You can withdraw a maximum of 25000 per transaction if you are funding by bank transfer and 50000 with debit card. Youd therefore have to withdraw 100000 divided by 274.

Aib Current Accounts Compare Fees Features And More Finder Ireland

Withdraw more and the odds drop to just over 50 if you.

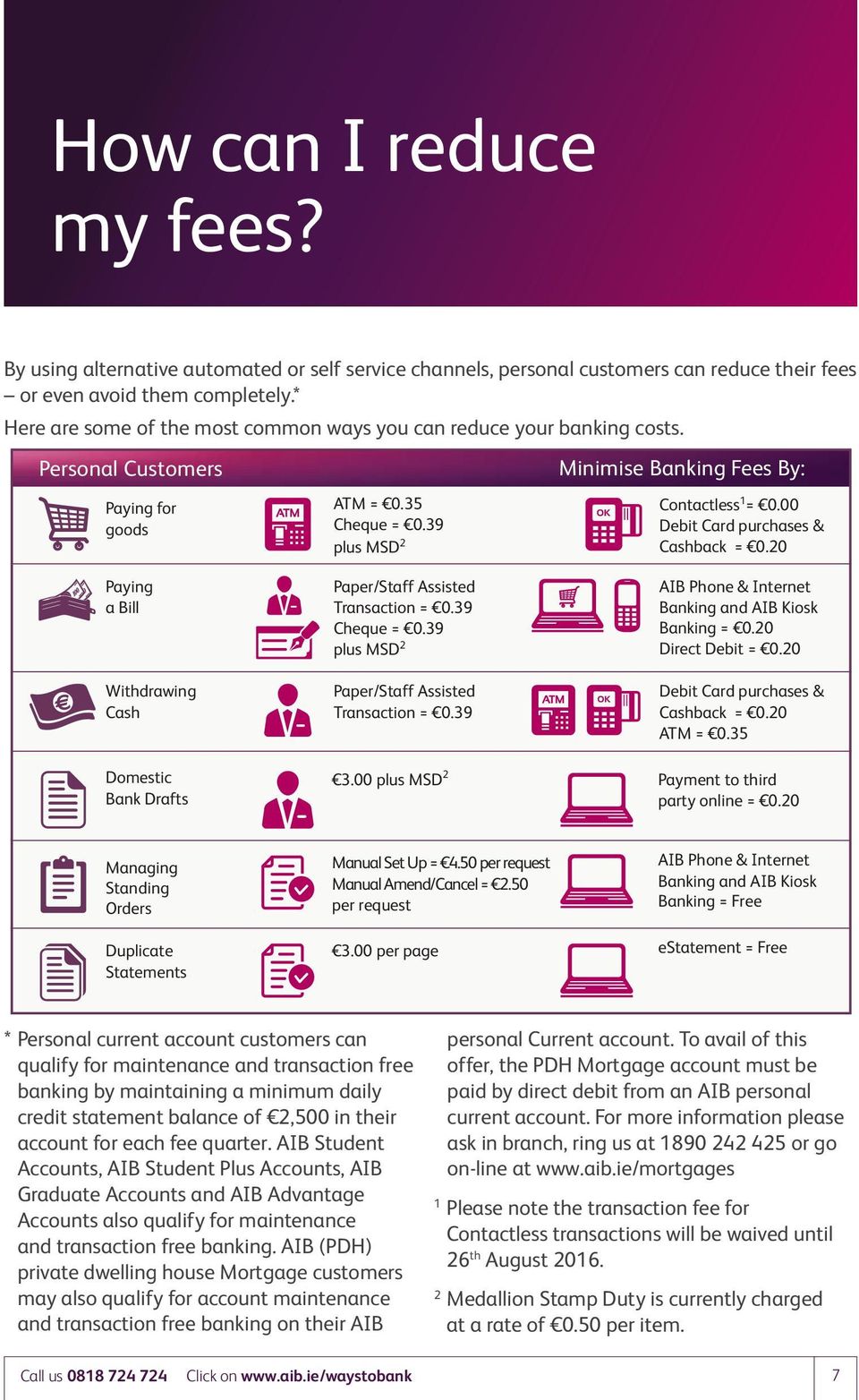

How much can i withdraw from my aib account. Effective from 8th December 2012 for personal users and from 22nd August 2013 for business users this is a cumulative limit for transfers completed using your AIB Kiosk AIB Phone and AIB Internet Banking. This 20 figure includes the first 5000 that can be withdrawn from age 55. Do I need to provide any documents to make a withdrawal.

