Find out the things you need to keep handy before you initiate the withdrawal process - with or without Aadhaar. You can apply for Pension which starts either at 50 early pension or 58 years of your age.

How To Withdraw Pension Contribution In Epf After Leaving The Job Abc Of Money

Change of job resulting in the transfer of EPF to the next employer.

How to withdraw pension contribution in epf without leaving the job. From the I want to apply tab select the claim you need full EPF settlementpension withdrawalEPF part withdrawal etc. If you want to withdraw EPF amount then you can withdraw the amount deposited in your account anytime. After submitting this form you will receive your monthly pension.

How To Withdraw Pension Contribution In Epf After Leaving The Job Abc Of Money. Remember you will be required to visit regional EPFO office to submit the duly filled form along with cancelled cheque of your. But you may face some difficulty to withdraw the pension.

10 rows Here is the process of withdrawing of PF without leaving a job. There are different rules for pension. Withdraw Pf Without Leaving Job Of Current Company Planmoneytax.

You cannot apply for withdrawal of EPF account balance immediately after your resignation from a company. EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. If you are withdrawing PF balance.

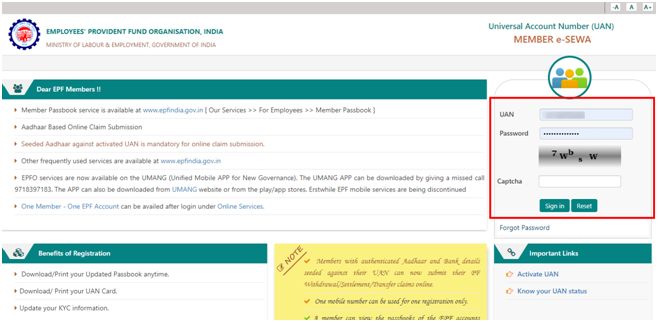

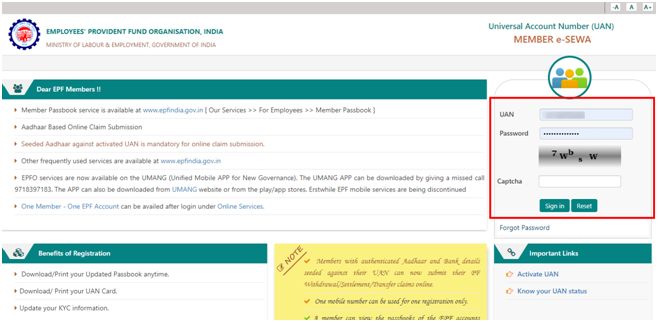

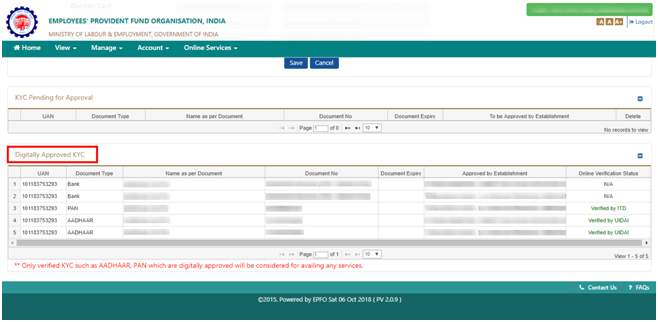

You will just have to fill the Composite Claim Form and choose both the options Final PF balance as well as pension withdrawal. To withdraw the PF balance and the EPS amount the EPFO has launched a composite form to take care of withdrawals transfer advances and other related payments. The employees will need to have an active Universal Account Number UAN and the Know Your Customers KYC details must be linked to the UAN in order to withdraw the EPS amount online.

You can get your PF amount transferred to your new employer after drawing your first months salary. Step 11 Click on the certificate to submit your application. Along with EPF there are funds in the EPS which the employee can either withdraw or carry-over to the new employer using the scheme certificate.

