Epf Claimed Settlement only means that EPFO officer has approved online your claim of applicationBut yes It is surely right epf claimed settled means that the amount will be credited bank account in the next coming step if your kyc is accurate or complete. Withdraw your EPF or apply for final settlement.

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

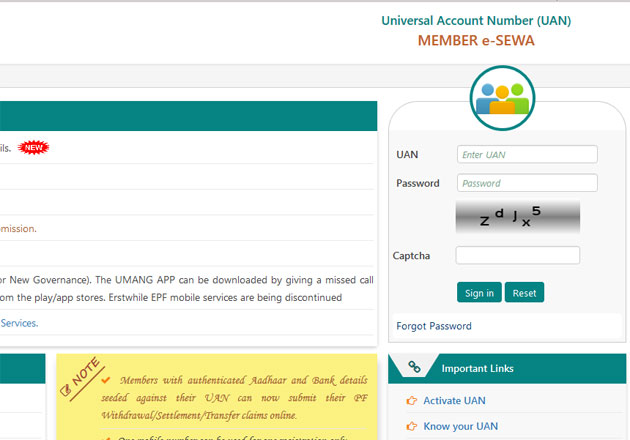

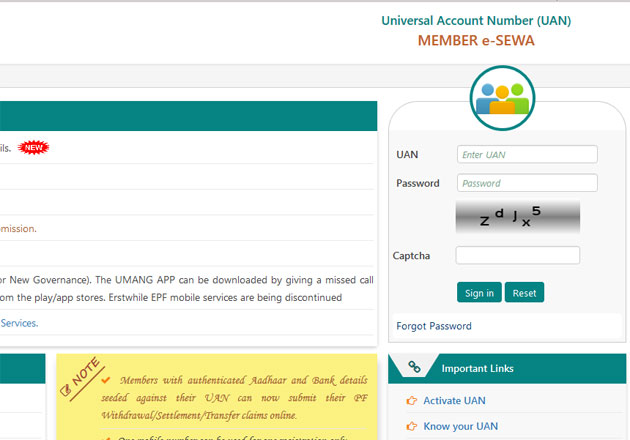

After getting this done you must follow the given steps-Log in to the UAN member portal here.

How to withdraw epf amount to bank account. But in some very rare cases it may take more than 30 days. Renovation of a house. Members of the Employees Provident Fund Organisation EPFO can avail various EPFO services on the UMANG App.

Step 2 Then input your UAN your password and the Captcha to sign in. To withdraw your PF amount using the EPFO portal you will need to ensure the following. The accumulated or a part of the amount in an EPF account can be withdrawn by the employee in the event of retirement or resignation or in case of COVID-19 crisis.

After doing this you can submit your withdrawl claim online itself. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. Before you begin to withdraw your EPF balance make sure that your EPF account is linked with your Aadhaar and that your UAN is activated.

Repayment of home loan. The bank account where you want to receive the amount must be the same as the bank account registered with your Aadhaar. How to Withdrawal EPF Balance.

Only the EPF account holder andor hisher spouse can apply for EPF withdrawal in this case. Fill in your address and the amount to be withdrawn. You can make up to 3 withdrawals from these criteria.

Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 19. The details have to be approved by your employer. The Umang app is a unified app that can be used to access a variety of pan-India e-government services including income tax filing Aadhaar and provident fund queries gas cylinder booking and Passport Seva.

Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. UMANG App can even be used by members to withdraw their EPF money from their Provident Fund PF account. The EPF account holder hisher parents spouse or children can apply for the withdrawal.

EPF account yields a return of 85 per cent annually. Withdrawal of the EPF account by a salaried employee between switching jobs is illegal. 90 of the total EPF corpus can be withdrawn.

You can file for online withdrawal of your EPF only if your PF money is held with the EPFO. This becomes all the more important in the current scenario. Claim Settlement epf does not mean that the epf claimed amount is credited in the bank account.

If you are planning to withdraw your PF amount then you need to know that you can do so in parts or withdraw the complete amount. How can I transfer my EPF amount to my bank account. How to check change bank account details in your EPF account The government announced back in March 2020 that an individual can withdraw a certain sum from their Employees Provident Fund EPF account if heshe is facing financial problems due to the coronavirus-related lockdown.

Make partial withdrawal loan or advance. Here is how to withdraw PF online. Step 1- Sign in to the UAN Member Portal with your UAN and Password.

To proceed enter the OTP sent to the registered mobile number. Aadhar number must be linked and verified with UAN. UMANG App can even be used by members to withdraw their EPF money from their Provident Fund PF account.

There are two ways to file a claim to withdraw money from EPF. Similarly this amount can be transferred from one company to another in case the employee changes his job. Upload Form 15G and Copy of Bank account.

Members of the Employees Provident Fund Organisation EPFO can avail various EPFO services on the UMANG App. Important points to note for EPF Withdrawal process. The updated New Account number needs to be approved by your employer.

Login to unified portal employee login In Manage section click on KYC and update your new bank account details save and submit the document to employer. So lets take a look at the EPF withdrawal rules to understand this better. Visit the UAN Member Portal and login using the UAN and password.

Upon successfully submitting the form you will give a confirmation SMS on your mobile number. Click on the checkbox to proceed with submission of withdrawal application. Once the PF claim status shows settled then in next 2-3 days your PF amount will credit into your bank account.

EPFO members can withdraw PF amount via UMANG App. The Umang app is one of the routes an Employees Provident Fund member can take to withdraw money from their PF accountEPF can be withdrawn in part or in whole. You have to fill it and submit the same in regional EPFO Office directly.

Click the Online Services tab on the menu bar. Click on the Claim Form-31 19 10C on the drop-down menu. Various reasons like illness medical expenses loss of wages natural calamities house construction Etc.

The employee should have been in continuous service for 3 years. Frequent changes in EPF withdrawal rules keep employees on the edge. This is necessary to ensure timely credit of the EPF funds withdrawn into your bank account.

Withdraw your EPS benefit. Enter your bank account number and IFSC code. Once approved the bank account gets linked with your UAN.

It is also mandatory that your bank account is seeded with your UAN. These are the common steps involved in PF withdrawal process and processing time for PF withdrawal time is 10-15 days for online claims and 15-30 days for offline claims. Using New EPF Withdrawal Forms you can do the following activity.

Click on the suitable reason to proceed. To withdraw funds from your Employees Provident Fund EPF account it is important that your correct bank account details be recorded in the EPF account. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

The online process through UAN Portal and the offline process by filing EPF withdrawal form. Next fill the claim form with all the necessary details. The major concern for them is whether the EPF withdrawal amount is taxable or not.

This New EPF Withdrawal Forms are easy to fill as they require your basic data. Login to your EPF account at the unified member portal. If opting for PARTIAL EPF Withdrawal then select the option PF AdvanceFORM-31 and then select Purpose for which advance is required.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Select Form 19 to withdraw your EPF fund. Once you confirm the above conditions follow the ten steps given below to withdraw from the EPF fund.

Upon successful processing the amount will be transferred to your bank account. An employee can withdraw up to 50 of his PF amount from his EPF account. If you meet this condition you can follow the procedure given below to withdraw your EPF online.

One can withdraw the advance amount from their PF. For full EPF withdrawal of accumulated amount select option Only PF Withdrawal.

Epf Withdrawal How To Check Change Bank Account Details In Your Epf Account The Economic Times

Pf Step By Step Pf Withdraw Process Online By Using Uan Account Complete A Z Youtube

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Pf Withdrawal Online Epf Withdrawal Procedure Global Indian Nurses Organization

Tidak ada komentar:

Posting Komentar