If you have set aside the Full Retirement Sum FRS in your Retirement Account RA you can apply to withdraw the balance in your SA and OA. You can make a withdrawal in the year you turn 55 or later if you leave your job for any reason.

Here S How Much You Can Withdraw From Cpf From Age 55

If you have less than the FRS or the BRS with a property You can withdraw up to 5000 unconditionally.

How much can you withdraw from cpf at 55. Upon turning age 55 CPF members can withdraw their CPF savings after setting aside their. When we turn 55 we are finally able to withdraw some of our CPF savings in cash. How much can I withdraw from my CPF savings.

Upon turning age 55 a CPF member can withdraw cash from his CPF OA and SA. Enter the amount that you wish to withdraw from your CPF SA and OA funds. Even though you can withdraw some of your CPF monies at 55 you may not be able to withdraw whatever amount you want because CPF will want you to set aside some monies for the public annuity scheme CPF LIFE.

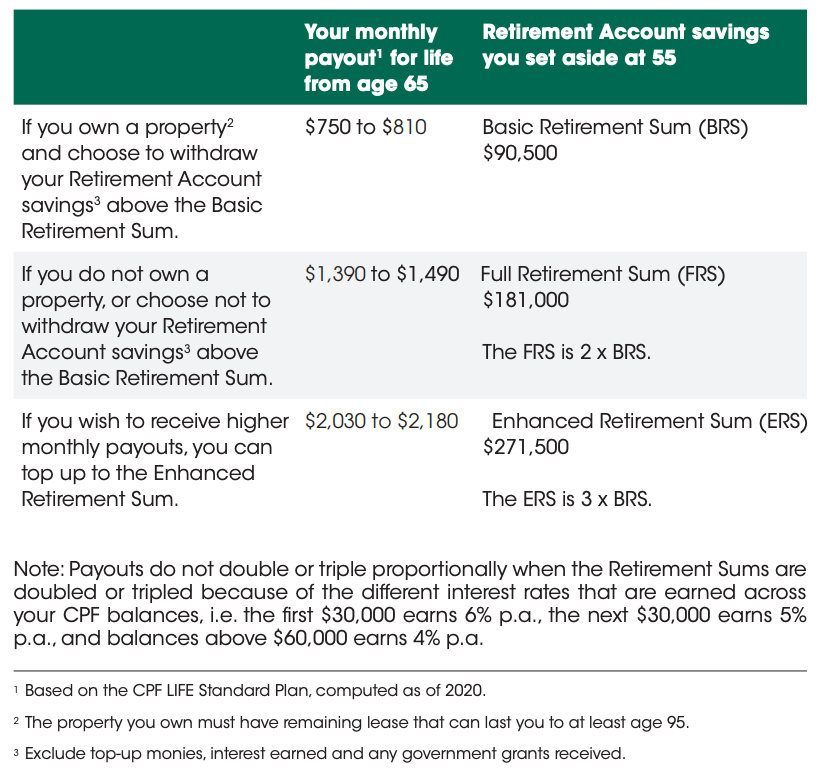

In 2020 the FRS is 181000. How much we can withdraw typically depends on how much CPF savings we have and whether we have hit our Full Retirement Sum FRS for our. You can withdraw at any time after 55 and.

You can withdraw up to 5000 from your SA and OA if you have not met CPF FRS requirements or your CPF SA and OA savings after setting aside your CPF FRS in RA whichever is. Log on to my cpf Online Services using your Singpass Click on My Messages Refer to Withdrawal you will be able to see your withdrawal amount in this message. There will be a one on one session to help the individual to understand the CPF scheme and plan for the options which will be available one year later when they turn 55.

How to withdraw CPF using PayNow. So how to decide. Members who have not set aside the FRS can still withdraw up to 5000 from.

Draw first from SA. Scroll down to Withdraw CPF savings. Additionally you can make a property pledge to withdraw more of your CPF savings but doing so will lower the monthly payouts you receive from CPF LIFE.

Yes you hear me right. 1 Everyone Can Withdraw At Least 5000. Any time from the age of 55 you can withdraw up to 5000 from your CPF Special and Ordinary Accounts SA and OA.

