0 found this helpful. When your father reaches 55 years of age he can withdraw in cash his EPF funds with the Insolvency Department by submitting a bankruptcy declaration letter.

Epf Introduces Akaun Emas For Withdrawal At Age 60 The Edge Markets

They can opt to withdraw any amount at any time.

How can i withdraw my epf at 55. As of the writing of this post there are several conditions or situations where you are permitted to withdraw your Employee Provident Fund EPF for Malaysians. Tax deducted at source TDS is deducted on the premature withdrawal only if the amount exceeds Rs. Got my money in February.

The money withdrawn from EPF accounts can be exempt from tax under certain conditions. The EPF corpus can be withdrawn if a person faces unemployment before retirement. You can withdraw 90 of EPF balance once you reach the age of 57 years Earlier a withdrawal was allowed up to 90 of the EPF balance one year prior to retirement ie.

Taxation on EPF withdrawal. Heres my experience on how Ive successfully withdrawn my EPF recently. EPF can also be withdrawn for the purpose of self siblings brother and sister and childrens marriage.

Theres a restriction on how many times you can withdraw for childrens higher. There is no interest on the EPS contribution. The EPF assures members that no such steps on raising the withdrawal age have been discussed with any party at this.

EPF withdrawal for age below 55. Answered on Sep 20 2008 at 2130. There should be no break in the 5 years.

Contribution period must be over 5 years. All this while many of us still think that the EPF withdrawal is only eligible when you reach 55 or 60 years old and above. 8 rows KUALA LUMPUR 3 November 2016.

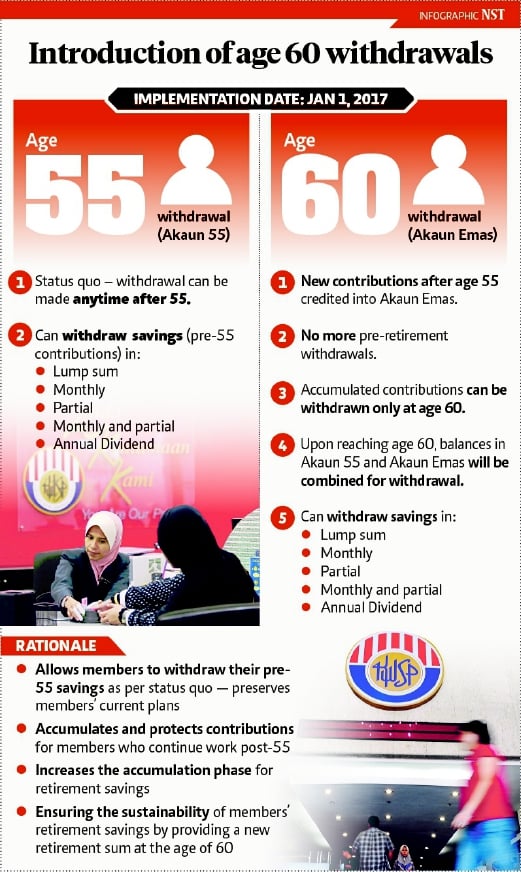

When members turn 55 they can make withdrawals and have access to savings in Akaun 55 anytime. The Employees Provident Fund EPF takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65. Although the EPF corpus can be withdrawn only after retirement early retirement is not considered until the person reaches 55 years of age.

Again a minimum 7-year service period is required for the same. My 55th birthday was in Jan 2012. For more details on types of withdrawal and how to go about checking their website is highly recommended.

The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. An employee can withdraw a maximum of 50 of the employees share along with interest. That is totally not right.

Withdraw via i-Akaun plan ahead for your retirement. How can i withdraw my epf at 55. Withdraw via i-Akaun plan ahead for your retirement.

KUALA LUMPUR 26 June 2020. The Employees Provident Fund EPF. Haj withdrawals helps members finance basic expenses of the Haj with a limit of RM3000.

But now account holder will have to wait till attaining the age of 57 years to withdraw 90 of the accumulated balance. You can withdraw all or part of the savings from this account at any time. But if you retire at age 55 youd be able to withdraw 90 of the EPF by age 54.

This is opposed to the Age 55 and Age 60 withdrawal policies that allow members to withdraw a minimum of RM2000 once every 30 days. The EPF at Jalan Raja Laut KL will issue a Arahan Bayaran payment order to you and you can cash out your EPF money at any RHB Islamic Bank Berhad provided you can get a LETTER from Jabatan Insolvensi Malaysia JIM stating. You can apply for withdrawal through i-Akaun.

Upon reaching age 55 your savings in Akaun 1 and Akaun 2 will be combined and put into this account. There is no minimum withdrawal amount required. Select reason for withdrawal Youll find a dropdown menu from which you would need to choose the reason for withdrawing from your PF.

The EPF interest rate is decided by the Govt of India together with the Central Board of Trustees CBT. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. At the age of 54 years.

EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old. EPF withdrawals are available for eligible members who are Malaysian citizens or non-Malaysian citizens residing in Malaysia who have an EPF account but they must be between 55 and 59-years old and hold their savings in Account 55. Should you choose to continue working after the age of 55 all further contributions you make will be credited in your Akaun Emas to be withdrawn only upon reaching age 60.

The EPF can be withdrawn by the employee when the employee retires or is not in employment for a minimum period of 2 months or if the employee moves abroad or when the employee is dead. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time.

Should I Withdraw My Epf Savings Mypf My

What You Need To Know About Epf S New Akaun Emas

Epf Proposes New Options For Withdrawal The Edge Markets

Tidak ada komentar:

Posting Komentar