The return rate on residential property is appreciate in line with inflation around 5 to 7 yearly rental around 3 to 5 yearly. In addition to withdrawal you can also use EPF fund for repayment of home loan EMI.

Kwsp Housing Loan Monthly Installment

Min is 8 to 12 EPF is 6 for year 2011 around 5 to 6 over past few years Obviously ROI for property is highly then in EPF.

How to withdraw money from epf to pay housing loan. Ideally you shouldnt if you can help it because you need to think of your financial security after your retirement. Apart from the existing conditions from 2017 the EPFO also inserted a new rule to allow withdrawal of up to 90 of the funds from the PF account for home purchases. What percentage of your salary goes as EMI.

To withdraw funds from EPF however a Universal Account Number must be linked to an Aadhaar number. There are two types of withdrawal Type 1. PTPTN borrowers who are affected by pandemic can choose to withdraw their EPF to pay their loans.

For home loans the EPFO has also allowed a non-refundable loan as well as a facility to use your future PF contributions to repay your pending home loan EMIs. A new EPF withdrawal rule is out now you can withdraw 90 of EPF balance for buying a house flat or under construction property. Heres how to use your EPF savings to help finance your home and pay the housing loan.

Is it worth to withdrawal epf money to pay housing loan. There sure is a lot of reasons the EPF allows you to withdraw simply because the situations above regularly requires a large sum of money upfront. Better withdraw from EPF account 2 to housing loan as following points.

Determine How Your EPF Money Will Be Used Understanding Your EPF Funds Account 1. No PF withdrawal will be allowed unless the member. LCF 01092011 at 546 pm.

For most Malaysians there are several types of EPF withdrawals to highlight. Obtain the at least the letter of approval for the housing loan. If it is worth I would like to pay my principal amount.

Before withdrawing money from your Employees Provident Fund EPF account to pay off your home loan there are certain aspects you need to consider. However if you have weighed in the cost and benefits you can go ahead and utilize. Your Account 2 funds can also be used to reduceredeem a housing loan on behalf of a spouse or immediate family member.

Some of these include your overall financial position. With around 25 years of your loan tenure left you have already paid the majority of the. The application only takes you less than 10 minutes and you can do it without having to leave your house.

When a person retires or remains unemployed for more than two months he is entitled to withdraw the EPF balance in full. It is applicable from 12th April 2017. Therefore it is important to take note.

Employees can withdraw up to 36 times the monthly salary cum Dearness Allowance in the home renovation or construction. The fund in Account 2 is withdrawn and paid to bank directly to reduce the principle amount Type 2. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF account.

One can withdraw from PFEPF account for loan repayment in two ways - offline and online. Retirement savings Cannot be withdrawn before the age of 55. Current epf interest is 6-7 while my housing loan interest is less than 5.

An individual who has a Provident Fund PF account is allowed to withdraw funds from it against a loan. 2 Buying a home as an individual You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not less than. With the provision that the amount from the EPF corpus will be debited and.

The employee must complete at least 5 years of total service. In case you want to prepay your home loan and just get over it while saving on housing loan interest you can withdraw funds from the employee EPF account. Partial EPF withdrawal is allowed in specific cases such as for medical reasons marriage home loan repayment and so on.

You can make a withdrawal to reducesettle your housing loan balance AND to pay your monthly housing loan instalment simultaneously. Flexible housing withdrawal. This new scheme is called as Employee Provident Funds Fourth Amendment Scheme 2017.

Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. This is the most common form of EPF. Owning your dream home is now made easier with EPF withdrawal.

The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees. The intent is to provide access to home loan where your loan repayment ability may be limited not considering EPF contributions. All withdrawals are subject to a minimum withdrawal of RM500 or all of Account 2 savings.

The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. The house should be held in hisher name or held jointly with the spouse.

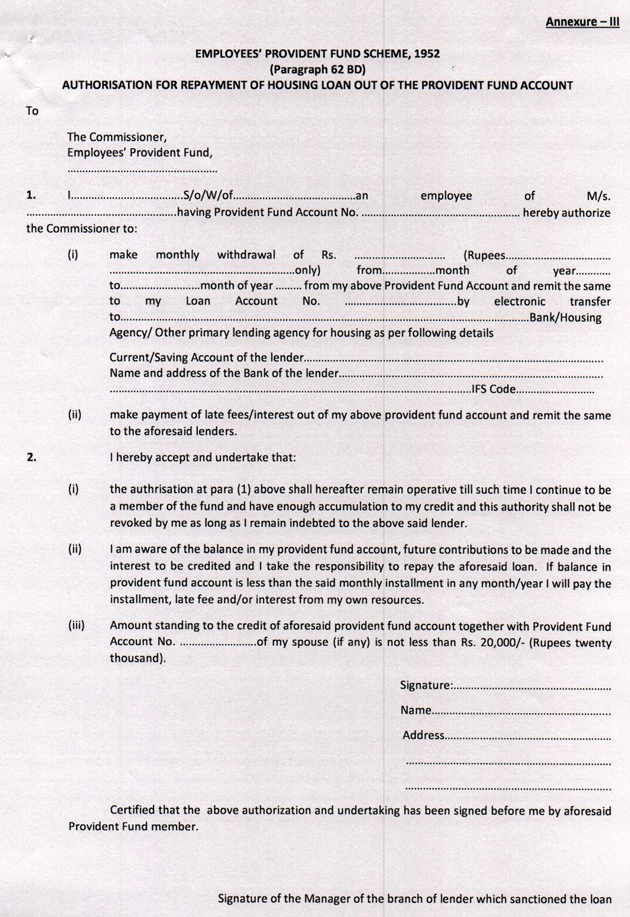

This withdrawal can only be made for repayment of the home loan taken either by the members andor by the spouse from specified. Withdrawn from EPF will then be credited directly to your home loan account. The employee can withdraw funds from his EPF account for the purpose of renovation and reconstruction.

Therefore in addition to partial withdrawal up to 90 of the corpus for purchase of house you can also pay your EMIs from EPF balance. EPF allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education. EPF reserves the right to cancel your monthly payment withdrawal if your loan has been fully settled your house has been soldauctionedits ownership transferred to another party or if you have been found guilty of.

The provident fund scheme allows you to avail of the withdrawal facility for repayment of the outstanding balance of a home loan taken by you or your spouse for any of the above purposes. Here are the 6 simple steps on how you can apply to pay back PTPTN with EPF money. You are allowed to withdraw from EPF Account 2 to finance the downpayment purchase of a house.

However to meet specific needs an employee can withdraw a partial provident fund amount or withdraw in the event of any emergency including medical emergency marriage purposes to repay education loan and home loan. Examples of such situations include withdrawal to reduce housing loan leaving country withdrawal education withdrawal including PTPTN repayment leaving country withdrawal members investment scheme housing loan monthly installment withdrawal and health withdrawal for medical payments and equipment. The amount cannot exceed 36 months basic salary and DA.

For Purchasing or constructing a. If you have an education loan with. One can partially withdraw the amount if heshe has.

The member can withdraw 12 times his monthly salary from his Provident fund account. Account 2 of distribution from monthly contribution. How to withdraw from PFEPF account for loan repayment.

However if 20-30 of the EPF reserves is enough to serve your purpose of home buy or construction then you can avoid paying the interest that comes with a home loan offered by the banks and.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

Here S The Easy Steps To Purchase Property Using Your Epf Money

How To Withdraw From Provident Fund Account For Home Loan Repayment The Financial Express

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

Tidak ada komentar:

Posting Komentar