You may buy a second house but only after you have sold off the first one. You cant withdraw to buy overseas properties.

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

You can withdraw funds from your PF account if you have to pay outstanding home loans.

How much can withdraw from epf account 2 for house. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. The number of times that an EPF member can withdraw PF advance amount will vary with each reason of PF advance withdrawal.

You cant withdraw to buy overseas properties. Upon reaching age 55 your savings in Akaun 1 and Akaun 2 will be combined and put into this account. You may buy a second house but only after you have sold off the first one.

6 Buying a third house You may buy a second house but only after you have sold off the first one. EPF is very efficient in processing applications. How long does it take to withdraw EPF Account 2 for house loan.

This withdrawal is subject to certain conditions. But that will be the extent of your withdrawal options for a home. Buying a house.

A home loan if youre purchasing residential property. As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of EMIs or for the construction of a. Withdrawal from Account 2 to build a house.

However if you are planning to migrate you may withdraw all the money in your EPF accounts. EPF allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical. Rs 90000 Rs 300003.

When members turn 55 they can make withdrawals and have access to savings in Akaun 55 anytime. Withdrawal from Account 2 to reduceredeem housing loan balance. These changes are called as Provident Funds Fourth Amendment Scheme 2017.

5 Buying a home outside of Malaysia You cant withdraw to buy overseas properties. Here Mr Z can withdraw lower of the below amounts. EPF members can utilize the fund accumulated in their EPF account to facilitate their housing needs after three years of account opening.

One can withdraw the advance amount from their PF. But that will be the extent of your withdrawal options for a home. These rules will come into effect from 12th April 2017.

Is either 10 of the house price or all of Account 2. An employee can withdraw up to 50 of his PF amount from his EPF account. If you obtained a full housing loan 100 you are eligible to withdraw as much as 10 of the.

Applications to withdraw can be submitted 6 months before reaching age 50 years. And payment will only be processed after you reached 50. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house.

Medical reasons dont require a lock-in period or a minimum service period. I already wrote a detailed post on EPF partial withdrawal rules. You can make up to 3 withdrawals from these criteria.

10 of the property price i think - 1 property at a time. Buying A Home Outside of Malaysia. However if you are planning to migrate you may withdraw all the money in your EPF accounts.

There is no limit if EPF member withdraw PF for illness reason and for construction of house only 1 time and for the marriage 3 times and for higher education 3 times and for power cut only 1 time and for physically handicapped persons no 2nd advance will be given. But that will be the extent of your withdrawal options for a home. Buying A Home Outside of Malaysia.

Haj withdrawals helps members finance basic expenses of the Haj with a limit of RM3000. You can withdraw your savings in EPF account II to finance the purchase of a house. April 23 2017.

Circumstances and conditions for the maximum amount allowed but the withdrawal guideline. It is wise to accumulate the sufficient amount of savings first before making your move. Rs 75000 75 of Rs 100000.

You wouldnt want to be indebted to your loved ones for a long time. Buying a Third House. EPF changed certain rules in relation to EPF withdrawal for house flat or construction of property.

To enable our members to plan for a comfortable retirement we allow you to withdraw from. If you already withdrew 1 time you cant withdraw the 2nd time without proof that. Mr Z can withdraw Rs 75000 as non-refundable advance from his EPF account.

Malaysians can start applying starting 1st April 2020 and lucky for you we have. For many of us the soaring property prices have made homeownership a seemingly impossible dream and taking a leap from renting to buying is one big milestone. You can withdraw funds from your PF balance for the medical treatment of self spouse parents and children.

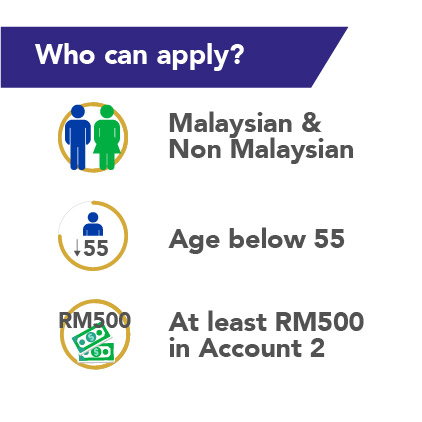

Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme. You can withdraw from your EPF to service. You can then pay them back with the monies withdrawn from your Account 2.

Basic salary for three months. However if you are planning to migrate you may withdraw all the money in your EPF accounts. 75 of the balance standing in the members account.

Buying a Third House.

How To Withdraw From Your Epf Account To Buy A Home

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Kwsp Housing Loan Monthly Installment

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Tidak ada komentar:

Posting Komentar