Select Remote Working e-Working Expenses in the Tax Credits and Reliefs page and insert the amount of expense at the Amount Claimed section. Part of the time at home and the remainder in your normal place of work.

How To Claim Working From Home Deductions Kearney Group

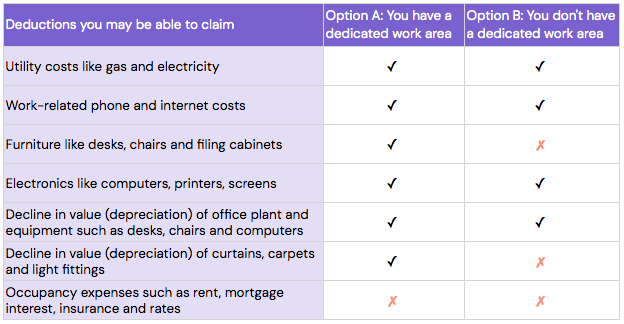

There are two basic requirements for the taxpayers home to qualify as a deduction.

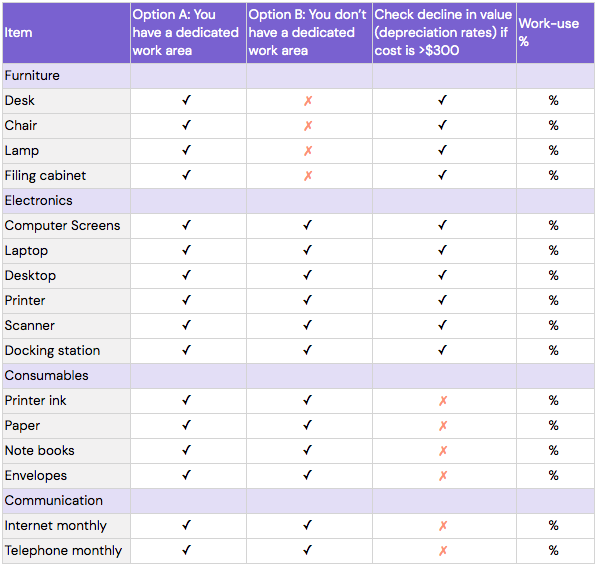

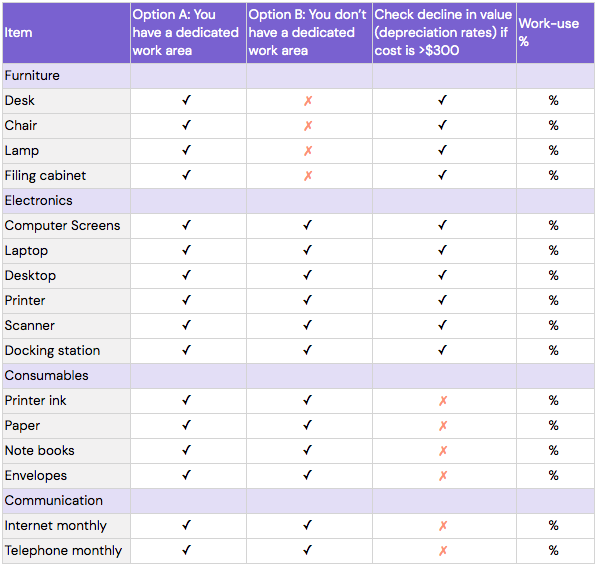

How to claim tax credits for working from home. You can usually claim income tax deductions for that part of your home because it has been used to produce assessable income. Work out your deduction amount. Keep a record of how many hours you worked from home.

Write COVID-19 hourly tax rate in your tax return. Sending and receiving email data or files remotely. This amount will be your claim for 2020 up to a maximum of 400 per individual.

Working for substantial periods outside your normal place of work. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs. How to apply.

At home on a full-time or part-time basis. Logging onto a work computer remotely. Yet apportioning extra costs such as heating and electricity is tough.

If you use this method for the 201920 income year you cant claim any other working from home expenses for the period 1 March 2020 to 30 June 2020. There must be exclusive use of a portion of the home for conducting business on a regular basis. Select the Income Tax return for the relevant tax year.

There are recent changes to claiming your tax deductions. Shoprite has its own police force and now makes over 200 arrests a year Next article. Find out more at wwwatogovauhome.

How much you can claim. As a claim may be selected for future examination all documentation relating to a claim should be retained for a period of six years from the end of the tax year to. There are 2 other ways you can work out deductions for working from home.

In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab. The proportion of the floor area that was set aside for rental or to run a business. Remote working is where you are required to work.

To work out your assessable capital gain or loss you take into account. You must have an area in your home set up for work where you. If you are not sure.

Once their application has been approved the online portal will adjust their tax code for the 2021. To claim for tax relief for working from home employees can apply directly via GOVUK for free. Fill in the form.

Include the calculated amount at other work-related expenses in your tax return and enter COVID-hourly rate as the description. For example a taxpayer who uses an extra room to run their business can take a home office deduction only for that extra room so long as it is used both regularly and exclusively in the. Click on Review your tax link in PAYE Services.

If you are one of the 700000 employees now working from your home office kitchen table or indeed bedroom you could be entitled to claim the e-workers tax relief. How to claim work from home expenses for tax in South Africa according to SARS. You can either claim tax relief on.

You must have a letter from your employer that states that you can work from home and confirms the percentage of time you spent there. For a summary of this content in poster format see Home-based business expenses PDF 456KB This link will download a file. If employees were required to work from home during the 2020 to 2021 tax year but did not claim for the tax relief they have not missed.

The process is similar to claiming other tax credits such as medical expenses. To claim the tax relief you must have and declare that you have had specific extra costs due to working from home. Due to that there is essentially a flat rate of 6 a week available to you.

Temporary shortcut method from 1 March 2020 to 30 June 2022 you may have the option of an all-inclusive 80 cents per work hour temporary shortcut method. Count the total number of days you worked from home in 2020 due to the COVID-19 pandemic and multiply that by 2 per day. Users can upload their utility bills online and theres a.

Write the deduction amount in your tax return in the Other work-related expenses section. To claim Working Tax Credit update your existing tax credit claim by reporting a change in your circumstances online or by phone. What youll get Next.

Working From Home Tax Deductions Covid 19

How To Claim Working From Home Deductions Kearney Group

Working From Home Tax Deductions Covid 19

Working From Home How To Claim Your Home Office Tax Deductions

Working From Home Because Of Coronavirus You Can Reduce Your Tax Bill

Tidak ada komentar:

Posting Komentar