All you need to do to claim this is to keep a note each day of the time. Keep a record of how many hours you worked from home.

How To Claim Home Office Expenses For Self Employed Turbotax Canada 2020 Youtube

CRA Eligibility criteria - Temporary flat rate method.

How to claim working from home on taxes turbotax. If you are not sure. Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400. However the ATOs new 80 cents deduction method covers ALL your expenses from working at home so be careful.

File your taxes directly. You dont need any supporting documents for this method nor do you need a signed T2200. You had to work.

In this case youd multiply 18 by three which means youd be eligible to claim 54 back on tax. Write COVID-19 hourly tax rate in your tax return. Thank you for using TurboTax.

The expense must be directly related to earning your income. In this role you may help people learn to use the TurboTax software use virtual tools to adjust settings for customers and generally assist people with any questions or problems with which they need support. Finally use the third-party software to file the taxes.

Work from home TurboTax jobs primarily include seasonal positions with Intuit related to customer service and tax preparation. Shoprite has its own police force and now makes over 200 arrests a year Next article. The ATO introduced what they call the Shortcut Method for claiming running expenses during COVID-19.

Prior to that employees who worked from home at the convenience of their employer were allowed to deduct home office expenses under the. Terms and conditions may vary and are subject to change without notice. If you decide your work usage is 20 this will come to 18.

The following steps outline how to figure out the amount you can claim back on tax. You must have spent the money. Claiming your home Internet use on tax.

Most W-2 employees wont be able to deduct home office expenses on their federal return even if theyve been asked to work from home due to COVID-19. On the Employment Expenses Profile page check the option. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs.

This is designed to cover the extra costs of heating cooling lighting and the decline in value depreciation of furniture. Most free tax software allows you to claim work-at-home expenses though upgraded commercial versions may support these expenses with more focus on self-employment. Claim the amount on line 22900 of your tax return.

Click on something like file your taxes here from your account page. You estimate what percentage of your Internet use is for work purposes. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

You have now used the flat rate method to claim employment expenses. But some states do allow W-2 employees to deduct these types of expenses on. This has been in place since 2018 when the Tax Cuts and Jobs Act was signed into law.

I didnt receive either form from my employer. Go to the CRA website. There are 2 other ways you can work out deductions for working from home.

As part of the home office deduction you can write off some of your utility expenses taxes insurance repair and depreciation. If you would like to claim a deduction in your tax return all of the following must apply. Write the deduction amount in your tax return in the Other work-related expenses section.

How much you can claim. Home offices became primary workspaces for many people this year. If using the form method one of the forms required the T777S-Statement of Employment Expenses for Working at Home Due to COVID-19 for the flat rate method will be available on one of our upcoming software updates.

This method means you claim 80 cents per hour for every hour worked at home. According to the ATO website if you are working from home you cant claim. Employment Expenses 2020.

Working from home resources for your 2020 taxes. Generally the easiest option is to claim the Australian Taxation Office ATOs flat rate allowance for working from home of 52 cents per hour. If you multiply this figure by 12 youll be eligible to claim 216 back on tax.

Employees working from home cant take the home office deduction even if youve been asked to work from home due to COVID-19. On the next screen Check the flat rate method and enter the number of days you worked from home. Alternatively you may have only been working from home for three months.

Expenses You Cant Claim. Find out more at wwwatogovauhome. Using Form T2125 Earnings and expenses from business and professional activity for an individual are reported by way of form T2125.

How to claim work from home expenses for tax in South Africa according to SARS. To be able to use this method. Work out your deduction amount.

It will be found when you enter your T4. You must have a record to prove it. While one might think theres not that many steps in the current system.

You can either claim tax relief on.

