill in some basic details on the first page which will give the EPFO to track the employers details of the PF account you once held with them. You even get interest on your PF for the said period.

An employee can withdraw the PF amount during his service period for medical expenses marriage or for purchase of house and other such cases. Since money is invested monthly it helps you build a corpus for your post-retirement life. You have 2 options for the unclaimed funds.

You can get the funds from your old EPF -1 account to the latest EPF-2 account through UAN portal. To log in on this portal you will provide the document Identification and phone number. After signing in on this portal you will see various options but go to the top tabs and click on the Request for Transfer pf amount of account.

However after the expiry of 36 months your PF account becomes inactive. To get EPS amount in the Composite Claim Form Aadhaar or Non-Aadhaar along with choosing Final PF balance also choose the pension withdrawal option. Enter your bank account number and after verification click on proceed for the claim.

To get back the money you have to knock the court. Earlier no interest was received but in 2016 the rules were amended. Log on to the EPFO website and fill up the EPF Claims Form.

To quicken the process EPFO has an online helpdesk. To withdraw your Provident Fund PF money you need to provide your UAN Universal Account Number. It is not recommended however that PF account holders use this money for celebrations.

Transfer PF Amount to Another PF Account. Both companies have different uan and different pf accounts but same bank account. Submit this form at your nearest EPFO office either by post or in person.

If you have switched a company and could not transfer your PF while the company has now shut down your account remains operative for 36 months. The transfer option is ideal for all subscribers whose EPF account in question is less than 5 years old. Now enter your mobile number and captcha and click on get OTP option.

To transfer the oldprevious account you will be required to get it attested either by the previous employer or present employer. To activate an account an application has to be made by going to EPFO. Explain that an employee.

Your claim in order to proceed requires your company to certify it. You may either choose to withdraw the funds or transfer them to your current or existing EPF account. This is the EPFO members claims portal.

This additional money credited to PF account holders will be especially valuable in the event of a medical emergency if you have a loan to repay or if you need money for your childs college tuition. How to Withdraw from an Unclaimed EPF Account. Withdrawing PF balance plus EPS amount for below ten years of service If service period has been less than 10 years both PF balance and the EPS amount will be paid.

Enter the old member ID ie previous PF account number or previous UAN. All you need to do is identify the account and then take the following steps. TRANSFERRING PROVIDENT FUND AMOUNT FROM OLD ACCOUNT TO NEW PF ACCOUNT ONLINE.

If you didnt join in any new job then also you can find the UAN allotted to your PF account here is the step by process to know your old UAN. EPFO has asked field offices to identify the beneficiaries of inoperative PF accounts and settle those by making payments or transferring money to their active accounts. Anew page will open.

How to get advance PF Amount Withdrawal PF money from your EPF Account. EPF is a recognized statutory body and highly recommended to all employees in India. Submit the details of your problem in not more than 1000 characters.

Now select PF advance form 31 option. Enter the details of your EmployerEmployment. You may also withdraw the funds from EPF-1 and can submit online claim for EPF-2 as well.

The facility is meant to help members trace their PF numbers or find the total fund accumulated. You can avail partial withdrawal on your PF funds for reasons like purchasingconstructing a house medical treatment marriage of own or daughter etc. The UAN number can be easily fetched from your employer.

In case online transfer is not possible you can contact your first employer and get the transfer claim processed. Once you click the first time user button you will be presented with a screen where you have to describe your problem in not more than 1000 characters. Do remember that such movement to SCWF will not happen automatically.

This is because the proceeds from a PF account if withdrawn within 5 years of setting up the account will attract taxes. What are my options for the EPF funds. But if you simply transfer the funds you get to enjoy your hard earned money in full.

An employee can choose attestation via present employer for faster processing of transfer request. Now you will find a new option called select service. Even after closing the account you get interest on the money lying in the account.

Now I want to withdraw some money from current account for covid emergency but it is showing that ur bank account is attached to another pf account. While your PF account will change every time you start working at a new organization your consolidated EPF account identified by your Universal Account Number UAN will not change. If previous company was not an exempted provident fund meaing that the contributions from you and your employer are paid to the Regional Privident Commissioner then you can approach the Regional PF office and ask for transfer of the PF balance to your new account.

HOW TO TRANSFER EMPLOYEES PROVIDENT FUND EPF AMOUNT FROM OLD ACCOUNT TO NEW PF ACCOUNT ONLINE at epfindiagovin. Go to UAN member portal and click on know your UAN option. Login in the UAN member portal and go to online services and click on claim form 31.

Once the details are found you will able to withdraw the amount available under your name. Withdrawing funds from your unclaimed EPF account is fairly simple. Click on Get Details.

To withdraw PF amount from the previous company online follow the below procedure.

How To Club Consolidate Multiple Epf Accounts Online

How To Transfer Old Pf To New Pf Account Withdraw Old Pf Balance Merge Old Pf With New Pf Epf Youtube

Epf Transfer Process Online How To Transfer Your Epf Account Online Employees Provident Fund Account Transfer

Transfer Old Pf Money New Pf How To Transfer Old Trust Pf To New Trust Pf Account Ssm Smart Tech Youtube

How To Transfer Old Pf To New Pf Account 2021 Withdraw Old Pf Balance Merge Old Pf With New Pf Youtube

Tidak ada komentar:

Posting Komentar