Some of that 400 would have to go to taxes. There is no cash withdrawal limit and you can withdrawal as much money as you need from your bank account at any time but there are some regulations in place for amounts over 10000. You can withdraw 9999 from your savings account without the bank reporting the transaction to the IRS.

By law the threshold for getting reported is 10000 but regulations have effectively lowered the amount to just 5000. Is there a limit. We are happy to advise you of your current limit and change this for you.

Typically the amount is about 1000 or less per business day. Any time you try to withdraw close to 10k in cash you can attract attention. Please see your Deposit Account Agreement for limits.

The number of withdrawal requests is unlimited. The minimum withdrawal amount is 100 or all your available account balance whichever is lower. But you wouldnt necessarily be able to spend it all.

A 1 million withdrawal may be a bigger sum than your bank branch has on site. IqOption verification before withdraw funds. Account Fees and Service Charges AIB ATM Banking You can withdraw up to 600 from any ATM displaying the Visa logo using your AIB Debit Card and PIN.

This is a very tricky calculation since you dont know what youll earn in any given year nor what the rate of inflation will be nor how long youll live. The withdrawal request must not exceed the amount available on your account. If we are born in 1957 which means we turned 55 in 2012 and will turn 65 in 2022 we can only withdraw a further 10 of the savings in our Retirement Account.

If you absolutely have no choice and need the cash for legitimate reasons then just withdraw as much as you need and dont worry about getting flagged. The maximum you can withdraw from Stash banking accounts at an ATM or Teller is 500 every 24 hours. However if you visit your bank for cash withdrawal you may withdraw up to 2500 without giving any notice in advance.

When a lot of customers come in wanting large cash teller withdrawals that day once it gets near the end of the day they might start restricting no-notice large withdrawals to a limit of say 2k. Conventional wisdom in retirement planning claims a conservative withdrawal rate should be 4 annually adjusted for inflation. Withdrawing cash from our checking or savings account with assistance from a bank teller allows us to withdraw larger amounts but can also get us arrested if we withdraw too much money or appear suspicious.

Banks dont often that much cash on hand contrary to the image they present. With a BBVA Savings Account or BBVA Online Savings Account you can withdraw funds in person at a BBVA branch or ATM with no withdrawal limits. How much can I withdraw per day from iqoption broker.

This limit in the UK is set to 500 a day. You may also withdraw funds up to six per month in the following ways. You can find these limits in the app in the Deposit Account Agreement To locate this in the app.

Call us on 0818 365 365 to do this. Large Currency Transaction Report The Money Laundering Control Act of 1986 enabled banks to begin completing Large Currency Transaction Reports LCTR on individuals who conduct transactions involving more than 10000 in cash. How much can I withdraw in one time.

You can withdraw up to 1000000 per day. Transferring funds via Online or Mobile Banking. For instance if you turned 70 12 and had an IRA with a balance of 100000 the IRS would calculate your life expectancy at 274 years.

You want to try to use a check or if youre moving to a new bank a cashiers check or do a transfer. If you take out less say 4 or 12000 a year the chance of being able to sustain those withdrawals to age 95 rises to about 90. Daily withdrawal and cash limits apply.

The daily spend limit is 10000 per day. If we are born in 1958 or after we can withdraw up to 20 of our Retirement Account Savings as at age 65. Maximum Transfer amount between your nominated AIB accounts 1050000.

The amount of cash you may withdraw from ATMs in Ireland using your Debit Card depends upon your card type and if you have changed this limit. They did say that their ability to do this much without notice depends on how many customers wanted cash that day and thus what their branch cash inventory that day was like. In case you need to withdraw more than this amount you will be required to pre-order a transaction in which the bank needs to.

Two people with the same bank and same checking account can have different ATM withdrawal limits. This rule says that you can withdraw about 4 of your principal each year so you could withdraw about 400 for every 10000 youve invested. The savings account withdrawal limit is no more than six per month and applies to transactions such as overdraft and bill-pay transfers and debit card transactions.

Your Money 24 7 Access With Aib Pdf Free Download

Tidak ada komentar:

Posting Komentar