Enter your mobile number on the Registration screen and select Proceed. Yes u can do what ever u like with the money as long the repayment is in order.

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia Propertyguru Malaysia

2 Buying a home as an individual.

How to withdraw money from epf account 2 for house loan. To qualify you would. Withdrawal should be prevented until and unless it is an emergency. How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties.

Malaysians can start applying starting 1st April 2020 and lucky for you we have. Buying A Home With An Immediate Family Member or Spouse. You can withdraw from your EPF to service.

Is either 10 of the house price or all of Account 2. How to withdraw from PFEPF account for loan repayment. 3 Buying a home with an immediate family member or spouse.

Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. However in case a member wants to withdraw funds from his EPF account he should keep the following EPF withdrawal rules in mind-. Purchase Construction of House.

You are allowed to withdraw from EPF Account 2 to finance the downpayment purchase of a house. Upon reaching age 55 your savings in Akaun 1 and Akaun 2 will be combined and put into this account. What percentage of your salary goes as EMI.

Again the maximum withdrawal is limited to the difference. To withdraw your PF amount using the EPFO portal you will need to ensure the following. You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not less than RM500.

Withdrawing Epf Funds For Repaying A Home Loan. Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. No PF withdrawal will be allowed unless the member.

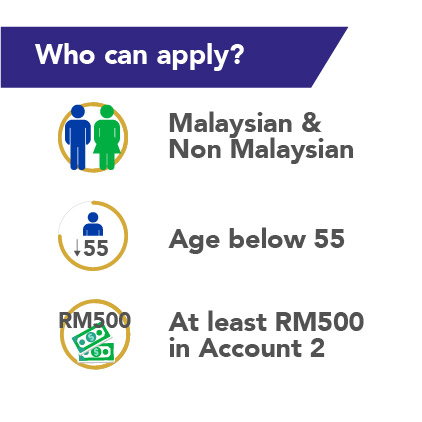

Min is 8 till 12 EPF is 6 for 2011 4 to. One can withdraw from PFEPF account for loan repayment in two ways - offline and online. Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme.

Here is a look at how to withdraw money from ones EPF account using the Umang app. Haj withdrawals helps members finance basic expenses of the Haj with a limit of RM3000. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. How to register for Umang app using mobile number. A home loan if youre purchasing residential property.

Conditions to Withdraw EPF Balance for Salaried Employees. With around 25 years of your loan tenure left you have already paid the majority of the. Withdraw all from Acc 2 and directly bank in to loan account to offset.

6 Reasons For Which You Can Withdraw Money From Your Epf Account. Download the Umang app from Google Play Store or Apple App Store. When members turn 55 they can make withdrawals and have access to savings in Akaun 55 anytime.

Before withdrawing money from your Employees Provident Fund EPF account to pay off your home loan there are certain aspects you need to consider. You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not less than RM500. KWSP will directly bank in.

Salaried employees can withdraw money from EPF accounts for various purposes subject to the following conditions. Buying a Home as an Individual. 2 ways to go about it.

Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. Open the app and select New User Step 3. Buying a Home as an Individual.

So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. Circumstances and conditions for the maximum amount allowed but the withdrawal guideline. Again the maximum withdrawal is limited to the.

6 Reasons For Which You Can Withdraw Money From Your. You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not less than RM500. How to withdraw EPF Account 2 money to purchase or build a house.

EPF Withdrawal Rules Employees Provident Fund is an investment scheme created for the purpose of retirement. There are 2 option to withdraw out for loan repayment or settlement purpose from Acc2. Pf Withdrawal Rule Here S How To Withdraw Money From Your Epf Account Online Utkal Today.

Aadhar number must be linked and verified with UAN. A salaried employee can withdraw up to either six times of his monthly salary or total amount towards medical treatment of self spouse children and parents. Owning your dream home is now made easier with EPF withdrawal.

Instead of taking a loan you can withdraw funds from your PF in whole or in part. One can withdraw up to 3 years of the basic pay and dearness allowance or may be the total of the employee and the employer contributions along with interest amount. To utilise your EPF Account 2 money to pay the 10 down payment for a house you will have to first fork out the 10 down payment yourself payable to the developer for primary properties or to the property owner if purchasing a sub-sale house.

Buying a house. One can make advance withdrawal of money from their PF account for the purchase or construction of house or flat. Step 2 Then input your UAN your password and the Captcha to sign in.

Again the maximum withdrawal is limited to the difference. Some of these include your overall financial position. Better to withdraw from EPF account 2 to housing loan as following points Residential property ROI for appreciation in line with inflation is 5 to 7 yearly rental is 3 to 5 yearly.

Buying A Home With An Immediate Family Member or Spouse.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Kwsp Housing Loan Monthly Installment

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Tidak ada komentar:

Posting Komentar