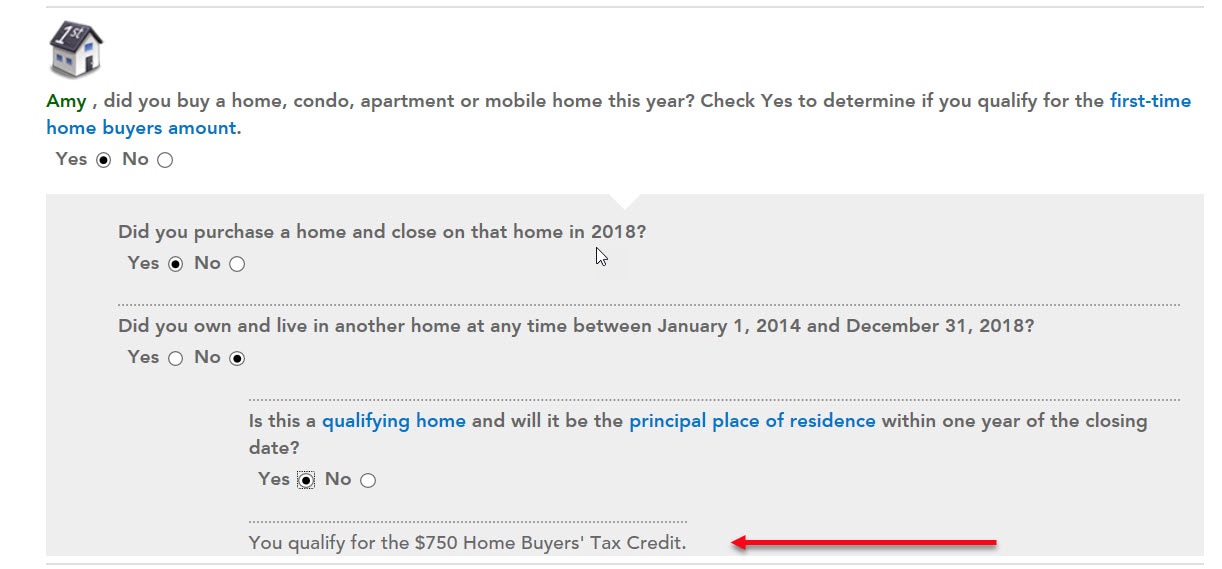

Where Do I Claim The Home Buyers Amount

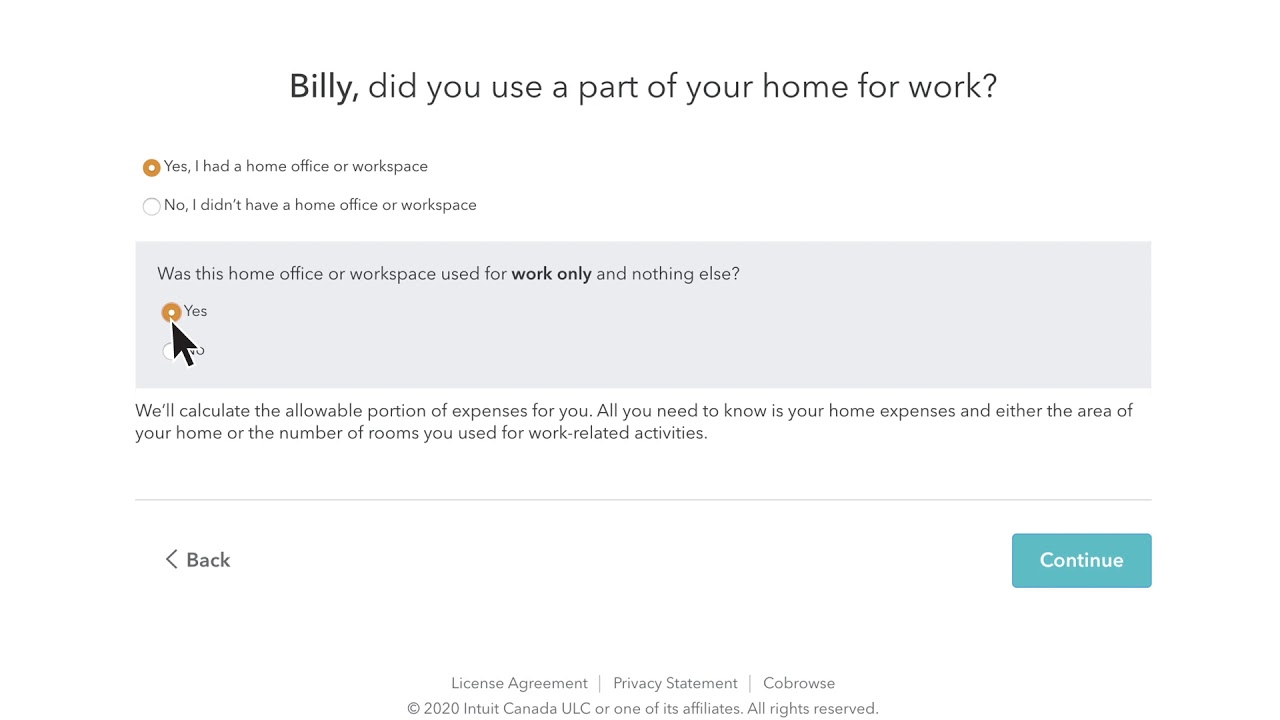

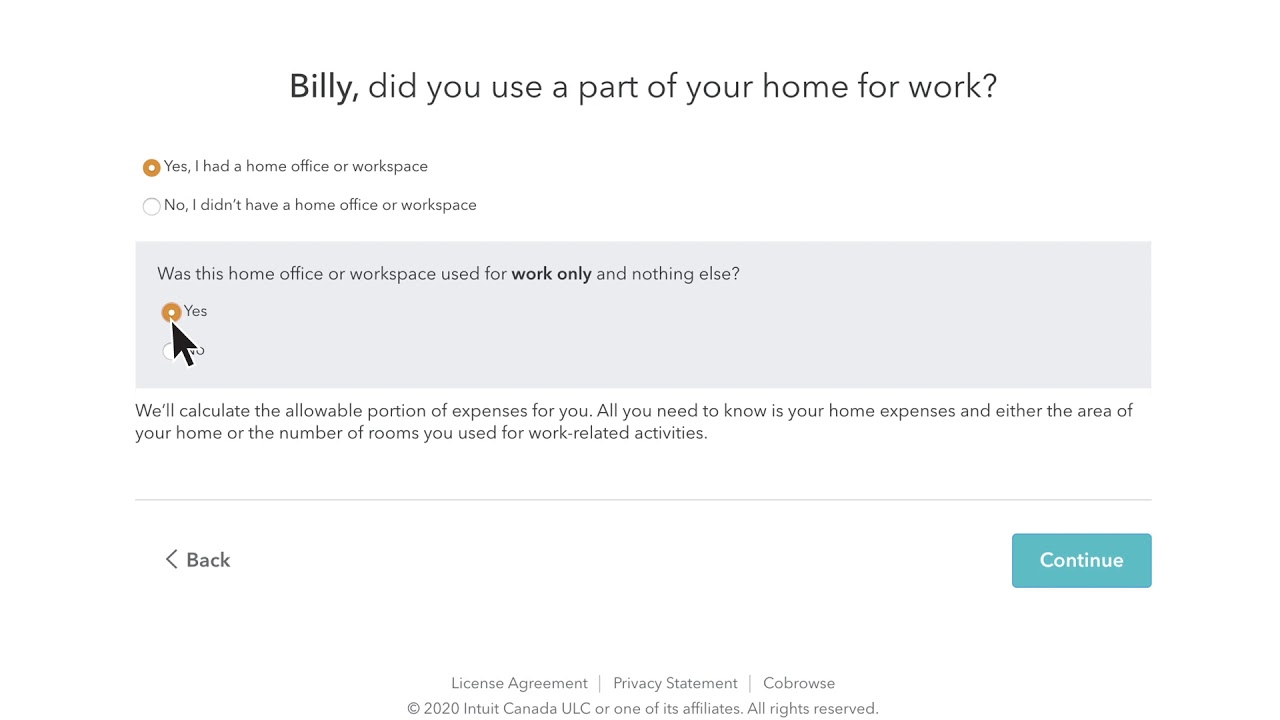

How To Claim Home Office Expenses For Self Employed Turbotax Canada 2020 Youtube

How Do I Claim The New Work From Home Deduction Du Page 3

Tax Tips For Employees Who Work At Home Turbotax Tax Tips Videos

Your Top Tax Questions About Working Remotely Answered The Turbotax Blog

Tidak ada komentar:

Posting Komentar