There is no limit if EPF member withdraw PF for illness reason and for construction of house only 1 time and for the marriage 3 times and for higher education 3 times and for power cut only 1 time and for physically handicapped persons no 2nd advance. In this case the three month Basic DA will be Rs 40000 x 3 Rs 120000 which is lower than Rs 15 lakh.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

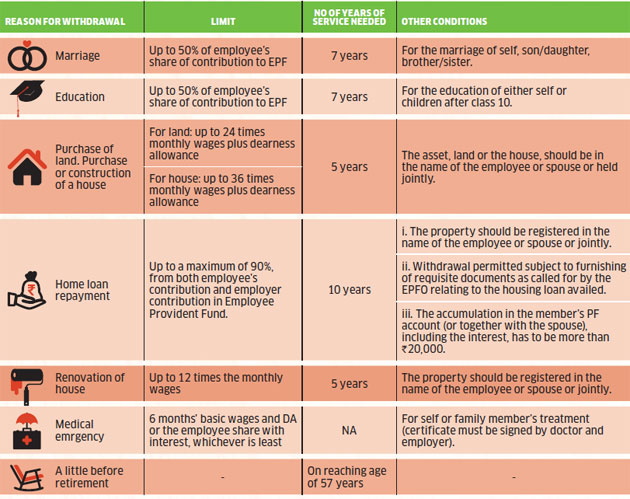

An individual who is a member of EPFO is allowed to withdraw the amount for purpose of purchase or construction of house only once during the course of entire employment.

How much we can withdraw from epf advance. Online submission of form 31 for EPF advance withdrawal. EPF advance for higher education of sondaughter. In general EPF members can get their 6 months basic wage DA or their total employee PF contribution.

One can withdraw the advance amount from their PF. Hi friends welcome to my channel my knowledge Aj ki is videomai hum Advance PF withdrawn karne ke rules and eligibility ke bare me vistar se janegeEPFO and. While still in service he can apply for advance under housing where 90 ot both EE and ER will be given.

An employee can withdraw up to 50 of his PF amount from his EPF account. Members can apply for lesser amount also. Employees can obtain an advance from their EPF balance up to three months salary or wages plus dearness allowance or 75 of the balance standing in their account whichever is less.

As on date EPFO has settled more than 7631 lakh COVID-19 advance claims thereby disbursing a total of Rs. You can withdraw up to 75 per cent of your EPF account balance or three months basic salary plus dearness allowance or the amount that you actually need whichever is lower. A For refund of outstanding principal and interest of a loan for purposes under Para.

Hence you can withdraw Rs 120000. Individuals can withdraw these funds only to finance the expenses incurred for their further studies or the education of their children post 10th standard. Unlike other EPF advance withdrawal reasons there is no maximum limit to withdraw PF advance for illness reason.

Heshe must be an. After logging in under the Online Services section choose Claim Form-31 19 and 10C. Answer 1 of 3.

The COVID-19 advance has been a great help to the EPF members during the pandemic especially for those having monthly wages of less than Rs. A person can apply for advance withdrawal if the individual has been a member of the EPFO for a minimum of five years. 3 months wages plus dearness allowance.

The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser. EPFO rules state that unemployed EPF account holders can avail non-refundable advance up to 75 of their balance after being unemployed for more than a month. But they need to have a sufficient amount in their PF account.

An employee can withdraw upto 90 of total PF balance within one year before retirement advance on unemployment upto 75 of total PF balance etc. This clause can be explained with a brief example. Then the next screen will appear with the details of the person an.

The number of times that an EPF member can withdraw PF advance amount will vary with each reason of PF advance withdrawal. 12 months basic wages and DA OR Employee Share with interest OR Cost Whichever is least 1 One 1ONE Member Declaration Form from Member II Para 68BB. An employee can withdraw up to 50 of his PF amount from his EPF account.

An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. 6 rows Here are the main amendments to EPF withdrawal rules-. You can make up to 3 withdrawals from these criteria.

The advance is non-refundable and the employee need not deposit the money withdrawn back into their EPF account. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of. Individuals can withdraw up to 50 of their contribution to the EPF.

Advance as relief against second wave of the pandemic. How much can be withdrawn from EPF account. Permissible withdrawal from EPF under the second wave of Covid 19 is calculated to be lower of 75 of the outstanding balance in the EPF account.

Individuals can withdraw up to 50 of their contribution to EPF. But this is not applicable if the member is 33 years ago. The EPF member can even withdraw 90 of hisher EPF contribution if only one year is left for hisher retirement or superannuation.

Employer share of EPF can only be withdrawn in final settlement ie when the member quit the job. Withdrawal under sl no e above. You can make final withdrawal of your EPF.

90 of the EPF balance can be. EPFO allows withdrawal of 50 per cent of an employees share with interest for post-matriculation studies of hisher children. Withdrawal from the fund for repayment of loans in special cases.

You can make up to 3 withdrawals from these criteria. EPF members can withdraw PF advance for medical reasons as many times as they need it.

How Many Times We Can Withdraw Pf Advance For Illness Youtube

Pf Withdrawal Process Online 2021 Pf Advance Limit And How Many Times Advance Pf Can Be Withdrawn Youtube

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Tidak ada komentar:

Posting Komentar