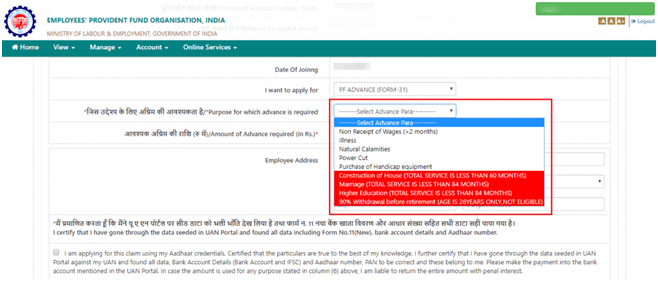

Form 31 UAN This form can be submitted if you want to partially withdraw from Employee providend fund EPF account. Withdrawal PF Amount After Leaving the Job Employee Provident Fund EPF is a retirement corpus from which an employee can make withdrawals if heshe has been unemployed for more than 2 months. The employee is free to either withdraw the monies held in the fund after leaving the job or transfer the balance over to the new employer.

Step 10 Select PF Advance Form 31 and provide the details of the amount you need the reason to withdraw etc. You can withdraw your EPF Amount using UAN forms without employer signature if your UAN is activated with your KYC details like Aadhaar and Bank Account Details. If an EPF member dies then the nominee such as wife or minor children will receive the monthly pension.

Withdrawing without using Aadhaar card number. How Can We Withdraw The Pension Contribution From A Pf Account Quora. When you leave your present job you will be thinking what to do with the contributions of your salary to PF.

There is no such transfer of PF to Pension after 10 years. EPF Withdrawal upon Leaving Job. However he can withdraw the Provident Fund at any time or when he leaves employment even before 58 years.

For unemployment of more than 2 months the remaining 25 of the corpus can be withdrawn. A person can withdraw 75 of his or her provident fund if heshe is unemployed for more than a month. There are two options available.

EPS account is a seperate account linked to your EPF which is for the purpose of pension. EPS Pension Formula. You can withdraw 75 of the fund after remaining unemployed for one month.

In the case of not taking the next job in India you can withdraw the EPF account balance after immediately resignation. There is generally a 2 month waiting period after resignation after which you can opt to withdraw your PF money. The second method is by requesting EPF officer in case if your EPF officer asks you that the DOE is not mentioned for your UAN then tell him the exact reason that your employer is not updating DOE then the EPF officer will update your date of exit in PF portal and accepts your PF application.

An employee who has been a member of EPF for the last 10 years will not be eligible for withdrawal of Pension Fund. In order to withdraw the EPS amount subscribers need to put claim via Form 10C. To withdraw this monthly pension amount you need to submit a form called form 10 D.

However the other option is to withdraw your PF amount. If you dont have an Aadhaar but have the PF number use this form - Composite Claim Form Non-Aadhaar. With the advent of UAN Universal Account Number a unique number assigned to the employee for PF purposes it has become furthermore easy to track balance initiate transfers or withdraw the EPF balance.

If you have not activated the UAN then you cannot withdraw your EPF without employer signature. But he will start getting pension on his attaining the age of 58 years. Currently the EPFO allows 75 PF withdrawal if it is carried out after just 1 month of unemployment.

How to start the withdrawal process Here is how you can initiate the withdrawal both with and without Aadhaar. If you are planning to work again you can submit the Form 10C and get the scheme certificate. Whether your job is 6 months or 10 years.

EPF Withdrawal Rules before 5 years of Service. Note that one is allowed to withdraw from EPS only if your EPF is not more than 10 yrs old. In case you resign from a job and join a new employer who does not offer EPF scheme then you can either withdraw EPS balance if service history is less than 10 years or apply for Scheme Certificate from EPFO.

Iii Raise a Grievance at PF Portal On Your Employer. Earlier PF could be withdrawn only after two months in case of leaving the job or becoming unemployed. How To Claim Full Pf.

Form 10-C UAN You can fill up this form in order to withdraw from your EPS amount. Under the current EPF rules if you want to do an EPF withdrawal before turning 58 you can withdraw the full PF balance by staying unemployed for 60 straight days two months after leaving a job. Now you can submit the monthly pension withdrawal form 10D online also at the UAN member portal.

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

How To Withdraw Pf Without Leaving My Job Quora

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

How To Withdraw Pension Contribution In Epf After Leaving The Job Abc Of Money

How To Withdraw Pf Without Leaving A Job E Filing Of Income Tax Return

Tidak ada komentar:

Posting Komentar