You will not be able to choose the account from which to withdraw your monies when you make a withdrawal after age 55. Similarly when you withdraw any excess above FRS still remaining in SAOA they will draw first from SA followed by OA. You typically must pay a 10 penalty if you make a withdrawal before age 59 12.

If you own a property you can maximum withdraw any amount above 90500. The question is just how much can we withdraw. If you are nearing or past age 55 please follow these steps to check how much you can withdraw from your Special andor Ordinary Accounts.

After members reach age 55 and have set aside the Full Retirement Sum FRS they will be able to withdraw the remaining balances from their Special Account SA first and then Ordinary Account OA. Please note that the above is an extremely simplified explanation and is simply meant to highlight the effect of the Retirement Sum when you turn 55 years old. How much can you withdraw from CPF at 55.

For example if you are born before 1954 you are allowed to withdraw 50 of your Ordinary and Special Account savings even if you have not set aside the Full Retirement Sum or Basic Retirement Sum at age 55. If insufficient to form FRS next draw from OA. In 2021 the FRS is 186000 about 28 higher.

The CPF withdrawal rules are. The sequence of how CPF forms the balance in RA at 55. If you dont own a property you can only withdraw up to 5000 and the rest needs to go to the retirement account.

Basic Retirement Sum BRS with sufficient charge or pledge in their Retirement Account RA OR. Upon turning age 55 a CPF member can withdraw cash from his CPF OA and SA. How much we can withdraw typically depends on how much CPF savings we have and whether we have hit our Full Retirement Sum FRS for our cohort.

All CPF members can withdraw up to 5000 of their CPF savings from age 55. You can then withdraw the remaining amount from your RA excluding top-up monies government grants and interest earned in your RA. 5000 OR your OA and SA savings above the Full Retirement Sum FRS whichever is higher.

Here are 7 steps youll need to withdraw your CPF using PayNow after reaching 55 years old. Earlier today there was this article indicating that those who turn 54 this year are eligible for a new CPF retirement planning service CRPS. The withdrawal rules are.

Below are the retirement sums for those turning 55 in 2019. The priority is to put money in the retirement account. 5000 OR your OA and SA savings above.

Only up to FRS amount will be transferred from SAOA to RA. On top of that members have the option to withdraw their remaining CPF savings the combined balances in the Ordinary Special and Retirement Accounts after setting. Retirement sum figures are applicable to members turning 55 in 2020.

How Much Can You Withdraw From Your CPF At 55. You can also top up to their CPF Special Account or Retirement Account if they are 55 and above with cash and enjoy up to 7000 of tax relief for top-ups up to the current FRS. You can only withdraw funds from the 401k offered by your most recent employer.

While withdrawal is an option once you turn 55 leaving cash in the CPF earns higher interest rates. Your estimated withdrawal amount from your Ordinary andor Special Accounts is. Because the 90500 is the minimal amount you need to set aside in the retirement account to provide you a monthly payout.

Why you cannot fully withdraw your CPF when you retire. If you own a property. The next 30000 earns 5 per cent and amounts above 60000 will earn 4 per cent.

How much you can withdraw from your CPF depends on the combined balances in your OA and. Go to Retirement income and select Withdrawing for immediate retirement needs. Your CPF withdrawal limit at age 55 is likely to be only 5000.

Savings in your OA and SA are between 5000 and 181000. You can see from the flow chart below when you turn 55 years old your CPF ordinary account and special account will be combined as a new account called retirement account. The first 30000 in the Special Medisave and Retirement Accounts for instance earns 6 per cent.

How much you can top up depends on how much the recipient can receive based on their current balances. However if you are born after 1957 you are only allowed. Full Retirement Sum FRS equivalent to 2 times BRS.

If you dont own a property you can only withdraw up to 5000 and the rest needs to go to the retirement account. All information and figures are accurate as at 1 February 2020For members turning.

How Much Money Can You Withdraw From Your Cpf At 55 Heartland Boy

Why Your Cpf Withdrawal Is Only 5k At Age 55 Ivan Guan

How Much Money Can You Withdraw From Your Cpf At 55 Heartland Boy

Simple Guide On How To Withdraw Money From Cpf At 55 By Yasi Datadriveninvestor

How Much Cpf Savings Can I Withdraw From Age 55 Youtube

Tidak ada komentar:

Posting Komentar